What you need to know before the close of the trading week:

By Senior Broker, Mark O’Brien

General:

It will likely be challenging to predict the next stage of the Israel/Hamas war in terms of how broadly it draws in other participants. For now, diplomatic efforts – negotiating for the release of hostages, calls for a cease fire, bringing humanitarian aid to civilians in Gaza – have toned down the severity of the fighting. Concurrently, Israel is softening up the opposition by bombing of targets thought to be Hamas military strongholds and the markets are anticipating the launch of a ground war.

Even with the conflict entering its 20th day and seeing how commodities have already reacted in that time, the start of ground fighting and/or a broadening of participants would likely see sharper moves in particular futures contracts, i.e., gains in energies, flight-to-quality upward movement in gold and the Swiss franc and even food-related commodities like wheat. Conversely, equity index futures – U.S. and more broadly – will be vulnerable to draw-downs. Note that the E-mini Nasdaq already fell into correction territory on Wednesday following the latest tech earnings.

Financials:

One instrument at a potential cross-roads – it’s current 6-month / ±$11K per contract decline a dominant catalyst for dragging shares around the world to multi-month lows – is the 10-year T-note futures contract. Its correspondent benchmark yield is hovering at a 15-yr high of 5%. Already vulnerable to information on the pace of the U.S. economy, the conflict uncertainty poses a new agitator to the market.

Crypto:

After trading down to 3-year lows below 15,000 last October, on Tuesday, Bitcoin futures traded through 35,000, a 17-month high, a ±$10,000 move for a Micro Bitcoin futures contract (contract size: 1/50 Bitcoin), a ±$100,000 for the “adult” / Bitcoin futures contract (contract size: 5 Bitcoin).

Softs:

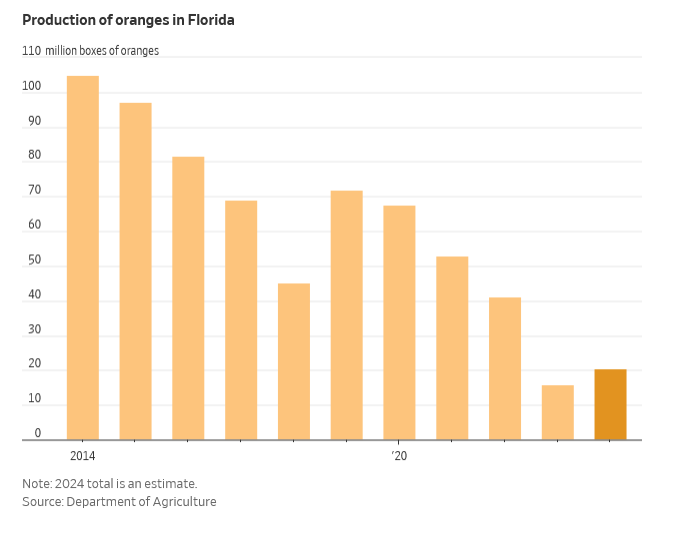

With new all-time highs being set all year – almost weekly – orange juice futures (basis Nov.) are poised to break through $4.00/lb. (contract size: 15,000 lbs, 1 cent = $150), more than double its ±$1.85 levels in January, a ±$32,000 per contract move. Florida orange growers harvested their smallest crop in nearly 90 years, the result of an ill-timed freeze, two hurricanes and the citrus psyllid, a tiny invasive winged insect that has spread citrus greening disease and is laying waste to Florida’s groves.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

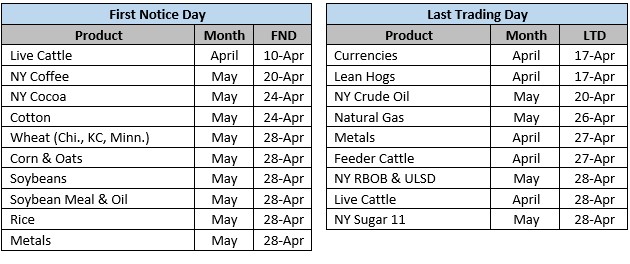

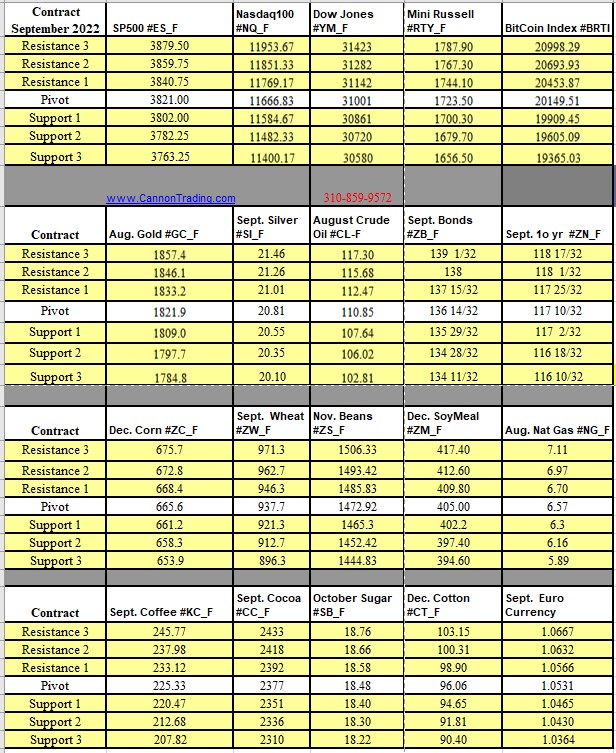

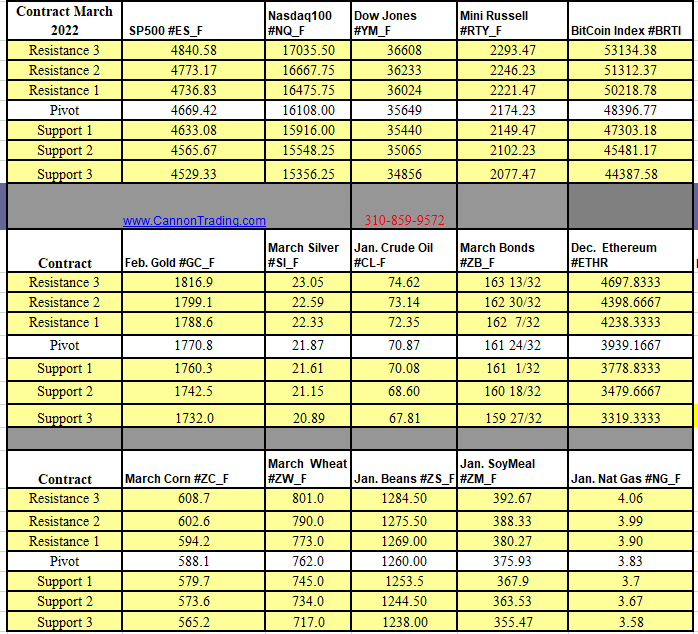

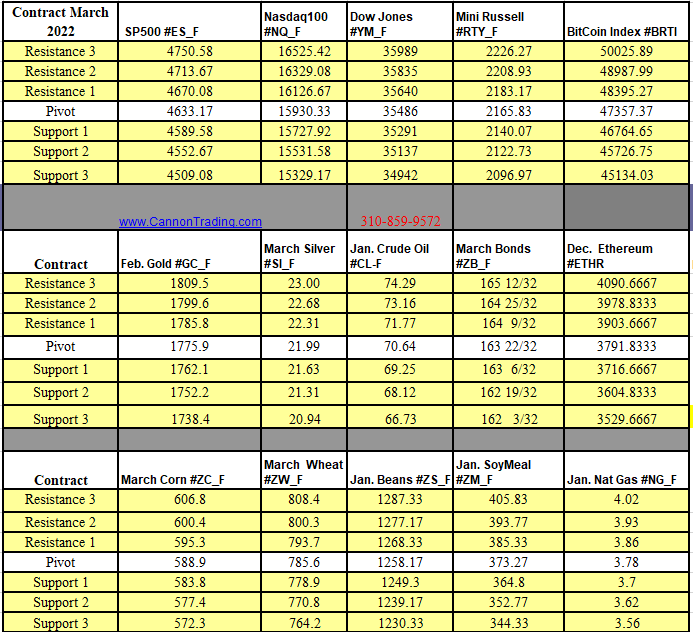

Futures Trading Levels

10-27-2023

Improve Your Trading Skills

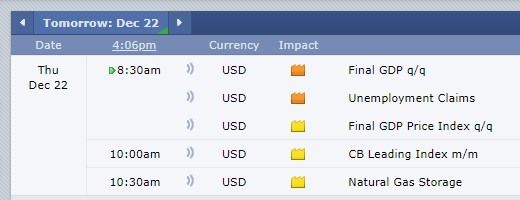

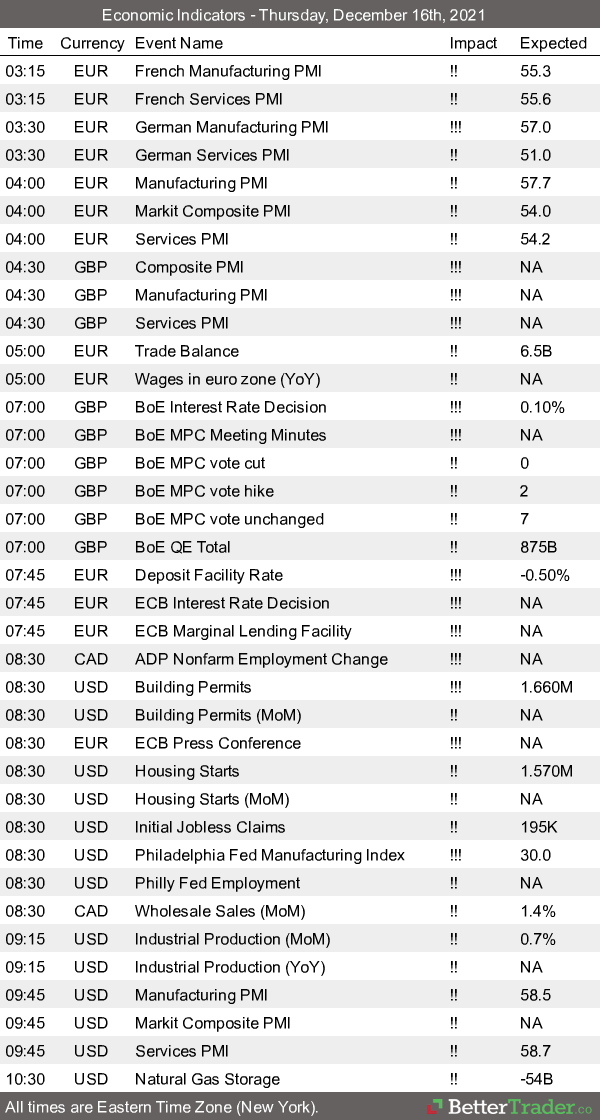

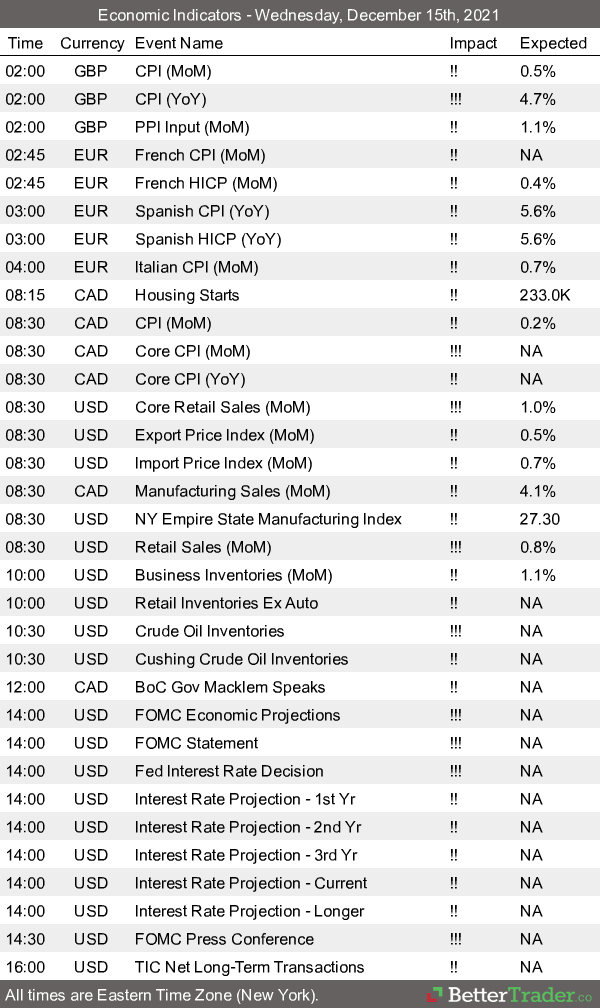

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.