Navigating Market Volatility in 2025

As financial markets continue to experience unprecedented levels of volatility, futures brokers in the USA play an increasingly critical role in helping traders navigate the complexities of futures trading. Heading into 2025, the unpredictability of global economic conditions, geopolitical events, and shifting monetary policies underscore the need for strategic intervention by futures brokers. Traders face unique challenges and opportunities in these conditions, making the guidance of experienced professionals more valuable than ever.

In this article, we will examine how futures brokers in the USA can assist their clients in managing volatility, offering ten actionable techniques supported by real-life trades, case studies, and hypotheticals. We will also explore why Cannon Trading Company, a leading futures broker with a stellar reputation, is an exceptional choice for traders seeking stability in turbulent times.

-

Hedging with Futures Contracts

One of the primary ways futures brokers help clients manage volatility is through hedging. By taking opposing positions in the futures market, traders can protect themselves against adverse price movements in underlying assets. For example:

- Case Study: A soybean farmer fears a drop in prices before the next harvest. By working with a futures broker, the farmer sells soybean futures contracts to lock in current prices. When the market later experiences a downturn due to surplus production, the loss in the physical market is offset by gains in the futures trading position.

Through personalized hedging strategies, futures brokers in the USA provide peace of mind to clients worried about market swings.

-

Utilizing Options on Futures

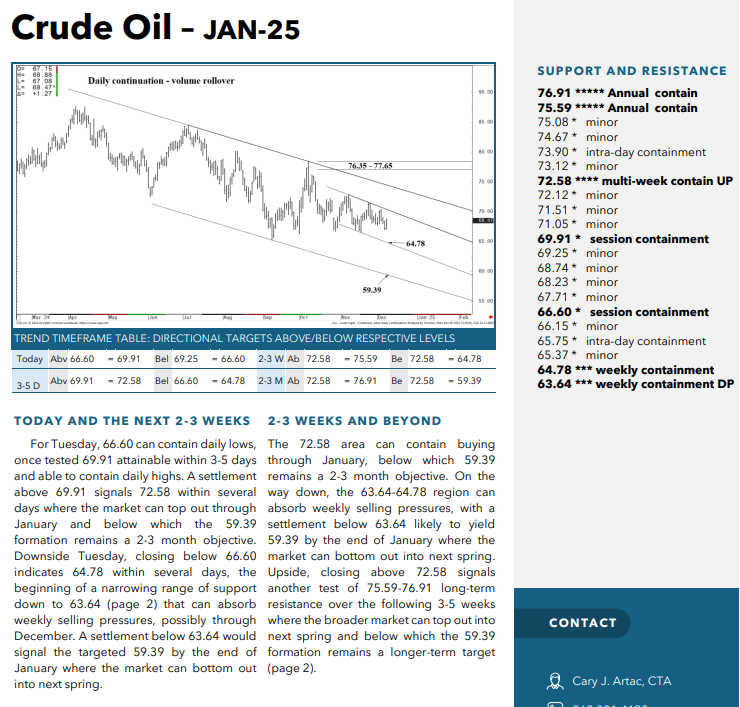

Another effective technique is trading options on futures contracts. These instruments provide traders the right, but not the obligation, to buy or sell futures at a specific price. For instance:

- Hypothetical Example: An energy company anticipates rising oil prices but wants limited risk exposure. A futures broker advises purchasing call options on crude oil futures. If oil prices soar, the call options generate profit. If prices fall, the company’s loss is capped at the premium paid.

Options on futures trading offer traders a way to benefit from volatility while managing risk.

-

Spreading Strategies

Spread trading, which involves taking offsetting positions in related contracts, is another volatility management tool. Examples include calendar spreads (trading futures with different expiration dates) and intercommodity spreads.

- Real-Life Example: A trader anticipates narrowing spreads between corn and wheat prices. A futures broker helps the trader go long on corn futures while shorting wheat futures. As the price gap tightens, the trader realizes gains irrespective of overall market direction.

This strategy reduces exposure to absolute price volatility and focuses on relative price movements.

-

Leveraging Stop-Loss Orders

Stop-loss orders are a critical tool for managing downside risk in volatile markets. A futures broker can work with clients to establish stop-loss levels tailored to their risk tolerance.

- Case Study: A gold trader enters a long position expecting prices to rise due to inflation concerns. The futures broker sets a stop-loss order at a 5% decline. When prices unexpectedly drop due to a stronger dollar, the order is triggered, limiting losses.

Stop-loss orders ensure disciplined trading futures even in chaotic market conditions.

-

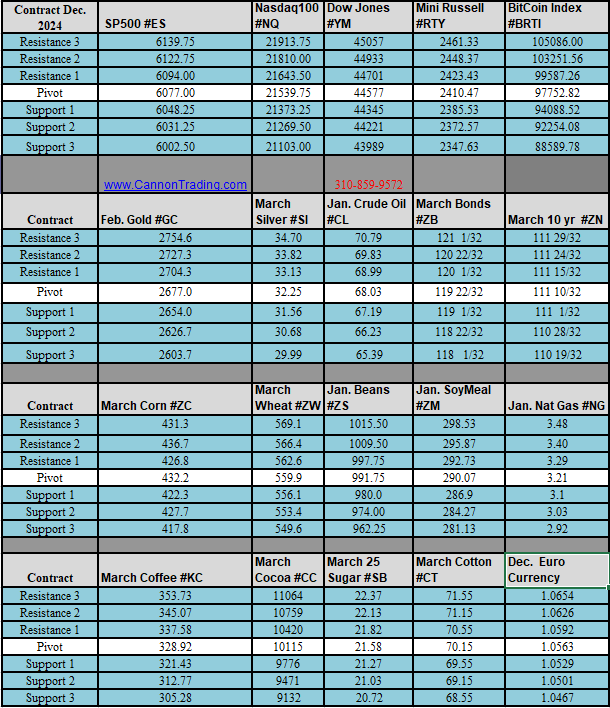

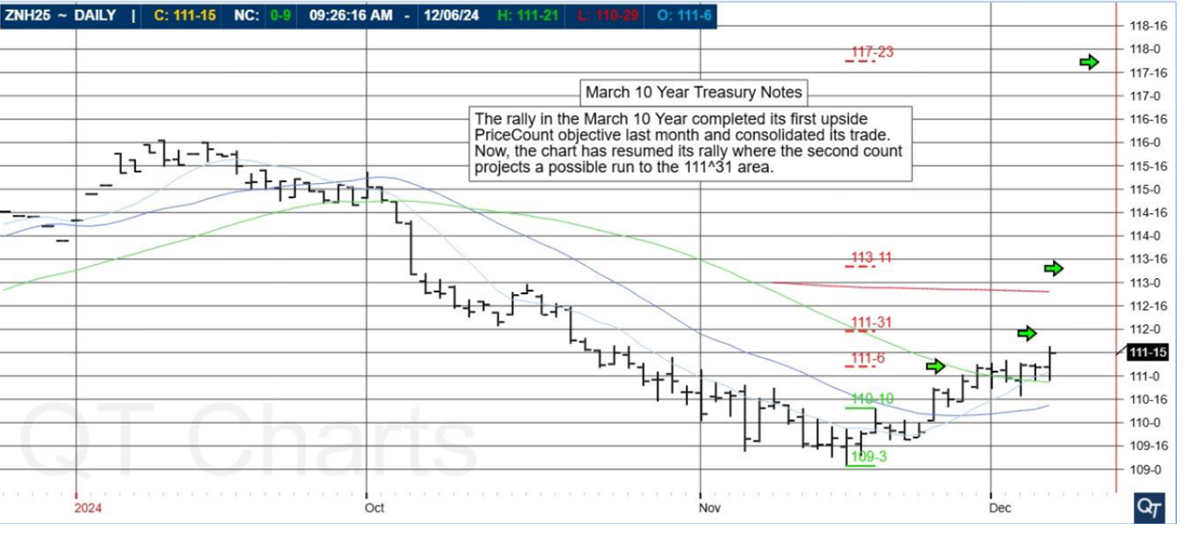

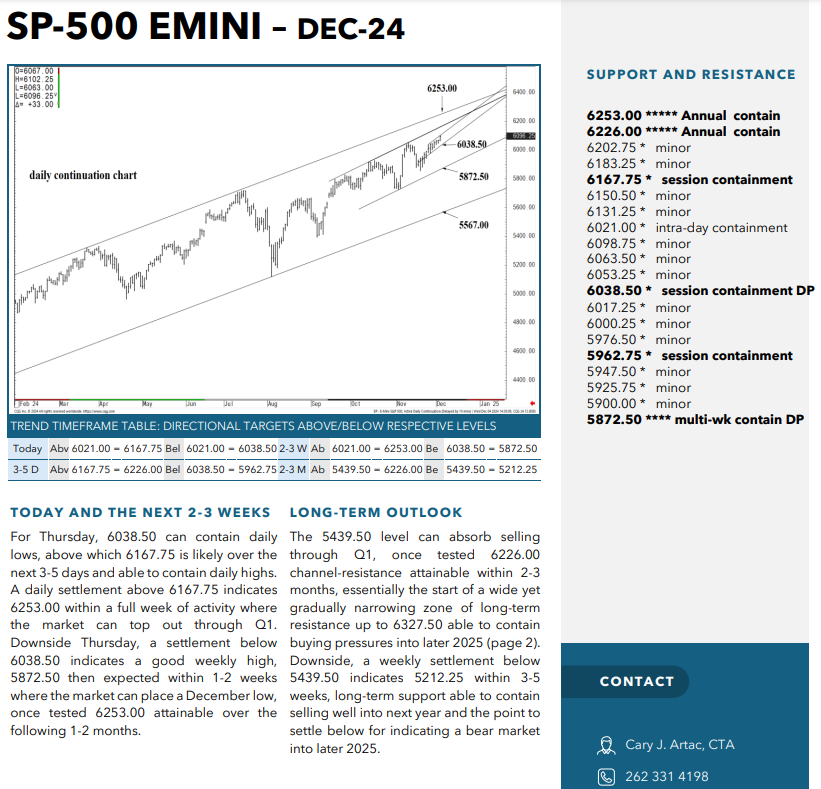

Using Technical Analysis

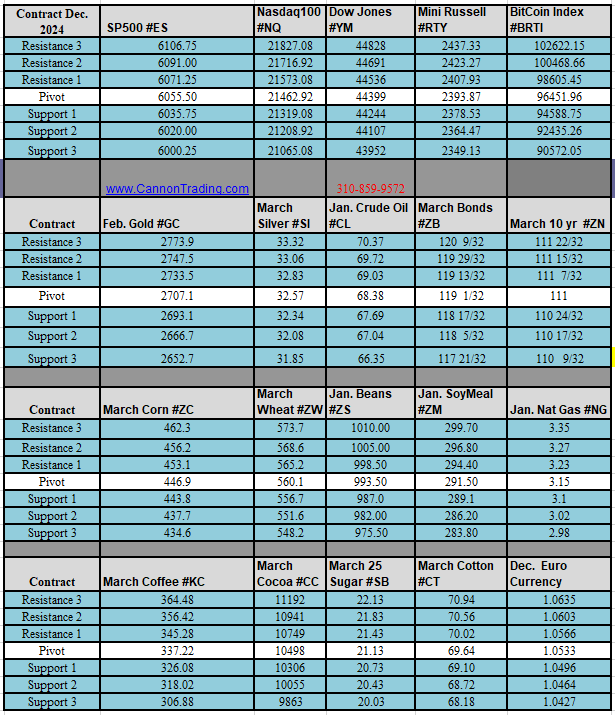

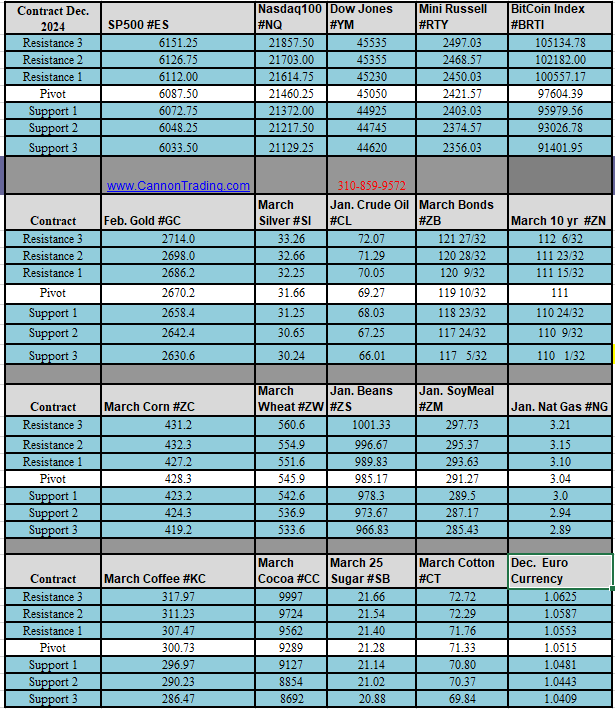

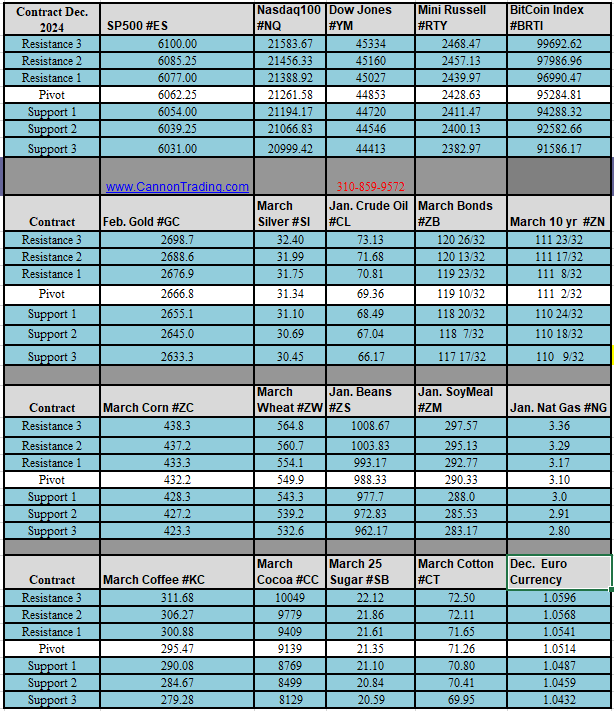

Futures brokers often provide clients with advanced charting tools and technical analysis to identify key market levels. These insights help traders execute informed decisions.

- Example: A professional trader collaborates with a futures broker to analyze historical price patterns in the S&P 500 futures market. Using Fibonacci retracements and moving averages, they pinpoint entry and exit points during a volatile earnings season.

By leveraging technical analysis, futures brokers in the USA empower clients to act decisively.

-

Diversifying Across Asset Classes

Diversification is a time-tested approach to mitigating risk. Futures brokers can guide traders in creating portfolios with exposure to various asset classes, such as commodities, equities, and currencies.

- Hypothetical Example: A trader overly reliant on equity index futures is advised by their futures broker to diversify into agricultural commodities. When equity markets experience heightened volatility, gains in agricultural futures trading help stabilize the portfolio.

This strategy minimizes reliance on a single market segment.

-

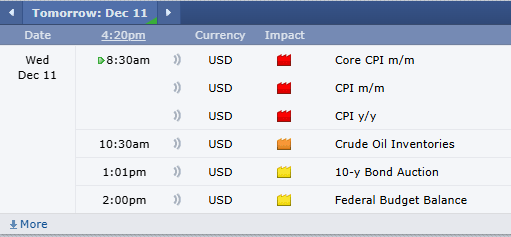

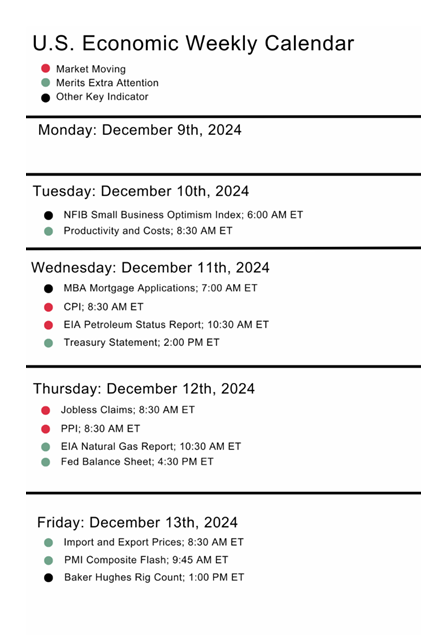

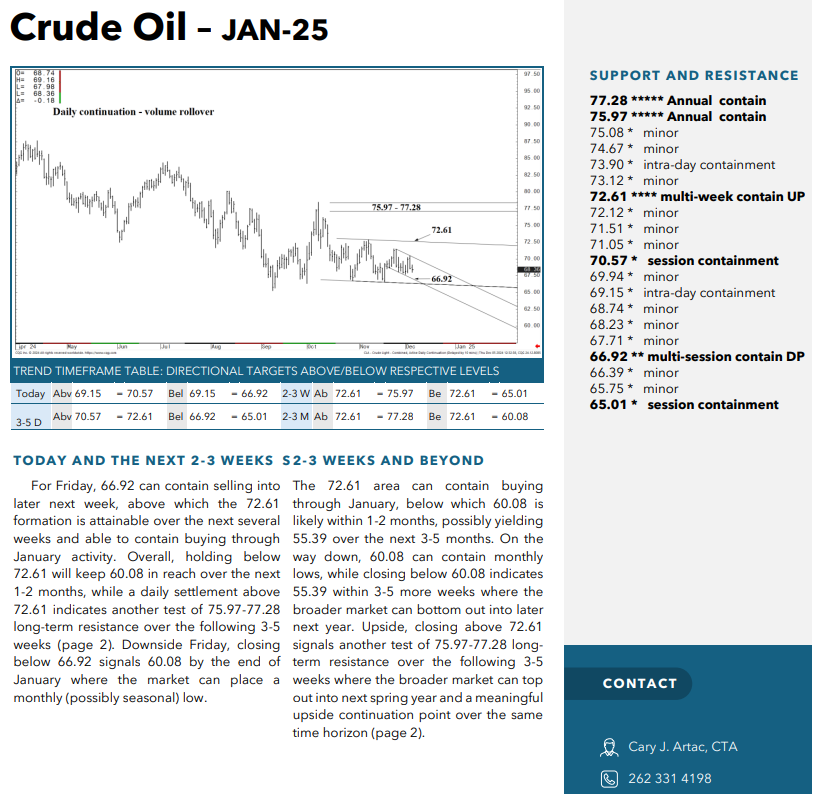

Providing Real-Time Market Insights

Modern futures brokers in the USA offer access to real-time data and expert commentary to help clients anticipate and respond to market moves.

- Example: During the 2022 energy crisis, Cannon Trading provided clients with timely analysis of natural gas futures. Traders who acted on this information navigated extreme price fluctuations more effectively than those without broker insights.

Access to accurate, up-to-date information is a cornerstone of successful trading futures.

-

Structured Trade Execution

Effective execution can make or break a trade during periods of high volatility. Experienced futures brokers employ smart order routing and execution algorithms to reduce slippage.

- Case Study: A high-frequency trader enters the E-mini S&P 500 futures market during a Fed announcement. With the help of a futures broker’s advanced platform, orders are executed swiftly, locking in favorable prices before the market reacts.

Top-tier execution is an often-underestimated advantage provided by reputable futures brokers in the USA.

-

Educating Clients Through Webinars and Research

Education is vital for empowering traders to manage risk. Many futures brokers, including Cannon Trading, provide webinars, market reports, and one-on-one consultations.

- Real-Life Example: In 2023, Cannon Trading hosted a webinar on “Trading Futures During High Volatility.” Participants learned strategies to navigate unpredictable interest rate announcements, which they later applied successfully in live trades.

Educational resources ensure traders are equipped to make informed decisions in volatile markets.

- Offering Access to Diverse Trading Platforms

In a fast-paced environment, the right trading platform can be the difference between success and failure. Leading futures brokers in the USA provide clients with access to state-of-the-art platforms tailored to their needs.

- Example: A swing trader uses a multi-asset platform from Cannon Trading to monitor futures, options, and spot markets simultaneously. This integrated view helps them identify arbitrage opportunities during a market selloff.

The ability to trade seamlessly across markets enhances resilience in volatile times.

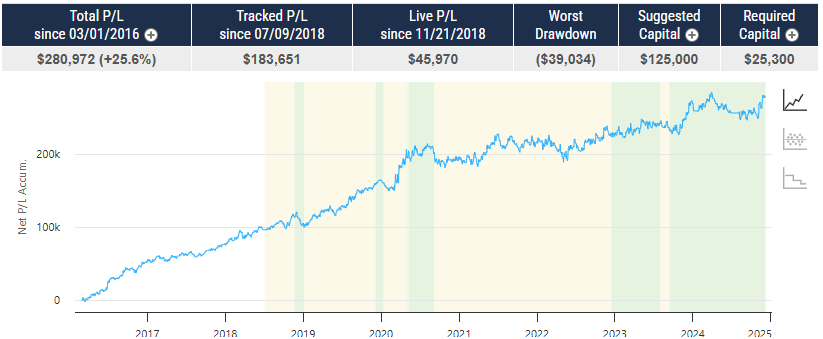

Why Choose Cannon Trading Company for Managing Volatility?

Cannon Trading Company is a standout in the crowded field of futures brokers in the USA, offering unmatched experience, client support, and technological resources. Here’s why Cannon is an excellent choice for traders concerned about market volatility:

- Decades of Experience: With over 35 years in the industry, Cannon Trading has weathered countless market cycles, making it a trusted partner in uncertain times.

- Top Regulatory Standards: Cannon Trading operates under strict compliance with U.S. regulatory bodies, providing traders with a secure and transparent trading environment.

- Highly Rated Service: The company boasts dozens of 5 out of 5-star ratings on TrustPilot, reflecting exceptional customer satisfaction.

- Diverse Platforms: Whether you are a beginner or a seasoned trader, Cannon Trading offers access to top-tier platforms like CQG, TradeStation, and Sierra Chart.

- Tailored Support: Cannon Trading’s personalized service helps traders develop customized strategies to navigate volatility effectively.

For traders seeking a reliable partner in futures trading, Cannon Trading delivers expertise, technology, and trustworthiness.

As we approach 2025, market volatility is likely to remain a defining feature of financial markets. Futures brokers in the USA play an indispensable role in helping traders navigate these challenges through hedging, diversification, advanced execution, and education. From stop-loss orders to real-time insights, the techniques outlined above demonstrate the breadth of strategies available to clients.

With a proven track record, comprehensive platform offerings, and a commitment to client success, Cannon Trading Company is uniquely positioned to assist traders in managing risk and capitalizing on opportunity in the world of futures trading. By leveraging the resources and expertise of leading futures brokers, traders can approach market volatility with confidence and resilience.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading