The Week Ahead: Will CPI alter your trading strategy?

By John Thorpe, Senior Broker

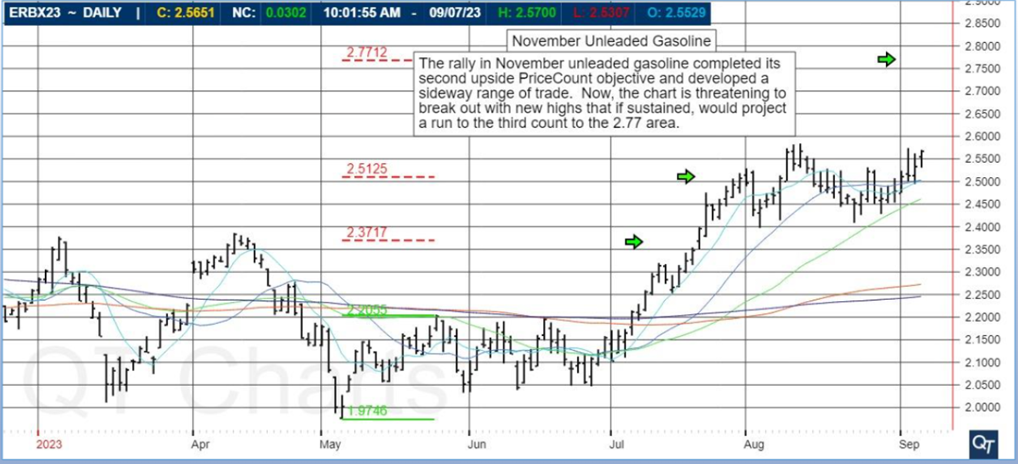

On the earnings front two additional AI equity plays report this week, both after their respective close. Oracle today is expecting a $1.14 per share increase (10.7% YoY) and Adobe on Thursday. Wallstreet analysts are expecting ADBE to report +3.98 per share (+17.0% YoY) These two earning factors could create directional change in the indices on the days following the releases. The Government reports being released this week could alter the course of the Fed’s short term interest rate decision making come September 20th.

The Fed has publicly stated in recent interviews and statements that the current string of rate increases used to assist in curbing inflation may be drawing to a close however, they will wait and see what the upcoming inflation numbers reveal. If the next two CPI reports show inflation running hot, especially in the service and shelter categories that the Fed is watching closely, then the chance of a November hike could increase.

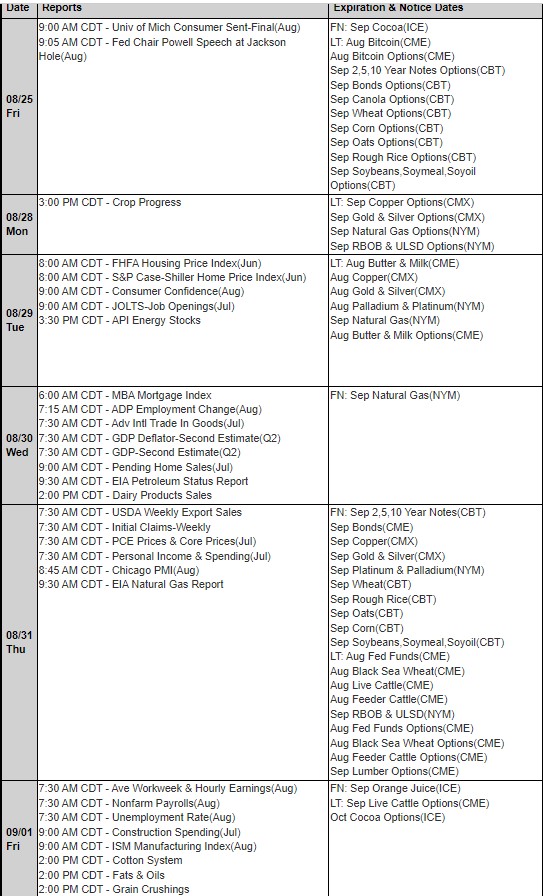

The Fed Funds Futures (ZQU23) Market is assigning a 93 % probability that the Fed will not raise during the Sep 20 meeting. This viewpoint could change significantly after several important reports will be released this week. Circle your calendars for Wednesday the 13th @ 7:30 A.M. CDT for CP and Thursday the 14th @7:30 A.M. CDT for 3 numbers: PPI final, Retail sales and Jobless claims. Finally on Friday @8:15 A.M. CDT for Industrial Production.

Expectations for CPI from Econoday.com are: Core prices in August are expected to hold steady and modest at a monthly increase of 0.2 percent to match July’s as-expected 0.2 percent increase. Yet overall prices, reflecting food and energy, are expected to rise 0.6 percent after July’s 0.2 percent increase which was also as expected. Annual rates, which in July were 3.2 percent overall and 4.7 percent for the core, are expected at 3.6 and 4.4 percent respectively.

What is CPI (Consumer Price Index)? is a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses.

Scope: Urban Consumers How the data is obtained: Survey of Business, Survey of Households. Sample sizes : CPI Survey collects about 94,000 prices and 8,000 rental housing unit quotes each month.

If you would like to drill down further, you can find a few links provided by the Bureau of Labor Statistics to CPI Fact sheets: Consumer Price Index Factsheets : U.S. Bureau of Labor Statistics (bls.gov)

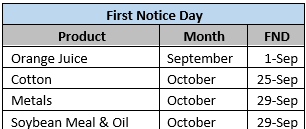

Volume in the September contracts will begin to drop off until their expiration Friday, September 15th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any September futures contracts through 8:30 A.M., Central Time on Friday, Sept. 15th, they will be offset with the cash settlement price, as set by the exchange.

Monday, September 18th is Last Trading Day for September currency futures. It is of the utmost importance for currency traders to exit all September futures contracts by Friday, September 15th and to start trading the December futures. Currency futures are DELIVERABLE contracts.

The month code for December is ‘Z.’ Please consider carefully how you place orders when changing over.

Watch the video below on how to rollover your market depth and charts!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

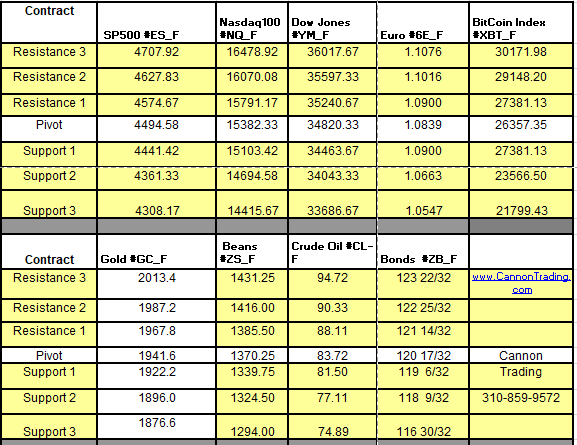

Futures Trading Levels

09-12-2023

Improve Your Trading Skills

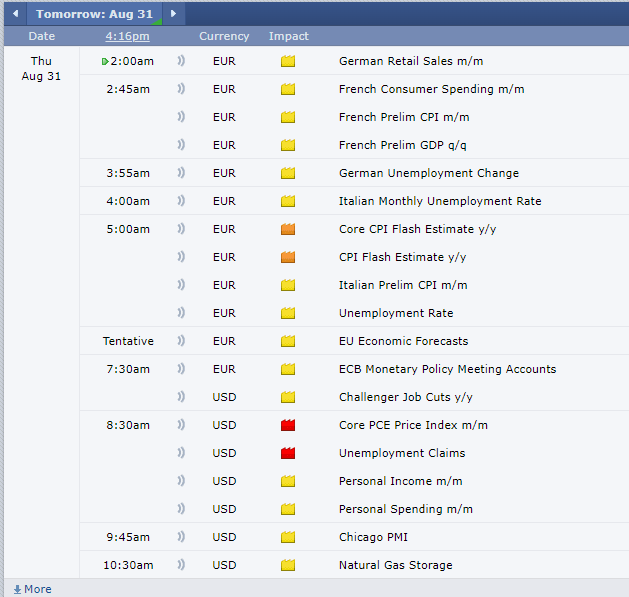

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.