The Week Ahead:

By John Thorpe, Senior broker

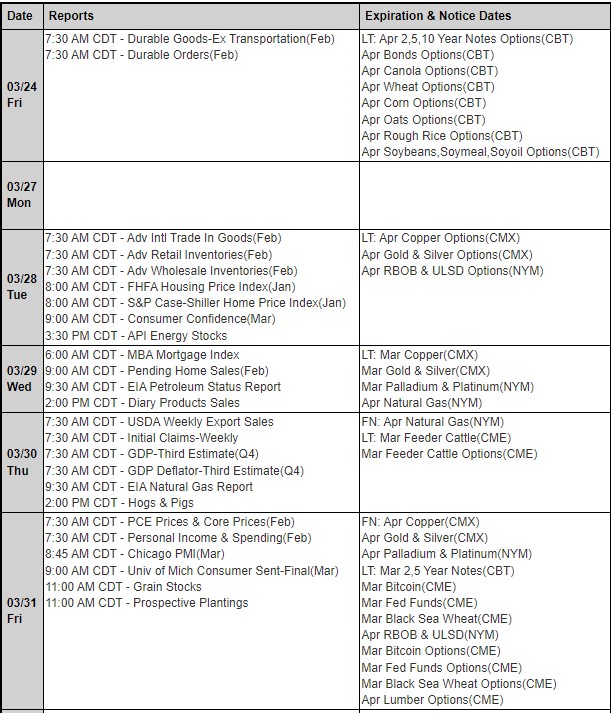

There are few reports with market-moving potential in the March 27 week for the financials, However, for the grain markets and impact on livestock prices, Friday will mark the once a year prospective plantings report.

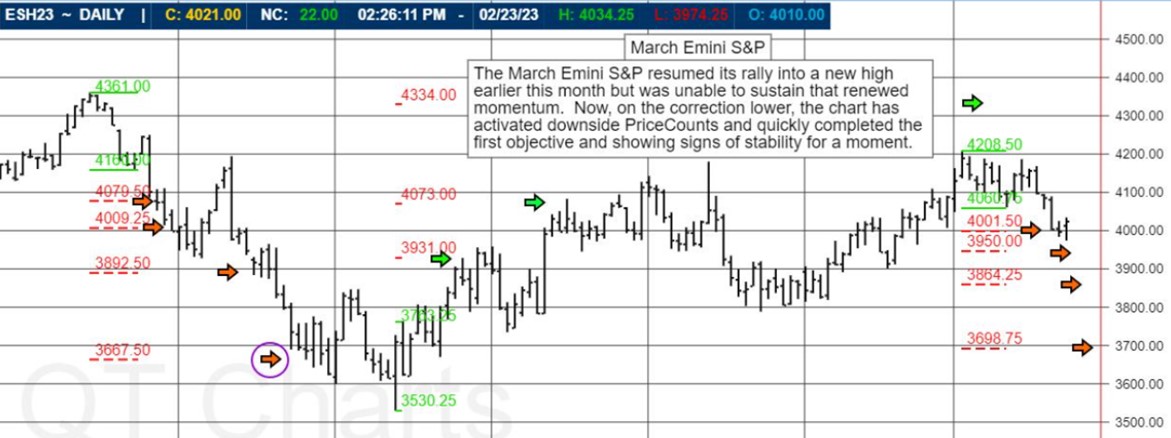

The third and final estimate of GDP for the fourth quarter 2022 will be reported at 7:30 CDT on Thursday. With the first quarter 2023 already nearing its end, there is far more interest in economic conditions in the January-March period.

Meanwhile, Fed policymakers will be back in public after the end of the communications blackout period from the March 21-22 FOMC meeting. No comments will be more closely attended to than Vice Chair of Supervision Michael Barr’s appearance before the House Financial Services Committee on Wednesday at 9:00 CDT. Aside from the committee’s posturing, Barr’s written testimony and responses to questioning will be a warning to other banks to clean up their risk management and any overreliance on narrow business sectors.

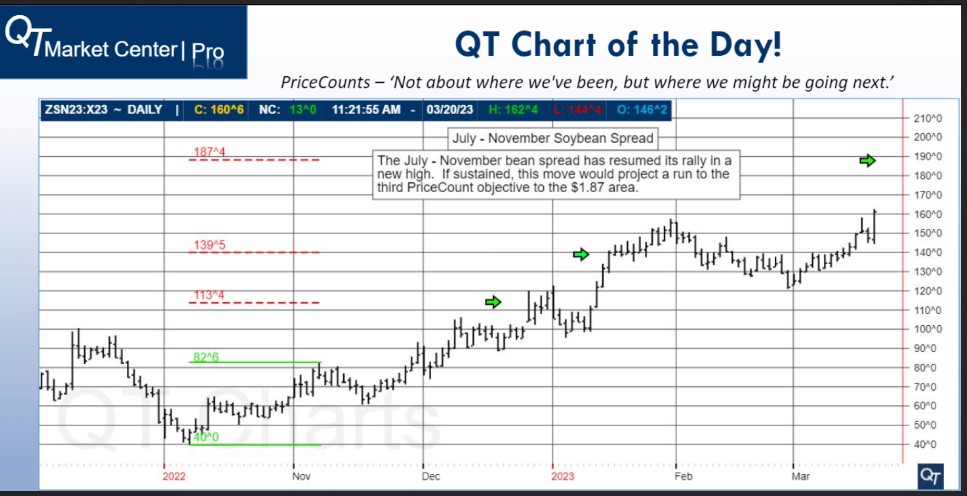

For our Grain Traders and Bona Fide Hedgers

This piece of information from one of our partners,

Offers expectations for Friday’s big and all important USDA Prospective Plantings report and USDA Quarterly Grain Stocks —

Ahead of this week’s USDA quarterly grain stocks report, analysts are forecasting as of March 1, US Soybean stockpiles at 1.73 bln bu, that compares with the 1.93 bln bu on March 1, 2022

— Ahead of this week’s USDA quarterly grain stocks report, analysts are forecasting as of March 1, US Corn stockpiles at 7.47 bln bu, that compares with the 7.76 bln bu on March 1, 2022

— Grain traders and analysts are forecasting next week’s USDA prospective planting report to show US Soybean acres at 88.3 mln, that compares with last season’s 87.5 mln acres. The data will be released Friday, March 31 around 11:00 am CT.

— Grain traders and analysts are forecasting next week’s USDA prospective planting report to show US Corn acres at 90.9 mln, that compares with last season’s 88.6 mln acres. The data will be released Friday, March 31 around 11:00 am CT.

Plan your trade and trade your plan.

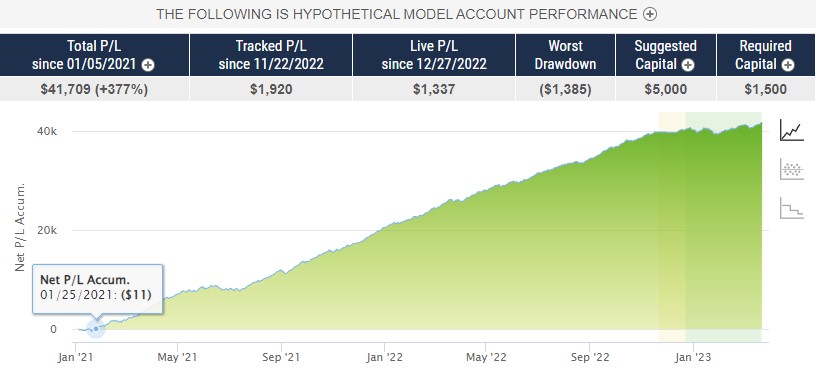

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

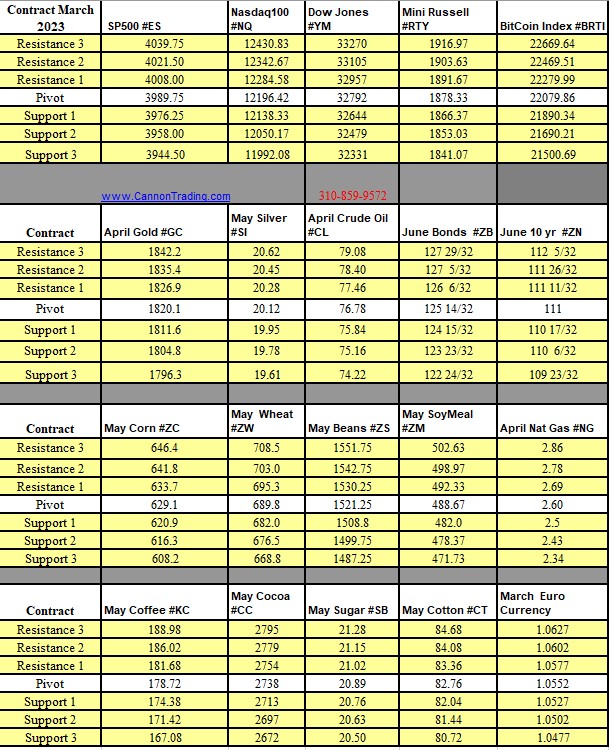

Futures Trading Levels

for 03-28-2023

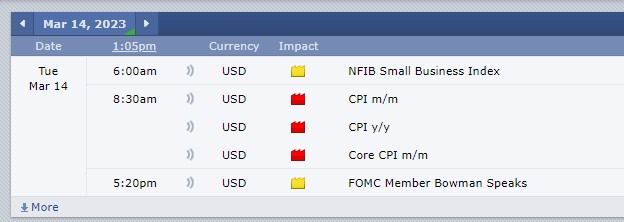

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.