| Movers and shakers!

By John Thorpe, Senior Broker

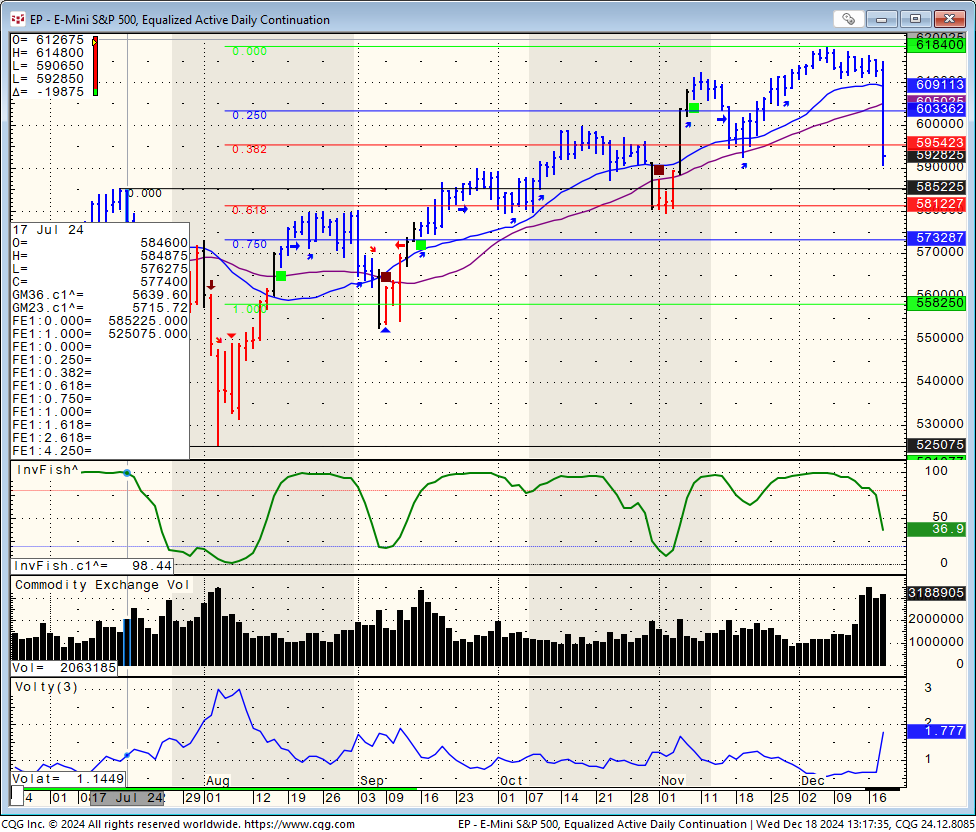

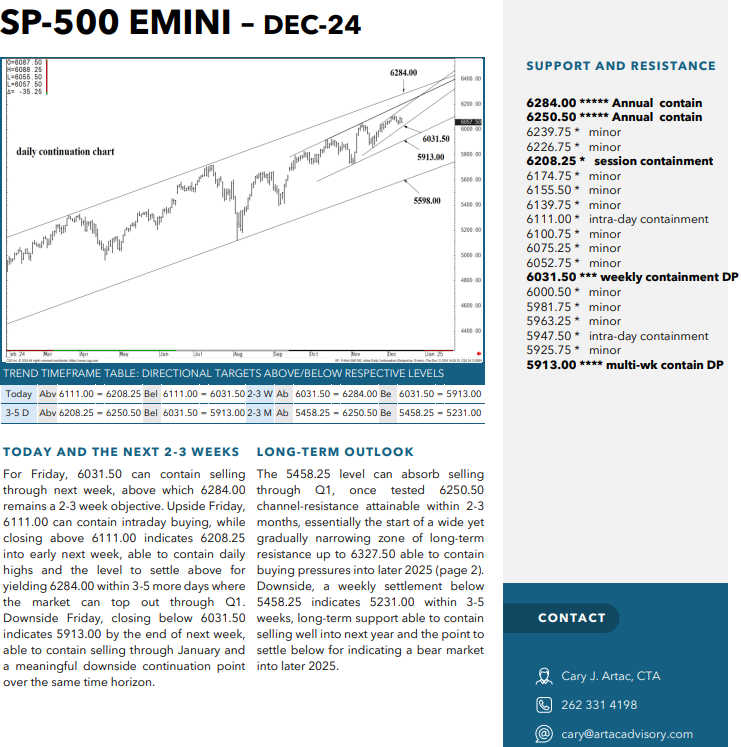

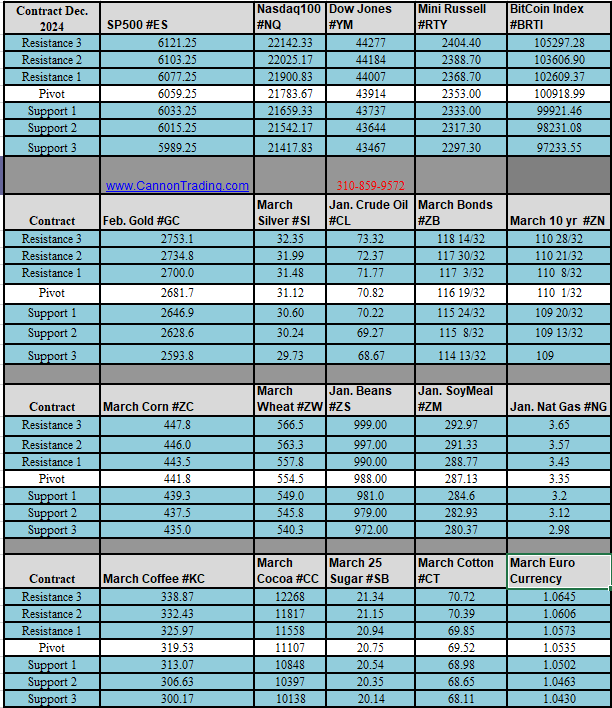

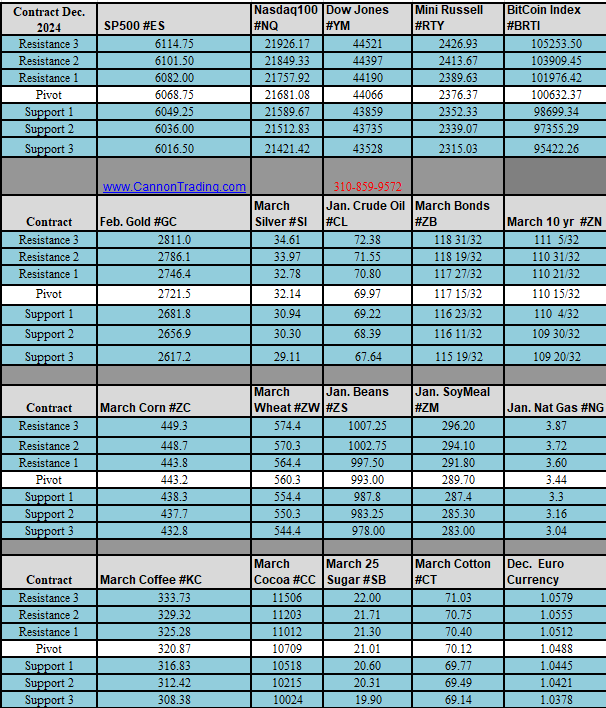

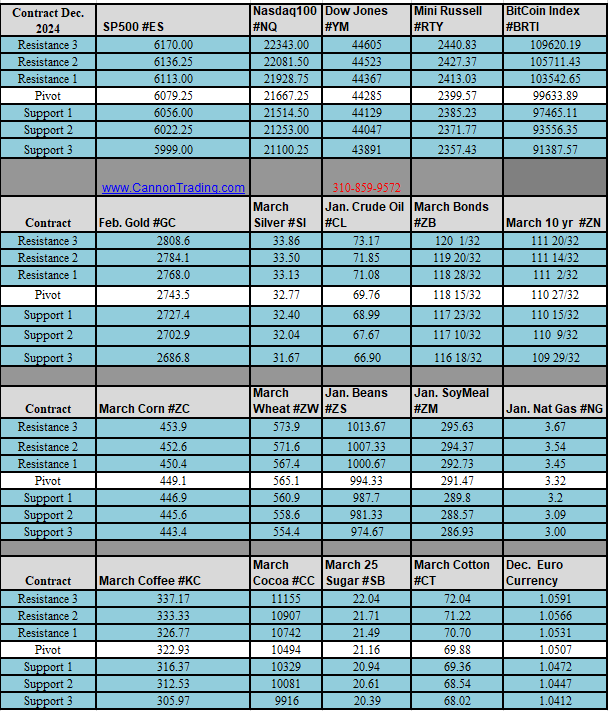

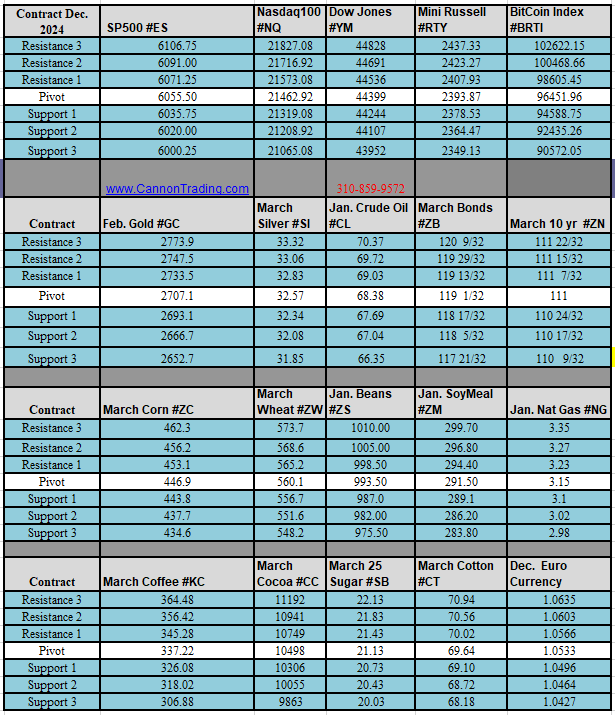

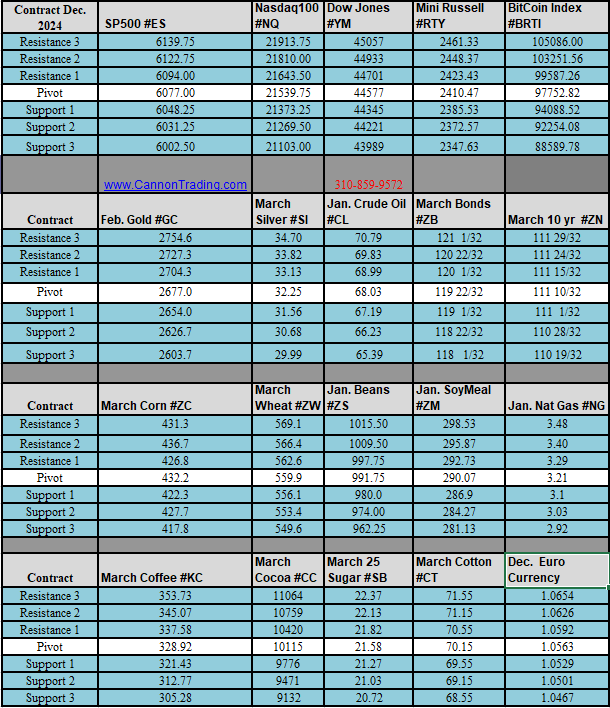

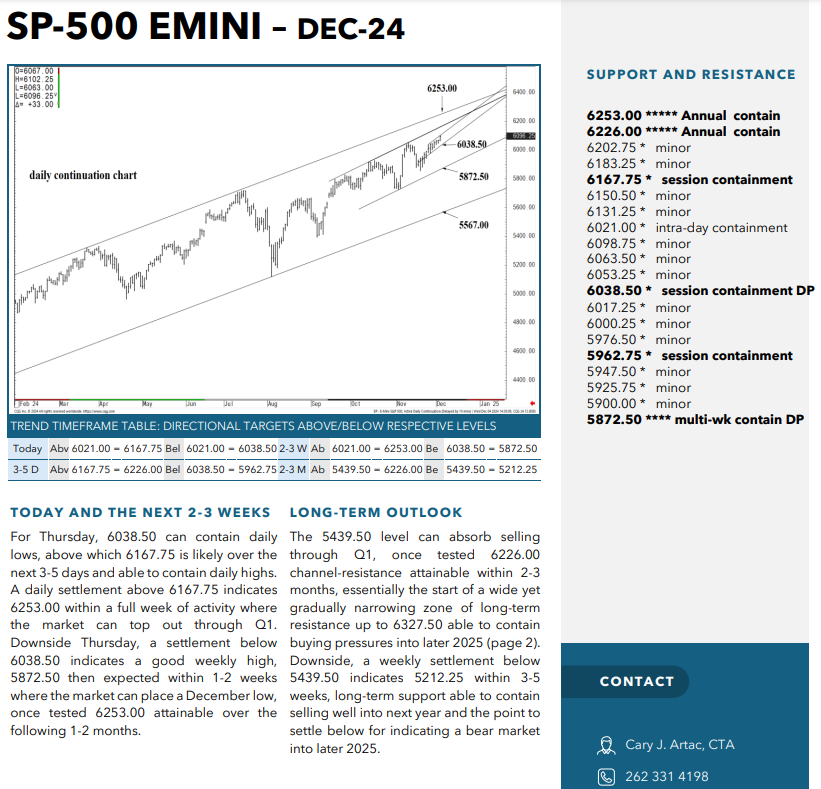

The Equity markets got a little less frothy today ahead of the Final rate decision; prices down marginally. Some SMA crossovers are showing a downside break is in store for the DOW Index. Not so for the S & P or Nasdaq Indices. Although the S&P does not appear to be poised for a breakdown like the Dow, (range bound for the past 3 weeks) NQ’s story is a little different and the Magnificent 7 have continue to fuel the endless rally with only a minor 6/10th’s of a percentage correction. My personal view is this is simply a retail selling opportunity in advance of the FOMC results tomorrow, I call it a little “risk off”.

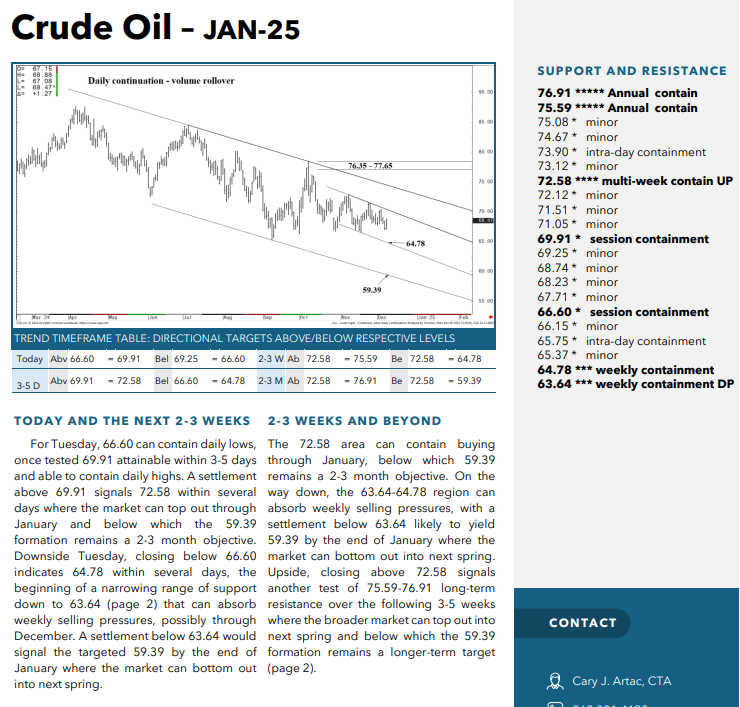

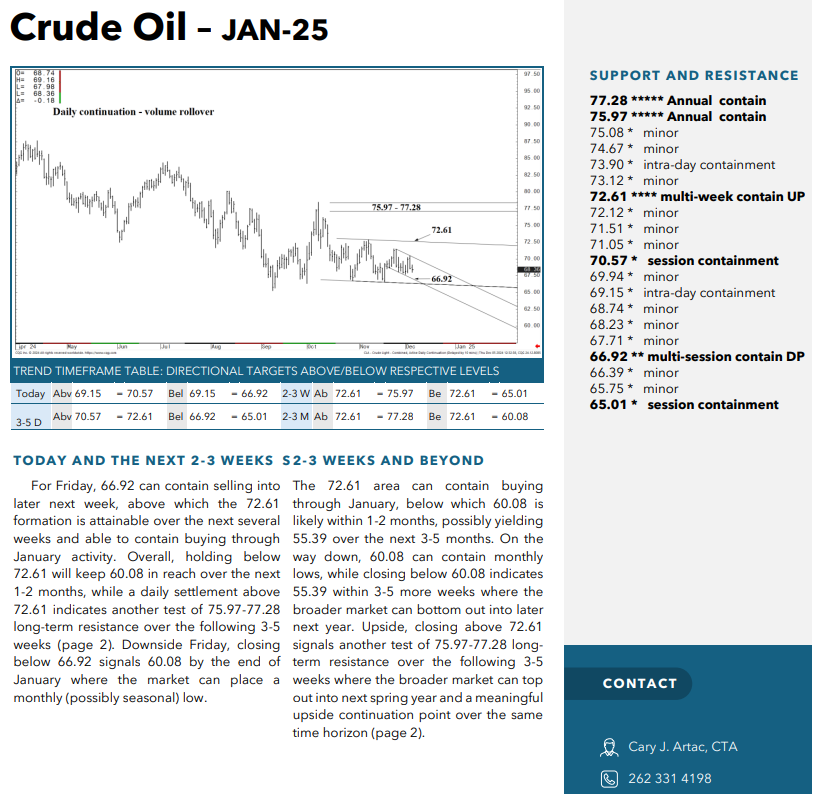

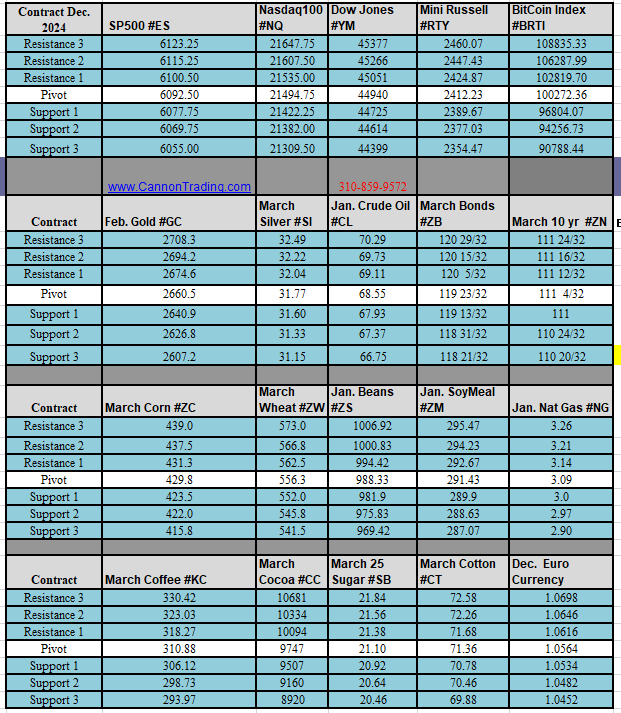

Energies, Grains, Metals, softs are all closing on the negative for the day with very few exceptions within the complexes.

US Advance Retail Sales Headline Recap

**US November Advance Retail Sales: +0.7%; expected +0.6%

**US November Advance Retail Sales ex Autos: +0.2%; expected +0.4%

**US revised October Retail Sales: +0.5% from +0.4%

Redbook Weekly US Retail Sales Headline Recap

**Redbook Weekly US Retail Sales were +4.5% in the first two weeks of December 2024 vs December 2023

**Redbook Weekly US Retail Sales were +4.8% in the week ending December 14th vs yr ago week

Redbook Weekly US Retail Sales Headline Recap

**Redbook Weekly US Retail Sales were +6.5% in the first week of September 2024 vs September 2023

**Redbook Weekly US Retail Sales were +6.5% in the week ending September 7 vs yr ago week

Updated: December 17, 2024 8:15 am

Federal Reserve US Industrial Production & Capacity Utilization Headline Recap

**Federal Reserve November US Industrial Production: -0.1%; expected +0.2%

**Federal Reserve November US Capacity Utilization: 76.8%; expected 77.2%

**Federal Reserve October US Industrial Production revised: -0.4%; prior -0.3%

**Federal Reserve October US Capacity Utilization revised: 77.0%; prior 77.1%

Updated: December 17, 2024 9:38 am

**US House Speaker Johnson Tuesday morning said the stopgap funding bill will have $10 billion for US farmers

Updated: September 10, 2024 12:49 pm

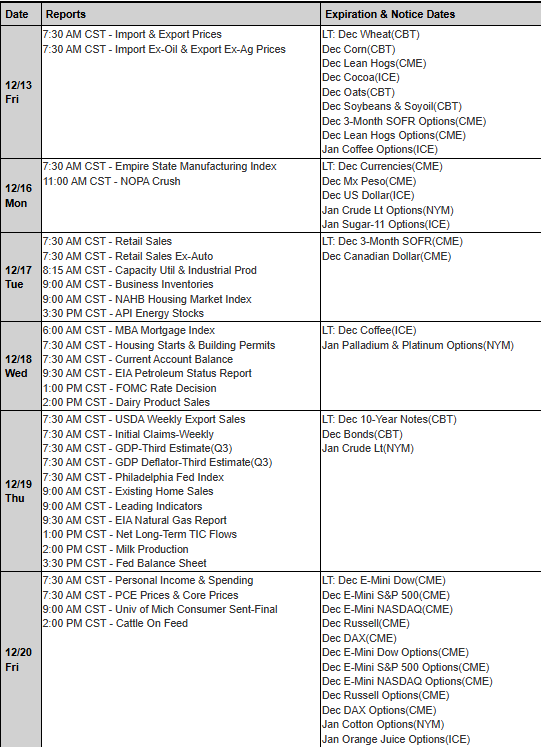

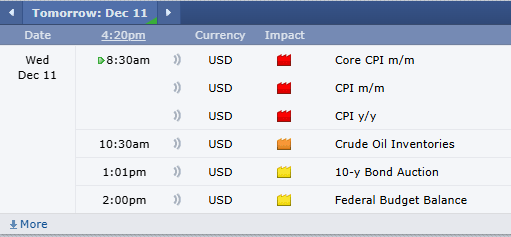

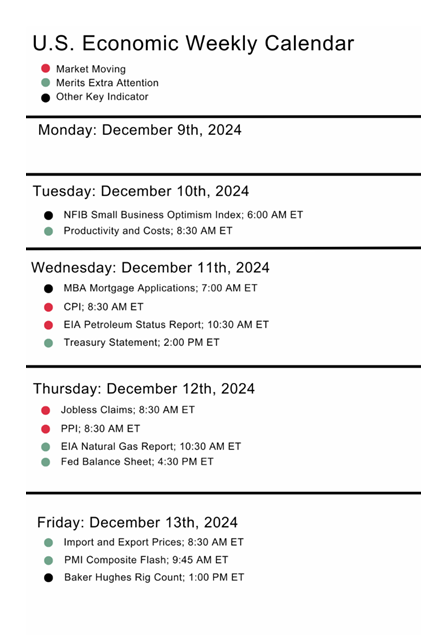

Watch Tomorrow’s Movers and Shakers:

Fed Funds FOMC Rate decision @ 1P.M. Central with 1:30 PM Presser with J. Powell to follow.

Consensus Outlook:

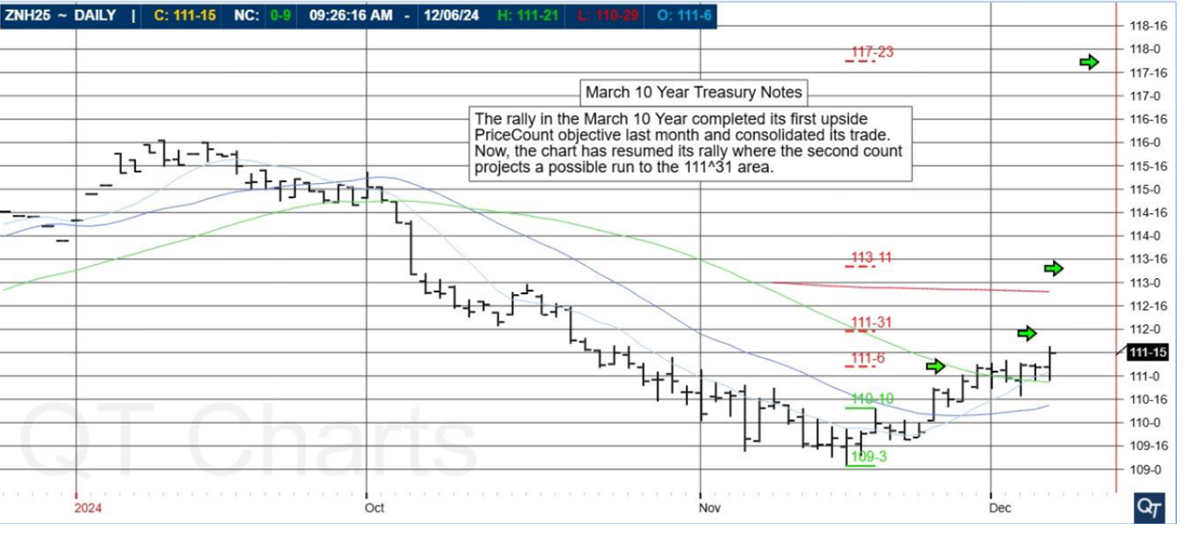

The US Federal Reserve will announce their FOMC policy statement Wednesday afternoon around 1:00 pm CT. Many economists expect the FOMC to lower the key Fed Funds rate by 25 basis points, to a range between 4.25% to 4.50%. However, after Tuesday’s strong November US retail sales data showed underlying economic momentum, pundits are wondering if the Fed may signal a cautious, slowing pace of interest rate cuts in 2025.

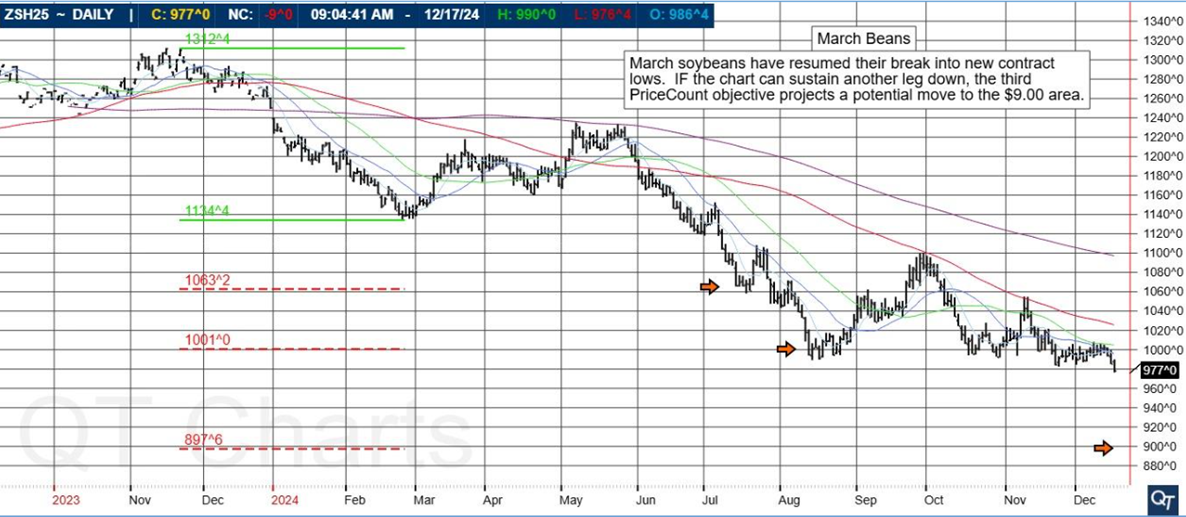

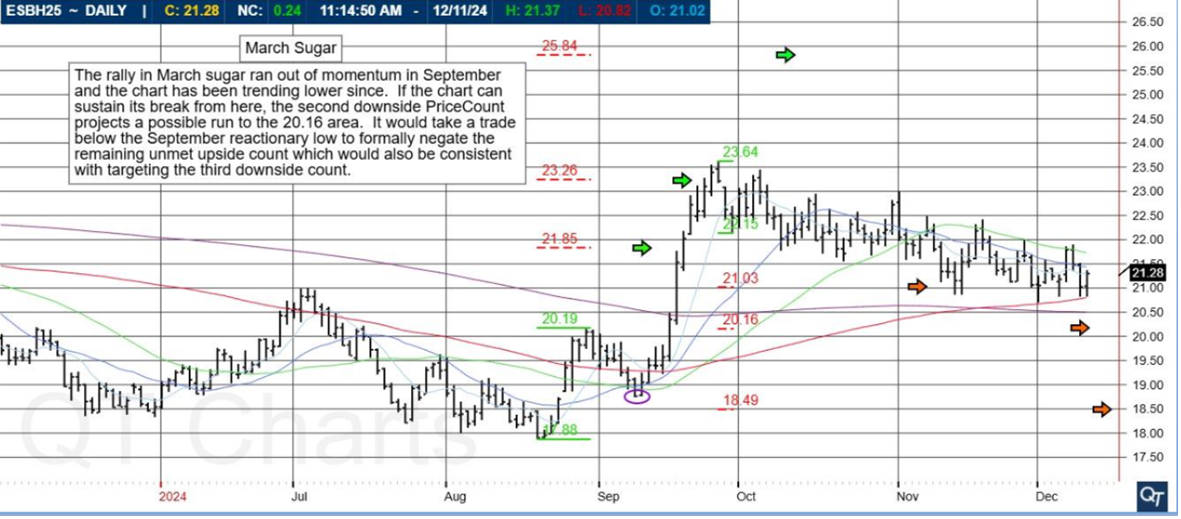

Soybeans Daily Chart Below: |

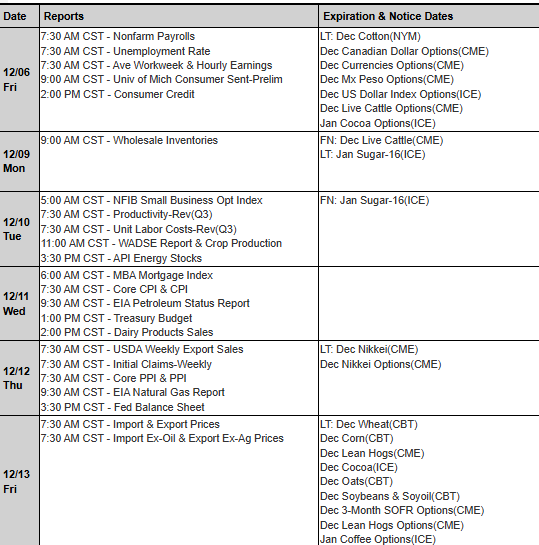

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010