Dear Traders,

Get Real Time updates and more on our private FB group!

VIX Stock Index Trading Signals

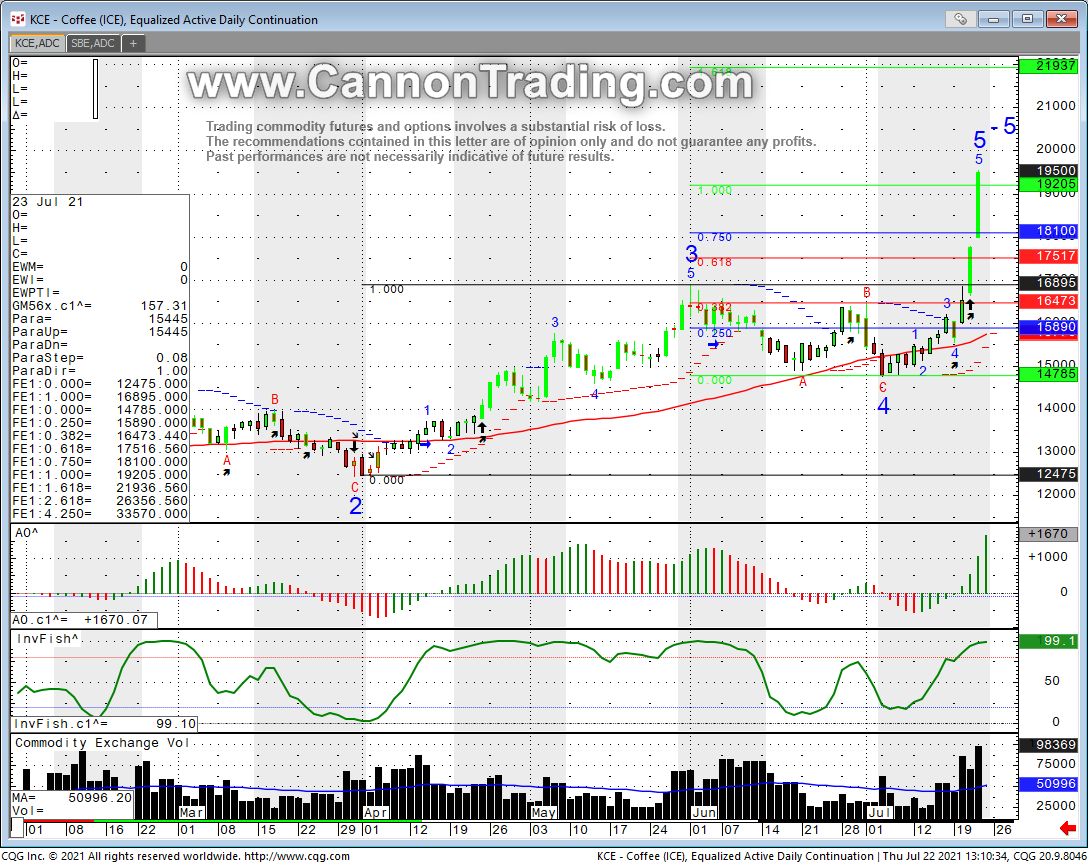

Over the last several months, two of the major stock averages (the S&P 500 and Nasdaq 100) have been on a relentless upward trajectory. This has occurred as the VIX (S&P 500 Volatility Index) has remained elevated relative to its historical levels. In past bull markets, the VIX (which many refer to as the fear gauge) has traded in the low teens and even dropped to single digit readings during strong advances in the stock market. So why is this time different? More importantly, can we use the VIX to increase our odds of timing long and short entries in the S&P 500 and Nasdaq futures? I believe the answer is yes.

First, A quick definition of the VIX: It is an index that measures the premium of at-the-money Calls and Puts on the Cash S&P 500 going out one month in duration. Some market participants utilize options (because of their leverage component) to hedge long only portfolios. For that reason, when the stocks come under pressure, the demand for this protection increases and thus premiums (the cost to buy options) increases. Simply, there is an inverse correlation between the VIX index and stocks. As stocks drop, the VIX will rise and vice-versa.

Now that we have a better understanding of how the VIX works, let’s look at a 4 hour chart going back 2 months. In it, we can see that it has formed a clearly defined range between 15 on the lower band and 21 on the high extremity. If you look at a chart of the S&P 500 futures you will notice that on every corrective (drop) in this index over the last 2 months, the VIX has rallied up to 21. Additionally, note that when the VIX fails to move above this level, the ES (S&P 500 futures) stops falling and usually finds buyers. Conversely, when stocks advance, and the VIX stays above 15, stocks generally pause or struggle to have any meaningful move higher.

Of course, this range will not persist indefinitely, as these patterns never do. However, I believe we can glean useful information from this environment. Can we surmise that a break above the recent range in the VIX implies more selling (bearish) implications? Separately, a break below the key 15 level may insinuate that institutional investors feel more comfortable lifting their hedges, thus leaving more room for stocks to rally in the short-term.

We can never rely on one single indicator to buy or sell, but as traders, we always need to seek an edge. Perhaps this can give you a different way to look at the markets. More importantly, by monitoring the VIX relative to what options traders and institutions are doing to hedge their portfolios, my hope is that it can help you make better trading decisions.

Until next time, I hope everyone has a great trading week.

Gabe

This is not a solicitation of any order to buy or sell, but a current market view provided by

Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

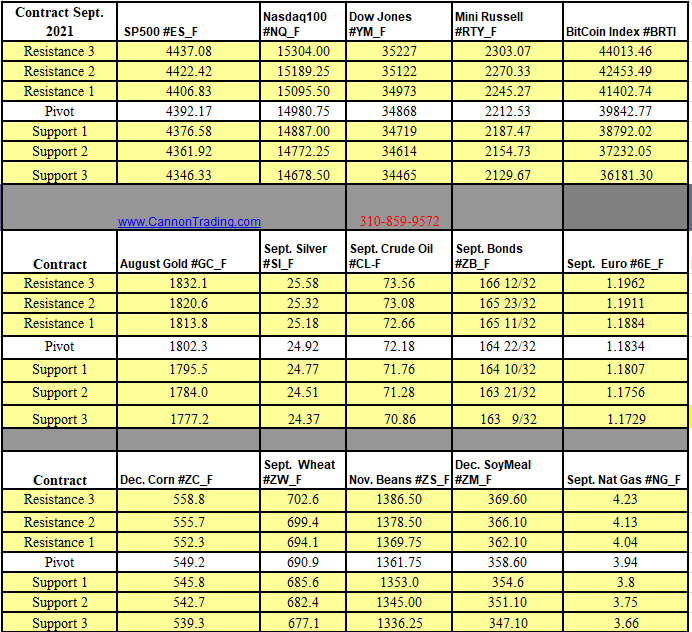

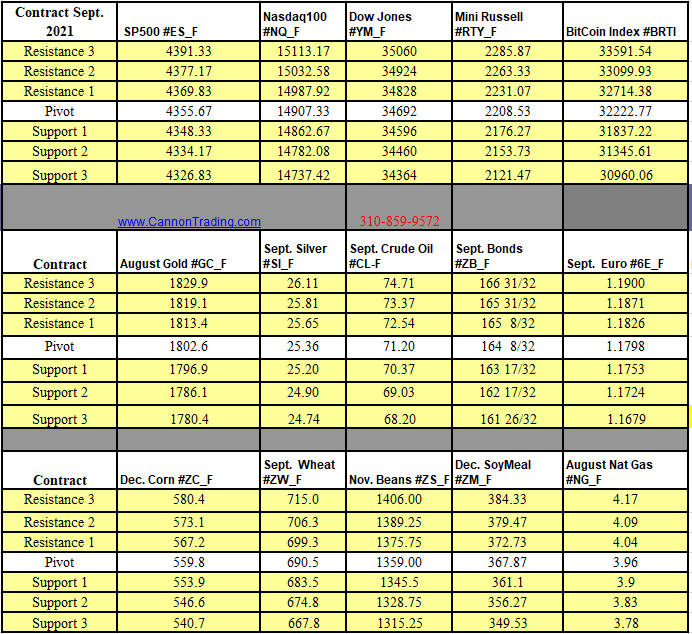

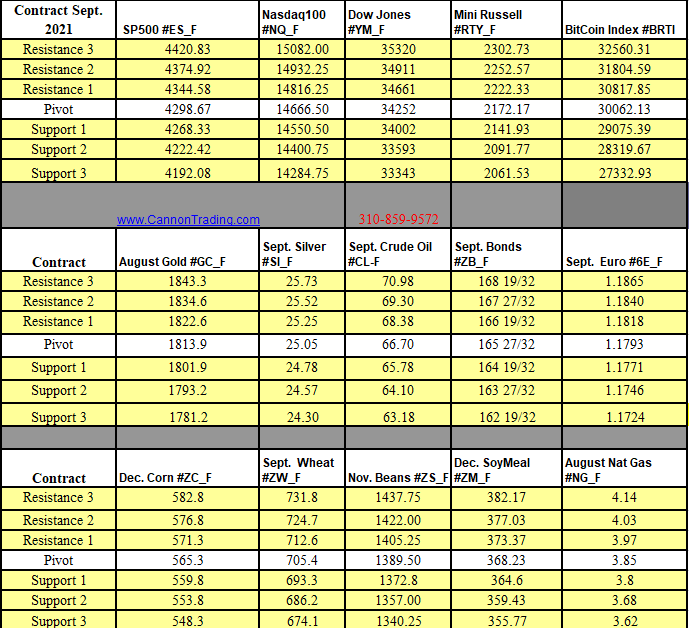

Futures Trading Levels

7-22-2021

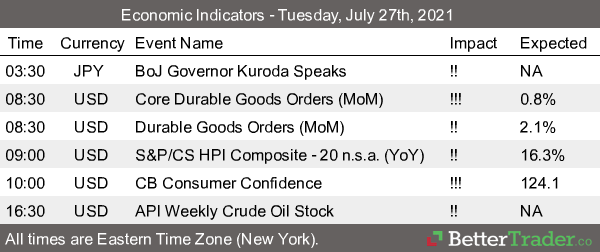

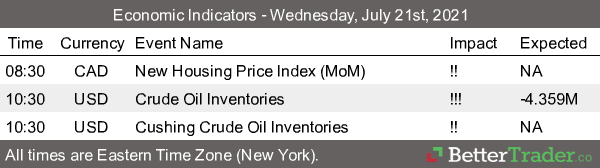

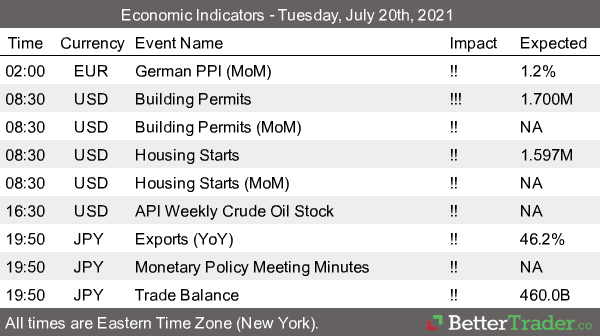

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to the accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.