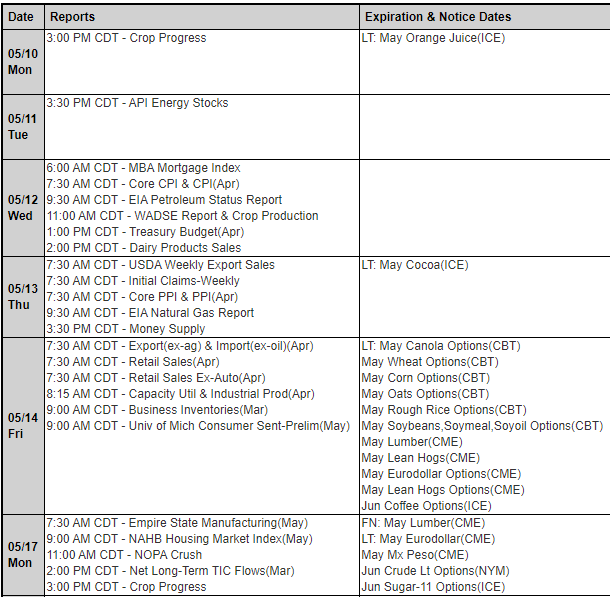

With NFP ( non Farm Payroll) report tomorrow – monthly un employment, I thought the following article is worth featuring:

RISK

It is a four letter word. As traders it is something that we thrive on and dread. We chase and fear. We look for and look to avoid. It is RISK. Without it, there is no opportunity for profit. Without it trading lacks potential. With it, failure and heartache are the consequences when it is abused.

Risk itself is not a bad thing. When it is misused by traders, it becomes a problem. Controlled risk presents traders with exciting and profitable opportunities. Uncontrolled, it brings the end to the dreams and careers of many traders.

How should we as traders confront risk? The first step is to respect it. Realize the damage it can do to our account equities when it is abused. The two most important tools that we have to control risk are stops and position size. Oh, I know, you hate stops. We all do. We have all been stopped out at the high or low only to see the market immediately move in the direction that we thought it would. But without using stops on every trade that we enter, disaster will eventually prevail. I have a love/hate relationship with my stop orders. I hate to place them, but love how they save me from large, unacceptable account crushing losses. It is the same for all successful traders. Those foolish enough to trade without stop protection are risking disaster on every trade. Unless you as a trader have developed perfect discipline to exit a losing trade quickly, and according to your pre-entry criteria, stops are mandatory. And admit it, at least to yourself…..do you have perfect discipline? I think not.

The other critical element in controlling risk is position size. By this I mean the percentage of your equity that you are risking per trade. I do not risk more than 3.5% of my equity on any trade. Some traders are comfortable risking 5% of their equity. This amount for me is an amount of risk with which I am comfortable. It allows for aggressive trading, and it allows me to stay in the game ( financially and psychologically) even after a series of losses. This aspect of strategy building is often forgotten by the novice trader. These folks have dreams of “the big hit” or the monster trade that allows their account equity to soar to heights unimagined by mere mortals. The problem is, oops, what if you are wrong? This type of trading/thinking is out of control. It leads to broken dreams and short careers. You must always remember that this is a highly volatile, sophisticated business. Treat it as such. If you want to gamble, jump on an airplane and visit Las Vegas.

The futures markets are highly leveraged, as we all know. Those traders that abuse risk by not respecting its power will eventually join the long list of former futures traders. Risk must be treated like a beautiful, intelligent woman. Treated with respect, wonderful things can happen. But, abuse it, or disrespect it, and suffer the consequences.

As a futures trader you have to embrace taking risk. Understand its impact. Respect it. Stay in control of it. Develop a trading method that makes risk an asset to your account instead of an enemy of your account. Risk/reward analysis is an important part of our everyday lives. Can I make it thru the intersection before the light turns red? Do I need to re-apply my sunscreen? Should I have one more beer before driving home? In trading, always keep in mind your risk versus the reward. A 50% gain in your account is not equal to a 50% loss of equity. A 50% winning trade puts you up by one half. But a 50% loss means that you have to double your equity to get back to your starting point. Respect your risk levels. Trade only using a risk level that you, personally, are comfortable with.

Rome wasn’t built in a day. Neither will your account be built in a day, or a week. Respect risk. Enjoy it’s benefits and your trading in rest of this year and in 2011 will produce profits and satisfaction. Enjoy the ride.