_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Get Real Time updates and more on our private FB group!

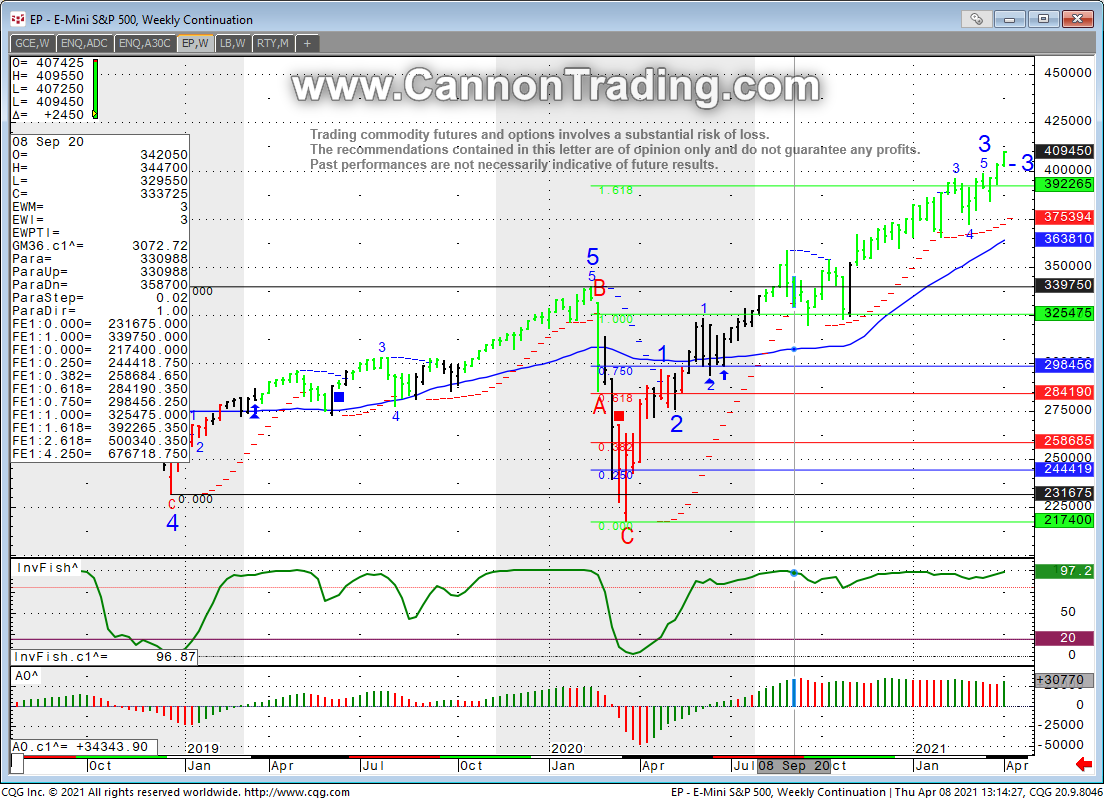

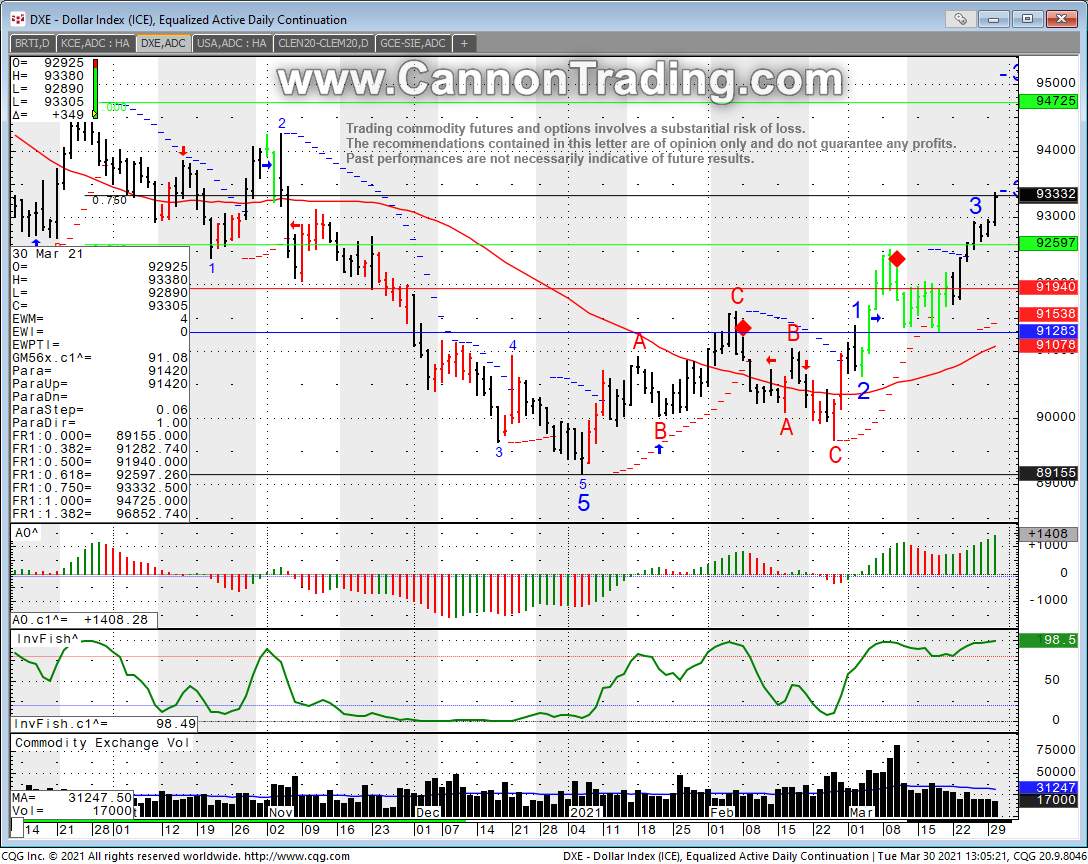

Different rhythm to the market this week versus what we saw last week before Good Friday.

Market rhythm, correlation between markets, money flow between assets, scheduled reports, longer term picture as well as volatility cycles all affect the intraday price action as well.

Do your homework each day before you start trading and keep notes.

If you like to have access to “wisdom nuggets” like the ones below shared BEFORE the market open, then join our private FB group at:

Here are some note from how we started the week yesterday –

04.05.21 Monday Morning commentary by

Al BicoffSCO = STOP CLOSE ONLY

XX = STOP

GOOD MORNING.

M S&P held ALGO’S SCO @ 3966.00

on Friday and exploded higher.

LOW was 3964.50

S&P objective is 4,050

US$ traded -0.28 again, triggering

short covering in GOLD, SILVER & CRUDE

BULLISH for EQUITIES!

BONDS, paradoxically rallied with S&P’s,

taking some insurance over the long weekend against EQUITIES.

Someone is wrong. BONDS or S&P.

Educated guess, BONDS. Therefore,

BONDS will break and S&P’S will rally.

DOW objective 35,000

GERMAN BUNDS:

10) -0.322%

20) -0.028% / negative again

30) +0.229%

U.S. RATES:

FED FUNDS WINDOW:

(J) CLOSED 0.1825% UNCH

02) 0.162%

10) 1.673%

30) 2.334%

2/10 Yield Curve Closed 1.511%

5/30 Yield Curve Closed 1.428%

M US$ / Closed 92.947 -0.289

SUPPORT:

92.92

92.81 Sell SCO

92.70

M DOW / Closed 33,037 +139

SUPPORT:

32,962

32,887 Sell SCO

32,804

M S&P / Closed 4010.00 +42.50

SUPPORT:

3995.50

3983.50 Sell SCO

3970.50

Money flow for M S&P’S:

Negative= N / Positive= P

K CRUDE down 1.01 / N

K Copper up 11.35 / P

M BONDS down 0.06 / P

M YEN up 0.115 / N

M PALLADIUM down 22.80 / N

M US$ down 0.046 / P

K LUMBER closed 1012.60 +3.50

K CRUDE / Closed $61.45 +$2.29

RESISTANCE:

65.86

64.52 Buy SCO

63.36

SUPPORT:

58.98

57.78 Sell SCO

56.39

M BONDS / Closed 156.07 +1.20

RESISTANCE:

158.11

157.23 Buy SCO

157.06

SUPPORT

155.06

154.21 Sell SCO

154.01

K COPPER / Closed $3.9905 -0.50

RESISTANCE:

4.1815

4.1415 Buy SCO

4.1070

SUPPORT:

3.9935

3.9685 Sell SCO

3.9400

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

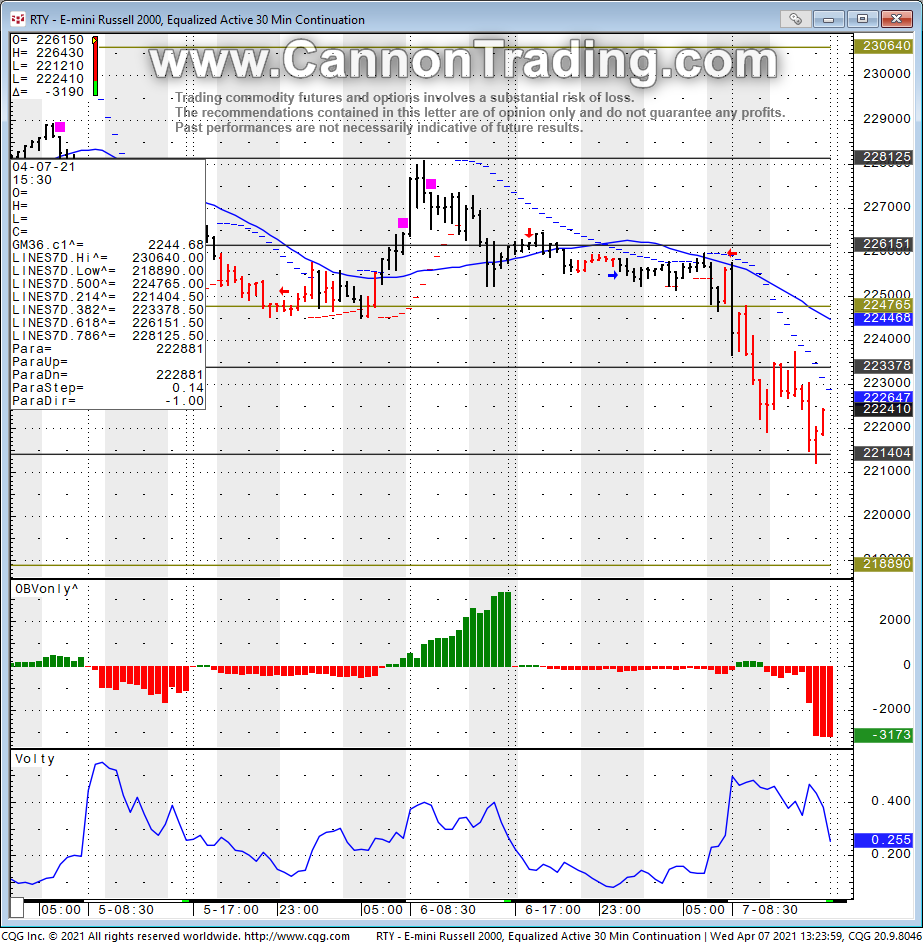

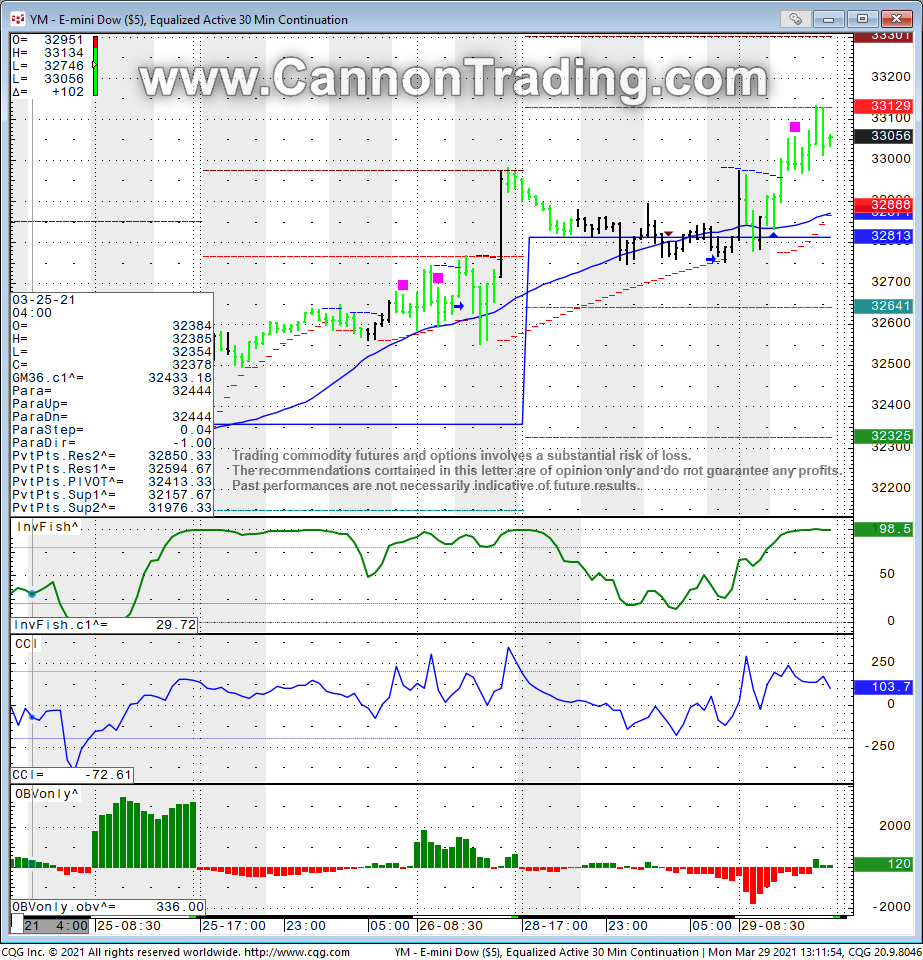

YM= Mini Dow 30 minute chart for your review below.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

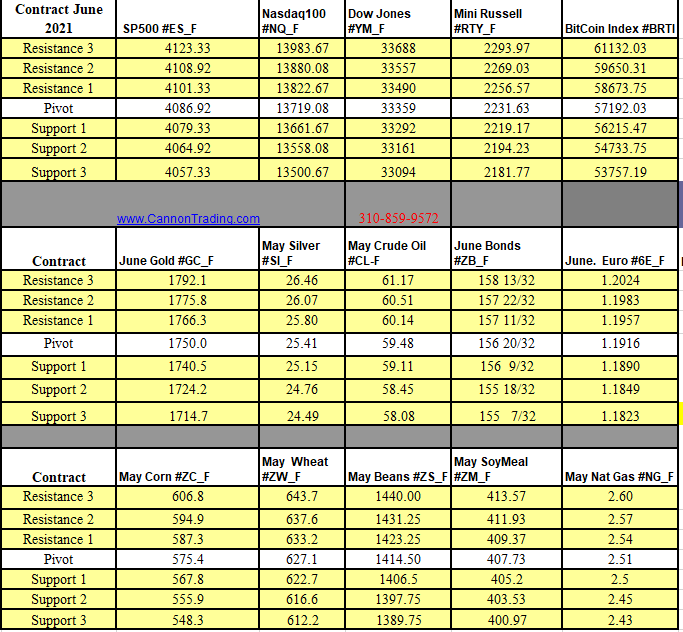

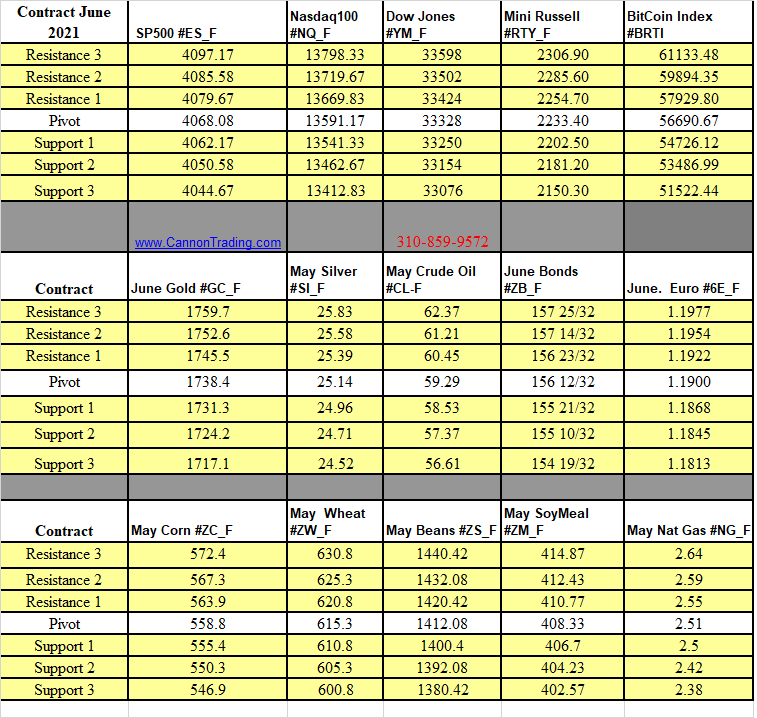

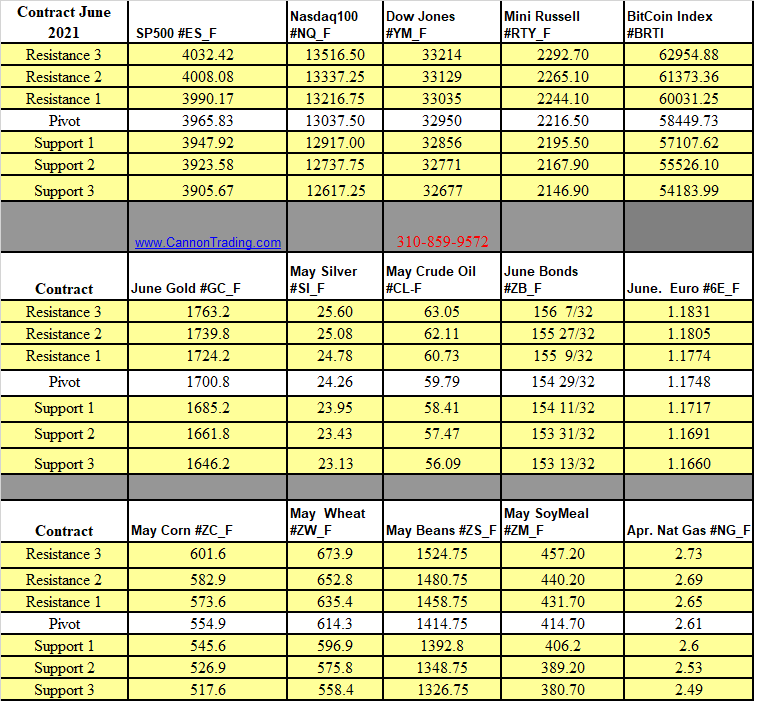

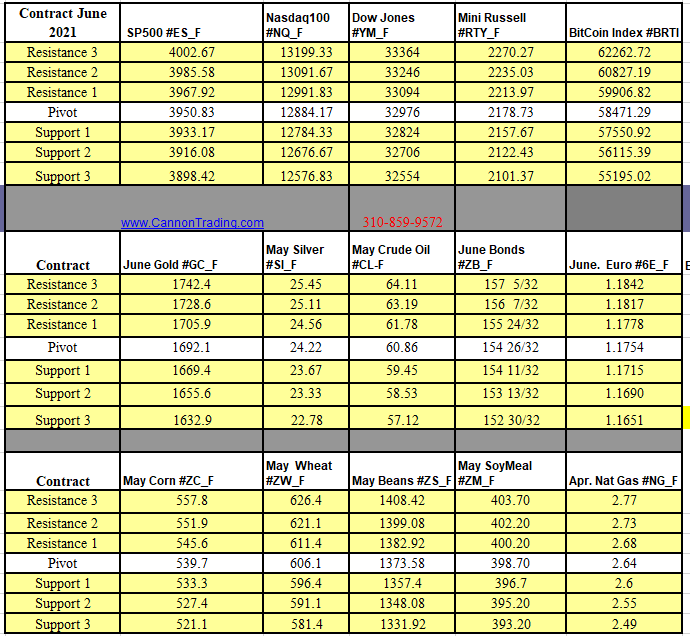

Futures Trading Levels

4-07-2021

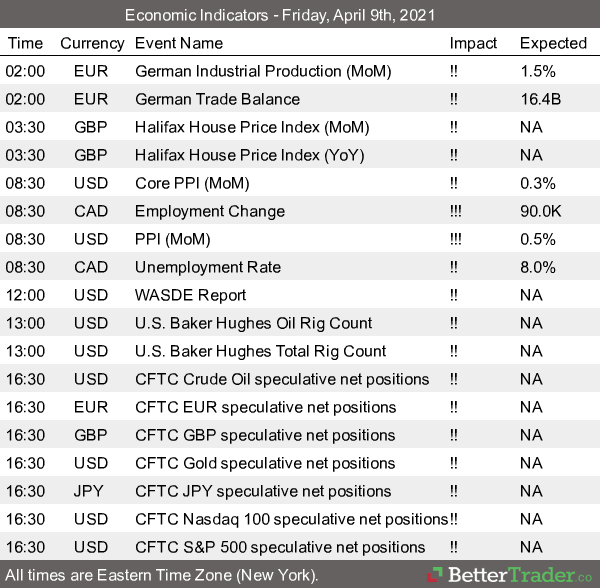

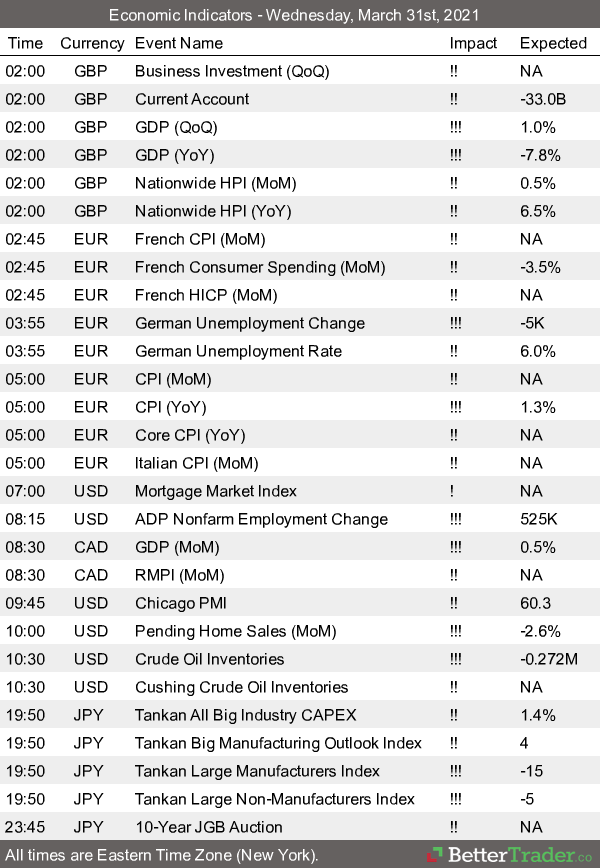

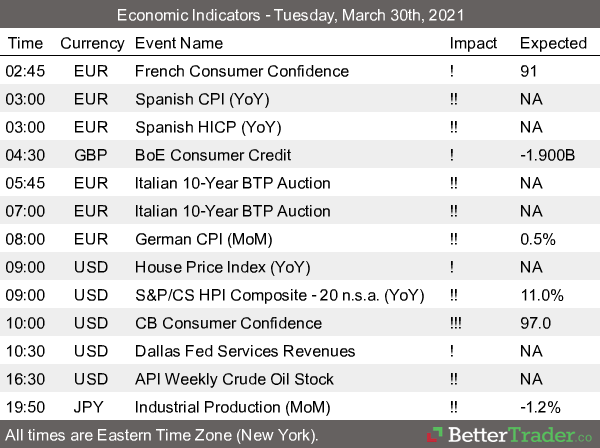

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.