_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

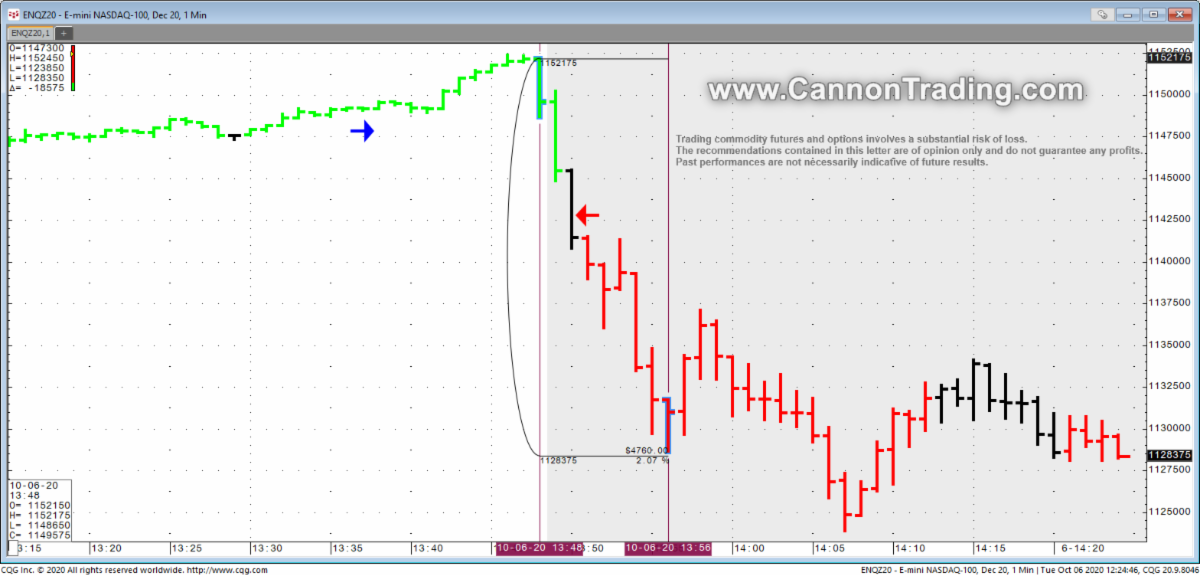

The news about President Trump and COVID along with an already “very spicy markets” encouraged me to share some of the following pointers.

Hope it helps.

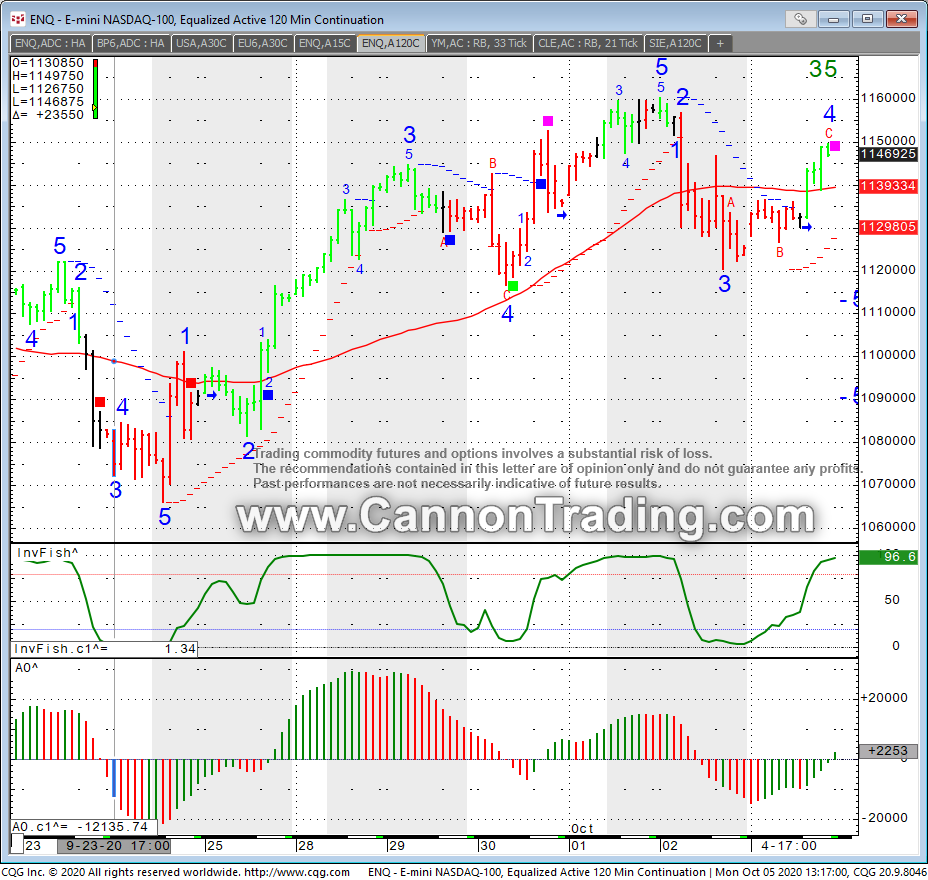

*While I have no idea were the market is going from day to day, minute to minute, week to week etc. I do know that in the past, some of the sharpest and largest rallies were short covering after a large sell off. More often than not market sell offs and volatility like we are seeing do not end up as V type of action but more like U or W when it is all said and done.

*Expect the unexpected…

* Have an idea of what you are looking to do, keep in mind possible risk and have a game plan. Now more than ever, plan your trade and than trade your plan!

* Think money management, hedging risk while you are still trying to figure out how to profit.

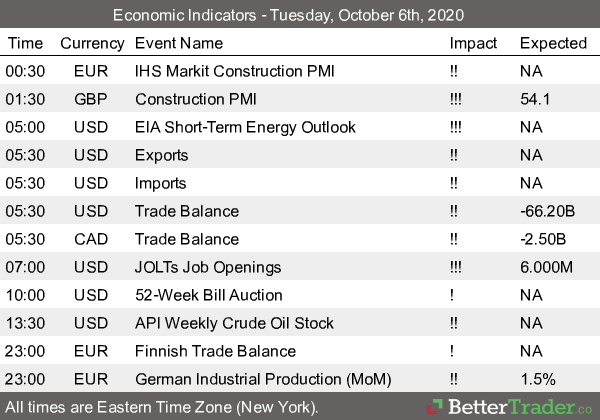

* Know what is going on, reports, current margins, current limits and more.

*Trade smaller. The bands are much larger. Watch the VIX.

* DO NOT assume anything…if you are not sure,

contact us and we will try our best to assist with the combined, vast experience we have here as a team.

* Wash hands, take this seriously and do your best to stay healthy….

__________________________________________________

I’ve received some questions about the price limits or circuit breakers we have seen mostly in stock index futures. Hopefully this explains things a bit better:

A price limit is the maximum price range permitted for a futures contract in each trading session. When markets hit the price limit, different actions can occur depending on the product being traded. Markets may temporarily halt until price limits can be expanded, they may remain in a limit condition or they may stop trading for the day, based on regulatory rules.

This is for Stock Index futures but keep in mind MANY other markets are experiencing LARGE swings and moves.

Overnight limits (5:00 P.M. – 8:30 A.M., Central Time): the futures contract is limited to a 5% price move up or a 5% price move down, based on the futures contract’s prior day’s settlement price (3:15 P.M., Central Time).

**Starting Sunday Night Oct. 11th, the OVERNIGHT PRICE LIMITS for the following contracts: S&P 500, E-mini S&P, Micro E-mini S&P 500, E-mini Select Sectors, E-mini Russell 1000 and 2000, Micro E-mini Russell 2000, Emini Nasdaq, Micro E-mini Nasdaq 100, E-mini Dow, Micro E-mini Dow, will NO LONGER BE 5%. Instead the NEW OVERNIGHT PRICE LIMITS WILL BE 7% up or down and trading will cease until the NYSE cash market opens at 8:30am Central Time.

This applies to the main stock index futures contracts available, such as the ES, MES, NQ, etc.

What is so dangerous you may ask?

If you are long an ES during the night session and the market is limit down (5%) you can NOT get out. There is a chance that when the market opens up at 8:30 AM CDT that the market will then go down the 7% limit with out you being able to exit. That means that on certain situations you can lose MORE than you have in your account.

**Starting Oct. 11th, the 5% overnight is no longer in affect and there is a hard 7% first limit/ circuit breaker

If you don’t understand how the circuit breakers/ price limits work…make sure you call us and talk to a broker at + 1 310 859 9572

This only applies for the overnight session ending at 8:30 A.M. Central Time. At that point, a new set of rules kick in ONLY to the downside….

-7% Trading Halt 15 mins

-13% Trading Halt 15 mins

-20% Closed for rest of day

2. Please enjoy the following:

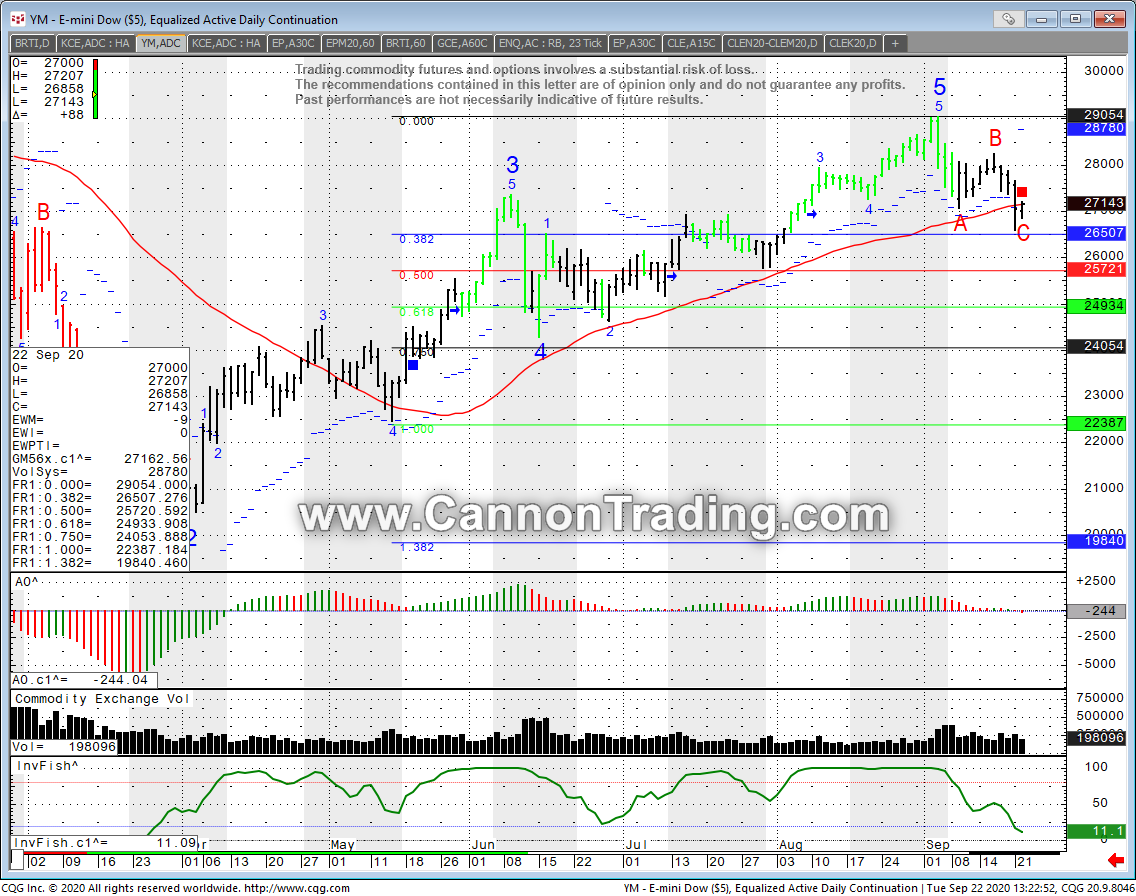

View video below on few different ways to “ride the trend” when one develops as well as more insight into using trailing stops.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

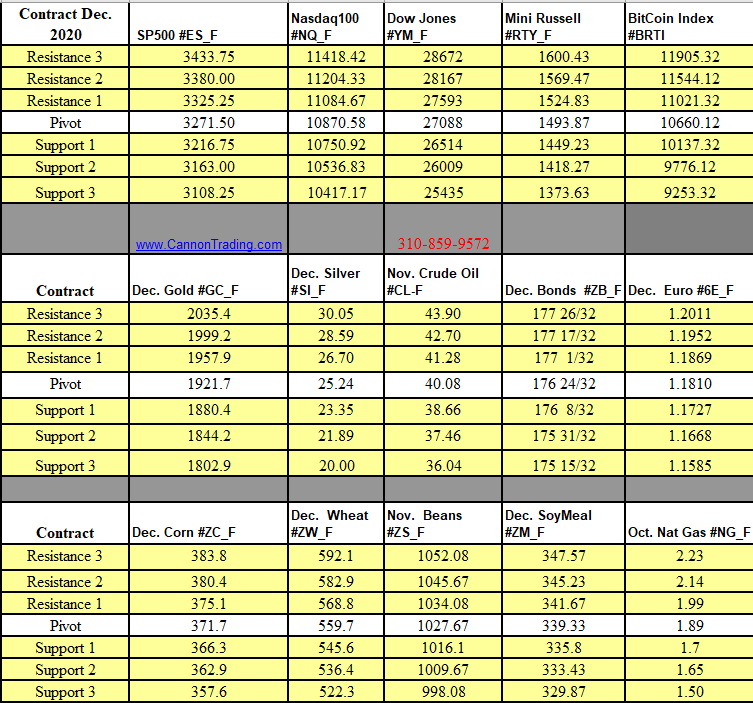

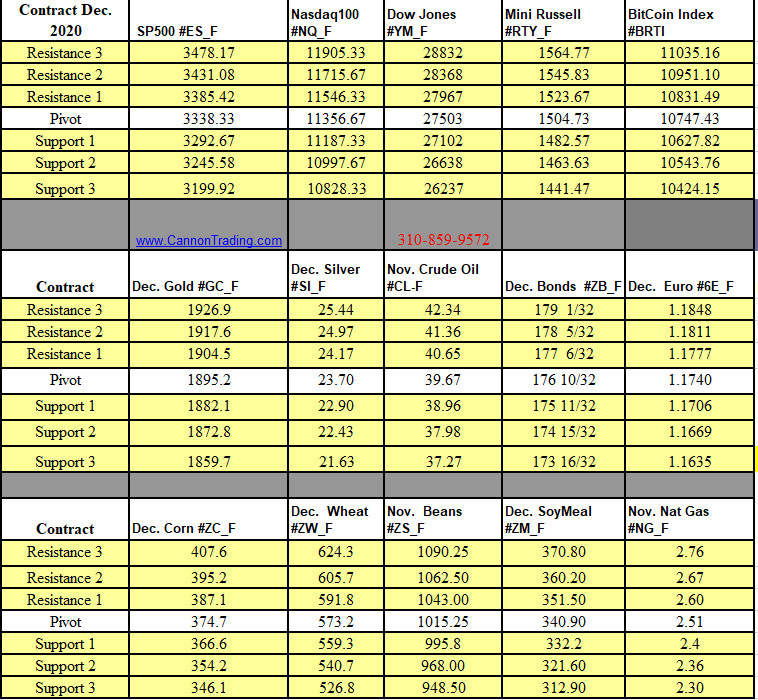

Futures Trading Levels

10-05-2020

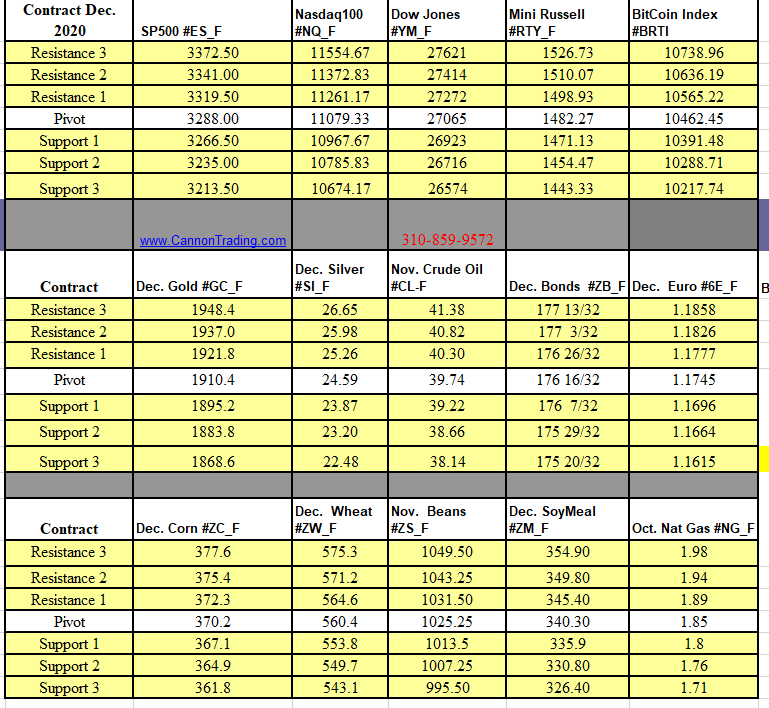

Weekly Levels

Reports, First Notice (FN), Last trading (LT) Days for the Week:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.