_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

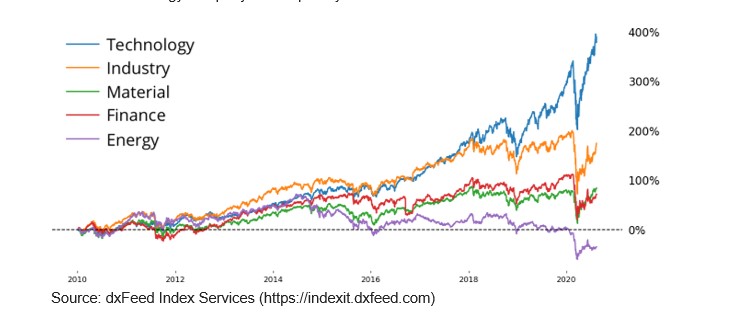

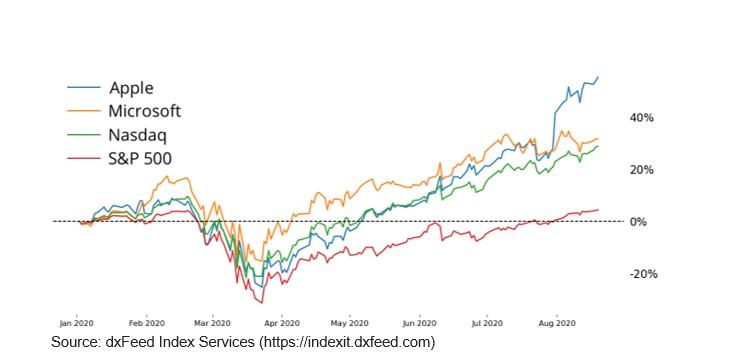

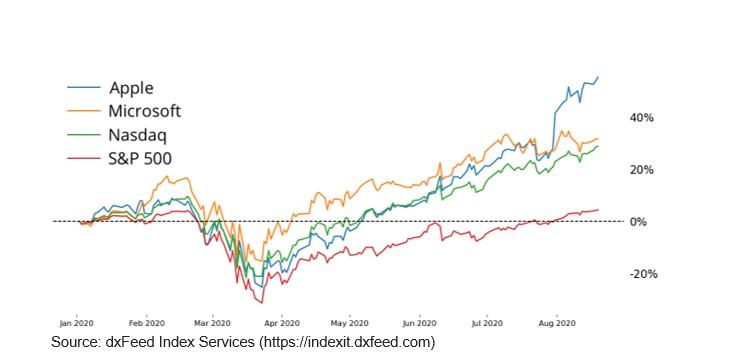

The technology sector is up 400% in the last decade, and, while there’s no telling where tech stocks go from here, it’s evident that they are some of the most prominent names in the market. In 2010, Exxon (XOM) was the S&P 500’s largest component, and Apple (AAPL) and Microsoft (MSFT) were the only technology stocks in its top five. Today, the index’s top five is all tech, and there isn’t an energy company in its top thirty names.

Overweight Tech Products

Major equity indexes such as the S&P 500 and Nasdaq are now heavily invested in the technology sector, 24% and 45% weightings respectively, and their futures (/ES, /NQ) and ETFs (SPY, QQQ) reflect this. Almost all of that tech exposure, however, is concentrated in just a few names. For instance, AAPL and MSFT make up 12% of the S&P and thus half of its technology sector weighting, and these same two names account for 24% of the Nasdaq.

Traditional sector-specific products like the exchange-traded fund XLK (43% AAPL and MSFT) run into the same problem of heaviness at the top. Burgeoning companies in biotechnology and the more technological fields of media and retail are often underrepresented due to their market capitalization. If technological advancements infatuate the everyday investor now more than ever, then why are they stuck with antiquated products that only really track a handful of companies?

A Future for Technology Trading

Small Technology 60 (/STIX) updates tech for the modern trader looking for a single market that puts rising companies like Regeneron (REGN) and Shopify (SHOP) shoulder-to-shoulder with Apple and Microsoft. Investors can get more diversified technology that’s split into four subsectors: information, retail, media, and biotechnology. And speculators get a more active trade that’s not merely the result of sentiment in a couple names.

Call us at 800-454-9572 or Int’l + 1 310 859 9572 or simply reply back to this email!

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

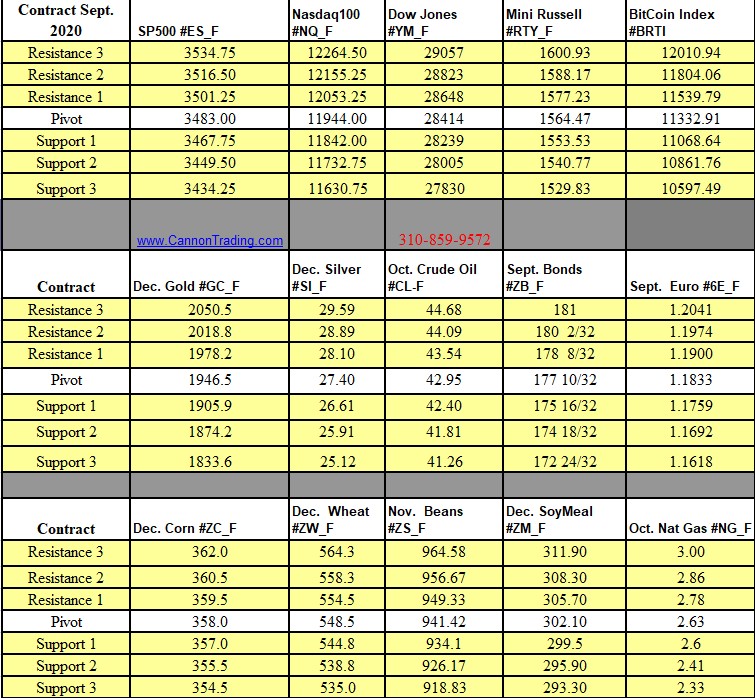

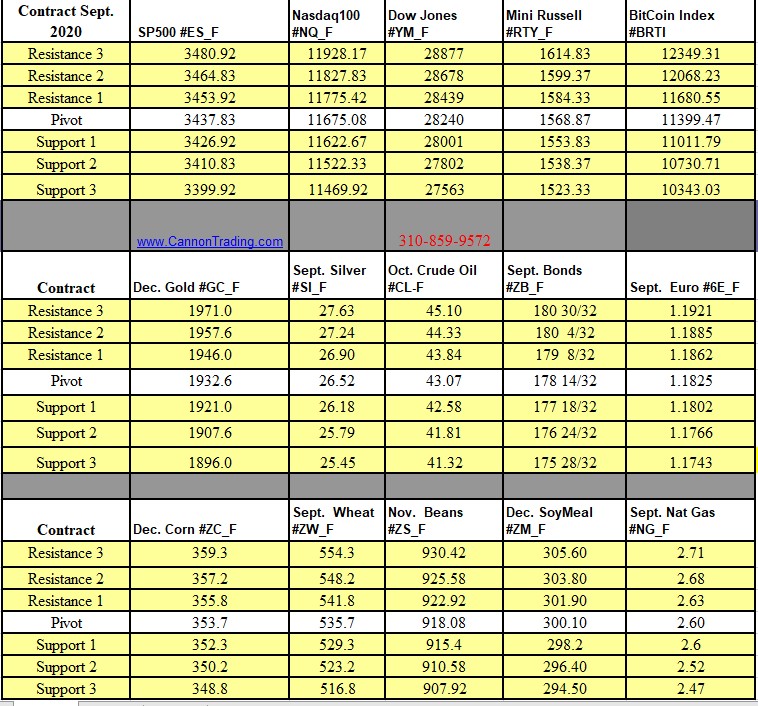

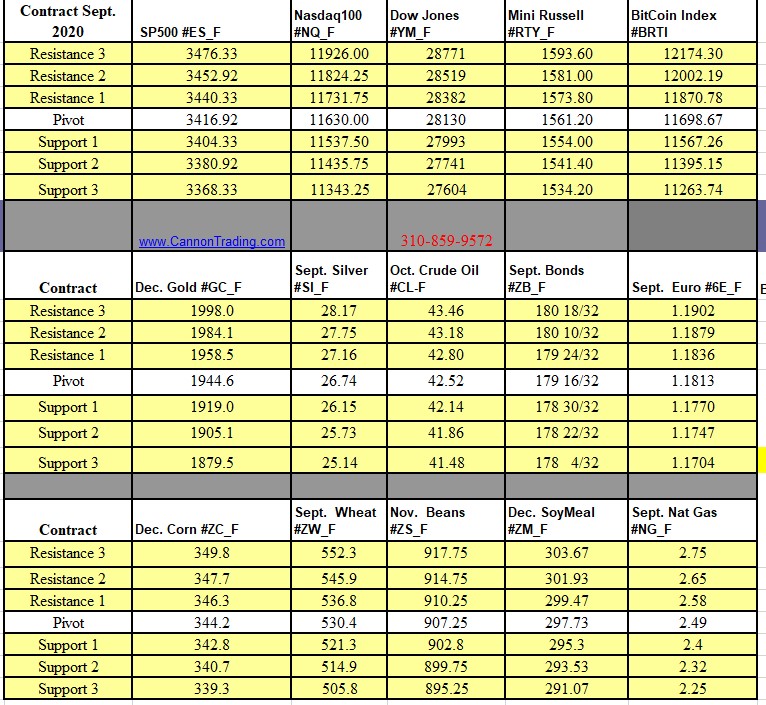

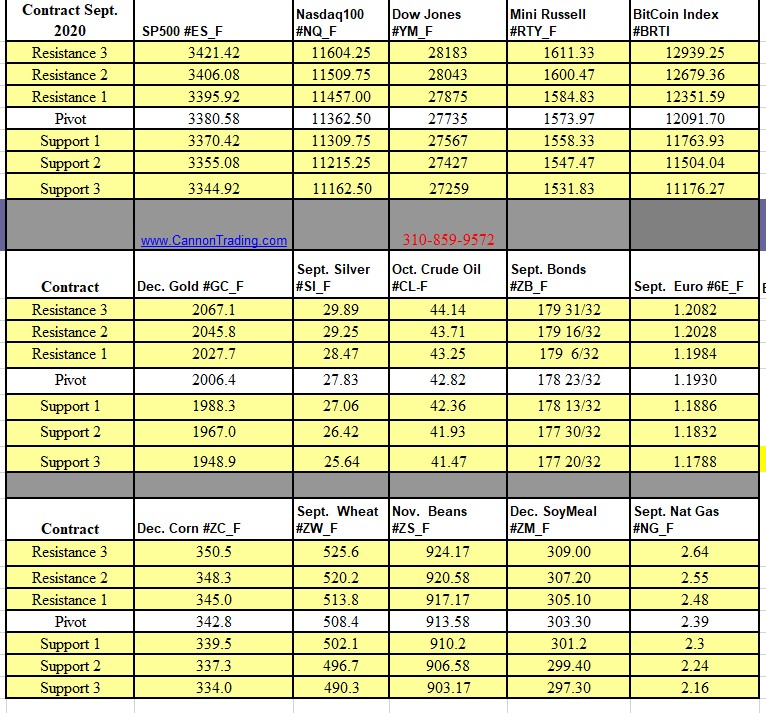

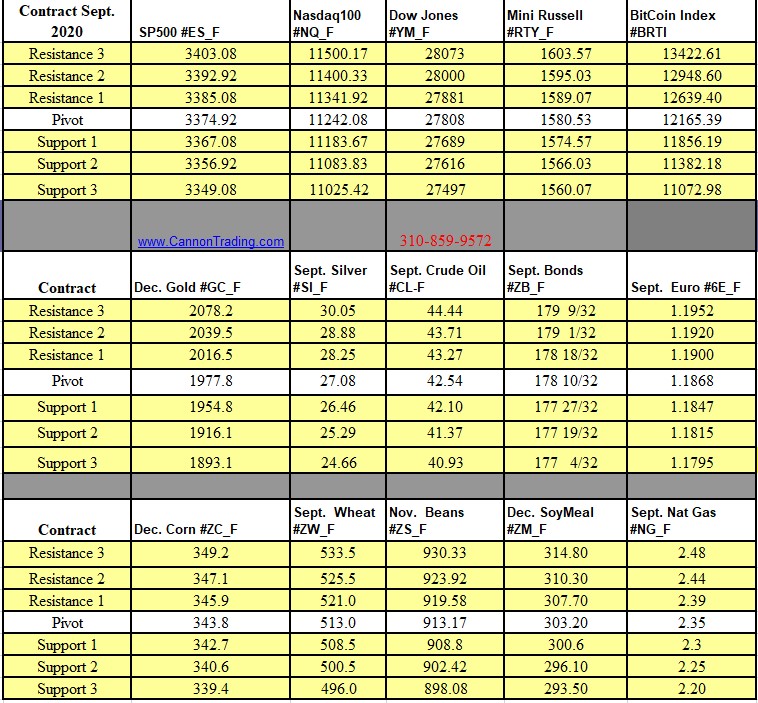

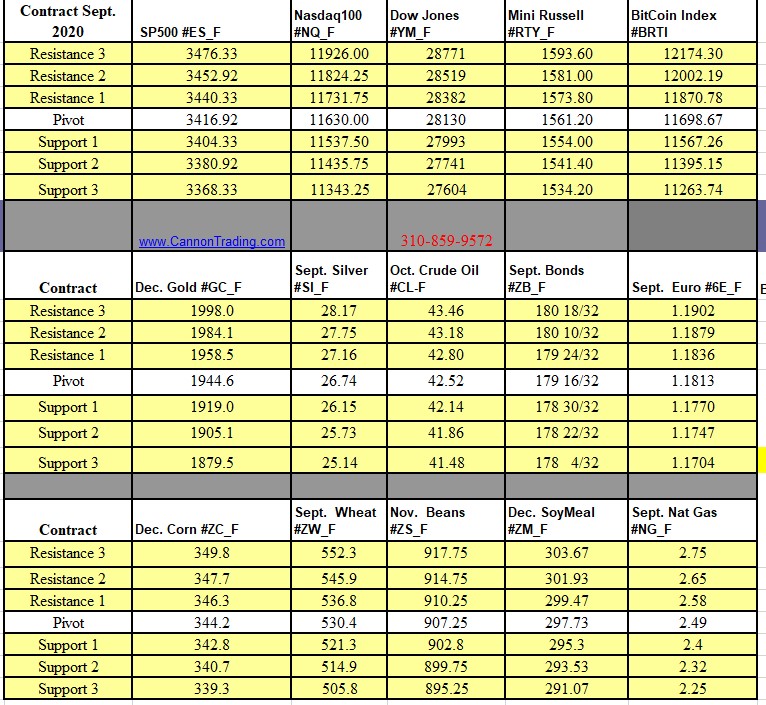

Futures Trading Levels

8-25-2020

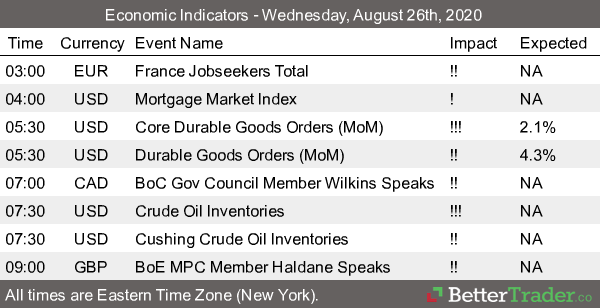

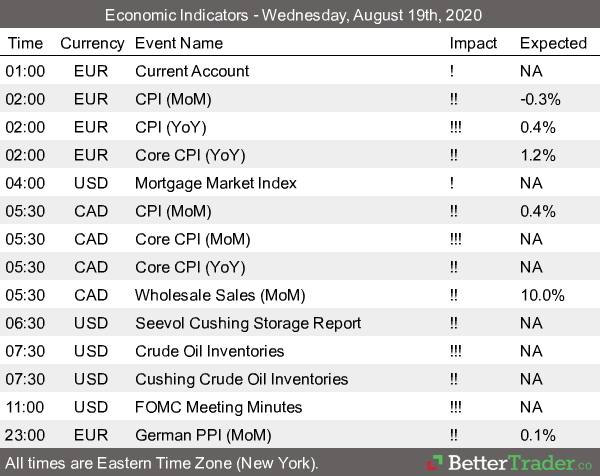

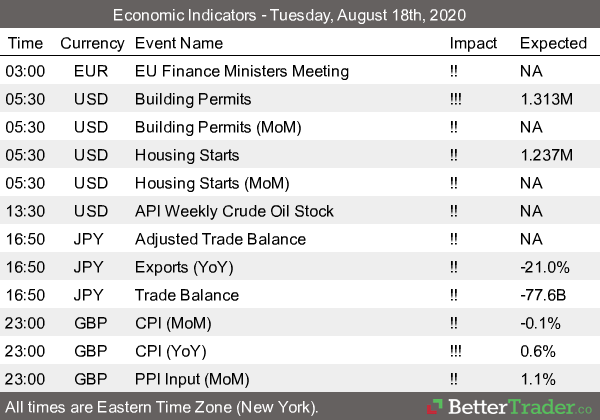

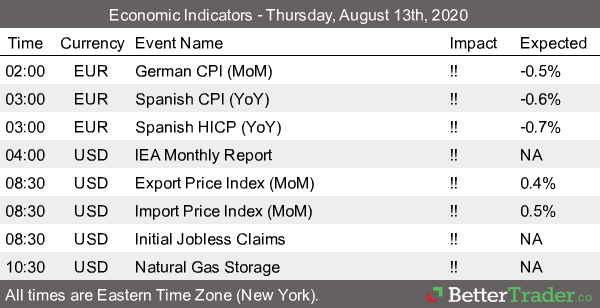

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.