____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Elliott Wave Int’l OPEN HOUSE

Our friends at Elliott Wave International have opened the doors to their entire lineup of trader-focused Pro Services — but only for a week!

Now through 4pm Eastern (New York) time on Friday, March 29, see every forecast, every chart, every piece of expert analysis for 50+ markets — stocks, forex, cryptos, gold, oil and more.

INSTANT BONUS: Join in now and watch Intro to the Wave Principle Applied. This video teaches you the best Elliott waves to trade, how to set your entry, targets and protective stops.

Don’t miss this! This is EWI’s most popular event of the year for a reason.

And the timing couldn’t be better.

Open House is your chance to join them — free for a week.

Who is Elliott Wave International?

EWI is the world’s largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to

catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and high-quality analysis have been their calling card for nearly 40 years, featured in financial news outlets such as Fox Business, CNBC, Reuters, MarketWatch and Bloomberg.

This email is a commercial and advertising message related to domestic and global financial markets and investment instruments including bonds, commodities, ETFs, Indexes, Forex, equities and penny stocks, as well as products or services related to trading or investing in the financial markets that may be of interest to you.

Cannon Trading Co, Inc. has not researched any of the product/services or offerings presented in this email, and makes no warranties, representations or claims of any kind, express or implied, with respect to the accuracy, results, merchantability, timeliness, correctness, completeness, fitness and suitability of the information contained in this email for any specific or particular purpose.

Cannon Trading Co, Inc. shall not be liable to you or anyone else arising from the opening or use of this email or its attachments, for the content of this email, or for the consequences of any action taken by you or anyone else on the basis of the information provided. All materials and information in this email are provided solely for informational purposes and do not constitute trading advice, investment advice, legal advice or opinion, or any other form of advice regarding any specific facts or circumstances pertaining to the materials and information.

Last Trading

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

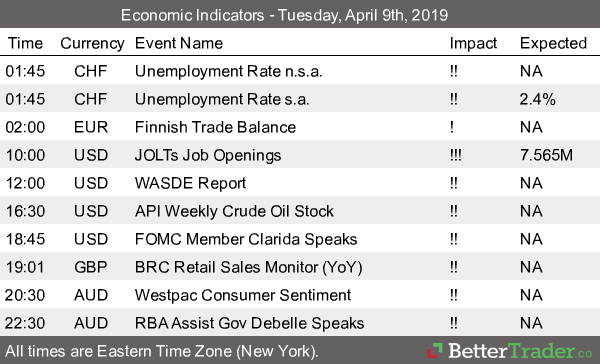

Futures Trading Levels

03-26-2019

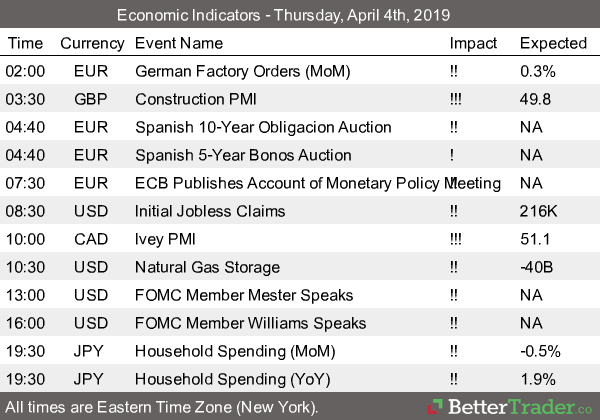

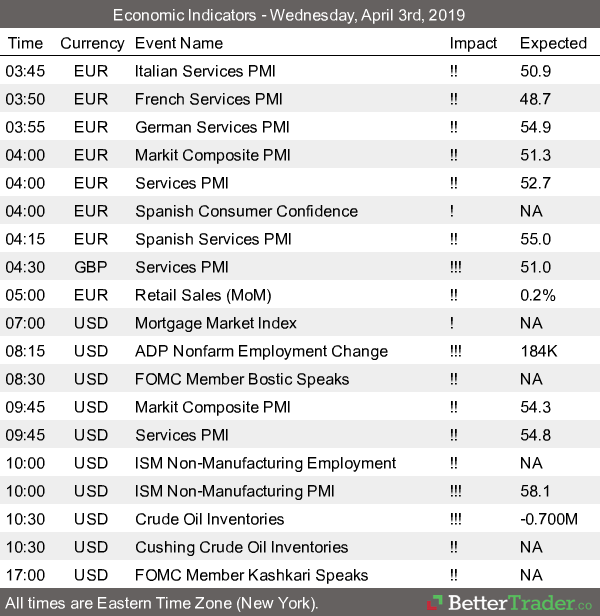

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.