____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Earnings reports are in full affect.

FOMC tomorrow and the markets are expecting NO CHANGE in rates tomorrow, however, traders will play close attention in an attempt to predict future hikes in 2019.

As of now markets see very slim chance for additional hikes before June 2019.

The following are suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 2625.00 with a stop at 2619.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 2619.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

10 year bonds:

Heiken-Ashi Daily Chart Below. 121.00 MAJOR support level to watch for:

Futures Trading Videos:

1. Identifying Support And Resistance Using A Line Chart.

2. Finding Levels of Support Resistance

3. Day Trading crude oil futures using fear and greed….

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

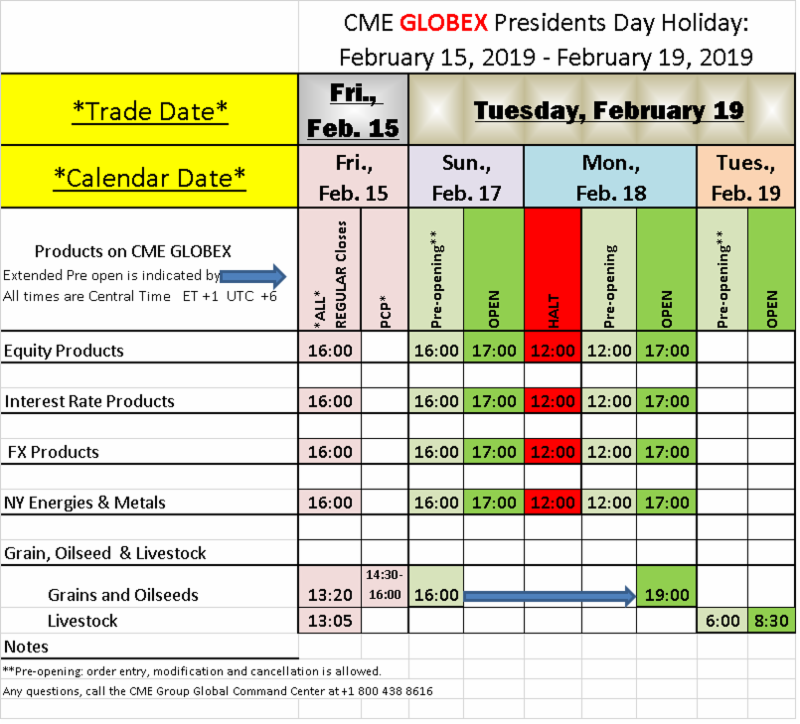

Futures Trading Levels

01-30-2019

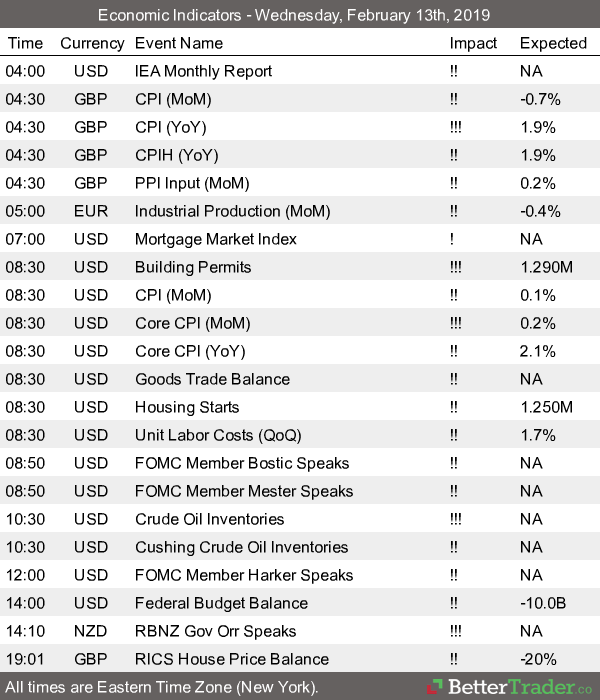

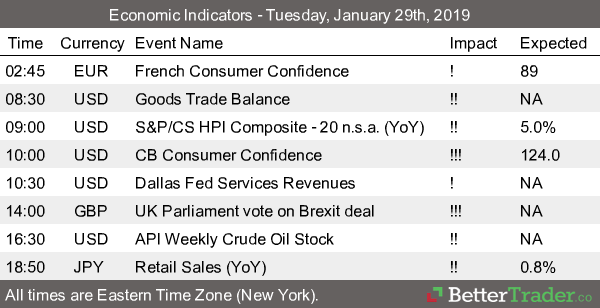

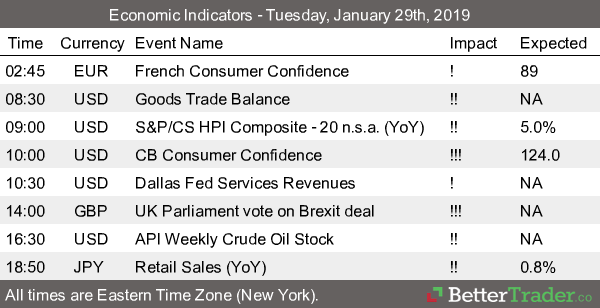

Economic Reports, source:

BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.