____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

In observance of the passing of President George H. W. Bush , please review the updated trading schedules below for tomorrow:

CME/Globex

Interest Rates:

Tuesday 12/4/18: Regular Schedule

Wednesday 12/5/18: Closed

Thursday 12/6/18: Regular Schedule

Equity Index:

Tuesday 12/4/18: Regular Schedule

Wednesday 12/5/18: Early 8:30am (CST) Close

Thursday 12/6/18: Regular Schedule

CBOE/CFE:

Tuesday 12/4/18: Regular Schedule

Wednesday 12/5/18: Early 8:30am (CST) Close

Thursday 12/6/18: Regular Schedule

Grains, metals, energies, softs, currencies, meats all have NORMAL TRADING HOURS. Only equities, bonds and VIX are affected!!

Cannon Trading in the news again!

Our senior broker, John Thorpe provides his insight into the energy markets ahead of OPEC meeting:

While we talking energies:

Another CL margin increase:

CL, $4015 –> $4692 (about 17% increase!)

Gold Daily chart below. Is the yellow metal finally waking up or is this just an end of the year bounce???

Would you like access to trading ALGOS that try to identify market turning points?

click hereGood Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

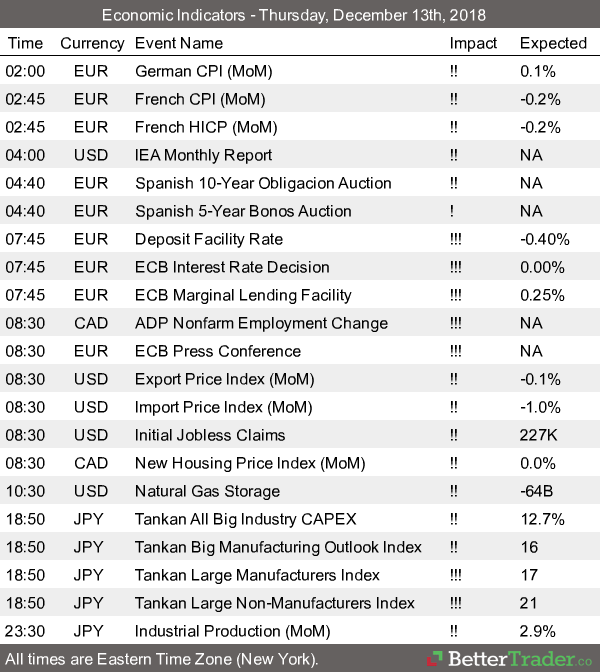

Futures Trading Levels

12-05-2018

Economic Reports, source:

www.forexfactory.com

|

| WedDec 5 |

3:15am |

EUR |

|

Spanish Services PMI

|

|

|

53.9 |

54.0 |

|

|

3:30am |

EUR |

|

ECB President Draghi Speaks

|

|

|

|

|

|

|

3:45am |

EUR |

|

Italian Services PMI

|

|

|

49.2 |

49.2 |

|

|

3:50am |

EUR |

|

French Final Services PMI

|

|

|

55.0 |

55.0 |

|

|

3:55am |

EUR |

|

German Final Services PMI

|

|

|

53.3 |

53.3 |

|

|

4:00am |

EUR |

|

Final Services PMI

|

|

|

53.1 |

53.1 |

|

|

4:30am |

GBP |

|

Services PMI

|

|

|

52.5 |

52.2 |

|

|

|

GBP |

|

FPC Meeting Minutes

|

|

|

|

|

|

|

5:00am |

EUR |

|

Retail Sales m/m

|

|

|

0.2% |

0.0% |

|

|

Tentative |

EUR |

|

Spanish 10-y Bond Auction

|

|

|

|

1.61|1.6 |

|

|

2:00pm |

USD |

|

Beige Book

|

|

|

|

|

|

|

8:15pm |

USD |

|

FOMC Member Quarles Speaks

|

|

|

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.