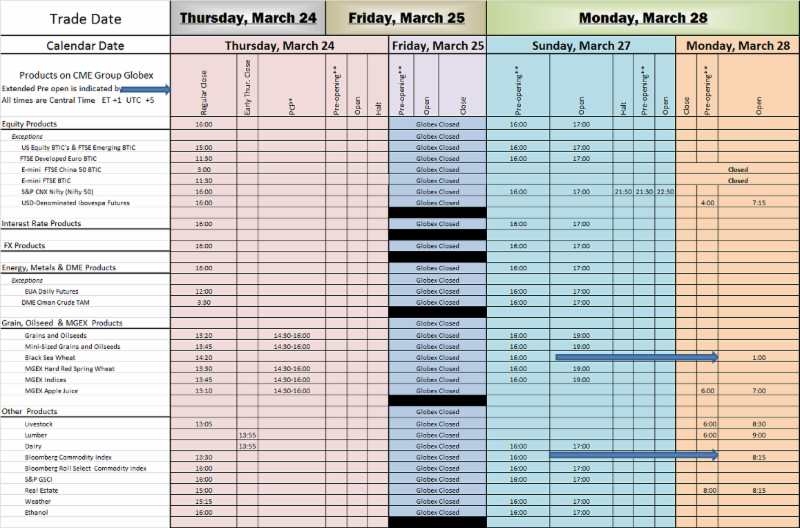

Globex Good Friday Holiday Futures Trading Schedule 2016

More details at: http://www.cmegroup.com/tools-information/holiday-calendar/files/2016-good-friday-holiday-schedule.pdf

The above sources were compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Ice Futures Good Friday Holiday Futures Trading Schedule

March 25 2015

Good Friday

All UK Markets are closed

ICE Futures US Soft’s, US Grains and Oilseeds, Metals & FIN Gas Power and Emissions all CLOSED

USDX Index & FOREX Early Close – 11:15 am No TAS trading

Russell, MSCI Equity, NYSE ARCA Gold Miners Index Early Close – 9:15 am No TAS trading

ICE Clear Europe CDS – Bank Holiday

ICE Futures Canada – All Markets Closed

Continue reading “Globex & ICE Good Friday Holiday Futures Trading Schedule 2016”