Greetings!

Many different ways to make and lose money trading futures, even more so when day trading.

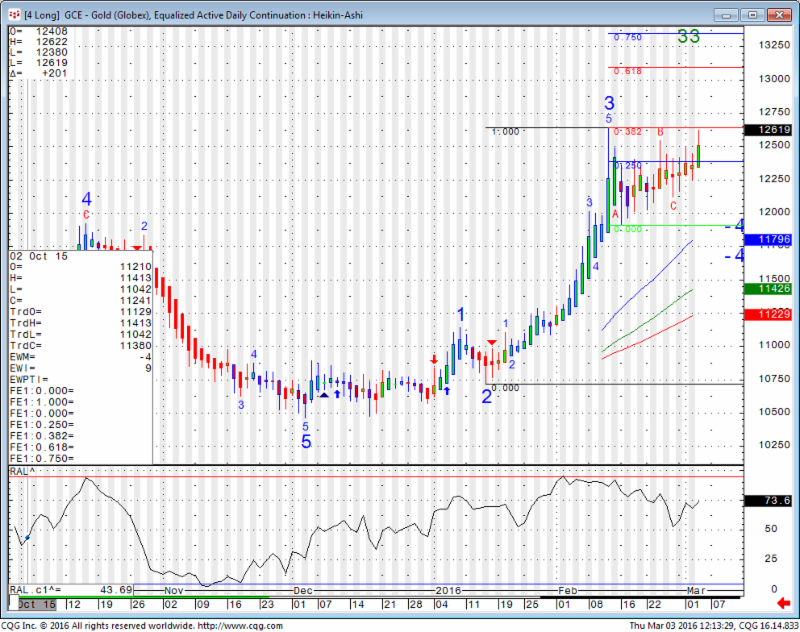

Today’s action in gold futures ( break out) led me to write about:

Three main approaches for trading, in my opinion.

The first is what I call the “trend is your friend”. A trader looks at few different time frames, looking to see if there is an established trend on longer time frame ( example 60 minutes chart) and then trying to look for pull back on lower time frames and “join the trend”. Only works for certain markets and only works few times of the month as most days markets do not have an intraday trend.

Second method is what we call break out. Traders will look for markets that have been in a lower volatility situation using indicators such as ADX for example. Then they will look at the chart to find what they feel are levels that if broken can fuel a stronger move in the same direction. These levels can be extracted visually looking at the chart or using highs/ lows of X periods. This method works better on some markets than others. I noticed that crude oil and gold futures tend to have better chances of a continued breakout move than the mini SP 500 for example.

The third one many traders use and believe in is “mean aversion”. Stock index futures in my opinion will fall into this category many trading days and today’s session ( July 24th 2014) was a good example. Market tested yesterday’s highs, then tested lows and traded in between. Traders will sometimes use RSI or Williams %R to get a feel for when the market gets away from the mean and will use counter trend methods in this case. Use of stops, when counter trend trading is even more important as you do NOT want to get caught on the few days a month when these markets do incur a break out situation…..

Obviously, all methods have good days, bad days and I guarantee you, none of these methods work all the time on all markets. Knowing the above and trying to understand what method should be the primary method for the market YOU trade and which can be used as secondary can help you while trading.

TRADE SMART / TRADE SYSTEMS — for the current rankings as well as actual performance of trading systems traded at Striker, click here.

Continue reading “Breakout Trading, Mean Reversion & Levels for Friday 2.19.2016”

![]()

![]()

![]()

![]()

![]()

![]()