|

|

|

|

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

|

|

|

|

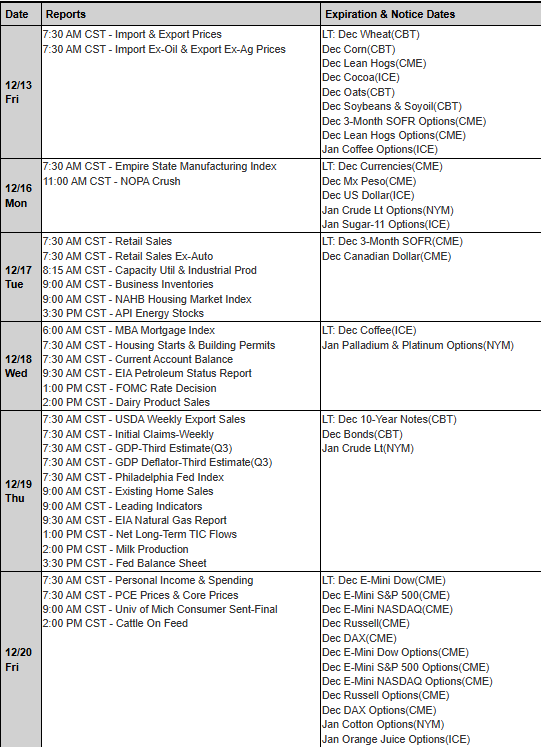

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe at +44 800 898 013 or in Asia at +65 6532 5010

When exploring the best futures trading platform to enhance your trading experience, platforms like E-Futures International and CannonPro stand out as exemplary choices for their robust features, intuitive interfaces, and tools tailored to effective risk management. Trading futures requires a deep understanding of market dynamics, leveraging the right tools, and adopting strategies that minimize risk while optimizing returns. This article will delve into the top ten tips for using these futures trading platforms, highlight aspects where your broker can provide more insights, and explore key risk elements that traders must address. We will also discuss why Cannon Trading Company is a stellar choice for trading futures with a strong emphasis on risk management.

Before diving into specific tips, it is essential to understand why trading platforms like E-Futures International and CannonPro are integral to trading futures successfully. These platforms provide advanced charting tools, market analysis, and real-time data feeds, enabling traders to make informed decisions. Coupled with the guidance of a knowledgeable commodity broker, these platforms empower both novice and experienced traders to navigate the complexities of the futures market.

While trading platforms offer a wealth of tools and features, the role of a commodity broker remains indispensable. Brokers can provide the following insights:

Trading futures inherently involves risks that must be carefully managed. These include:

Why Awareness Matters: Understanding these risks allows traders to implement safeguards like diversification, proper position sizing, and hedging strategies.

Cannon Trading Company has earned its reputation as one of the best futures trading platforms for several reasons:

Selecting the best futures trading platform is a critical step toward achieving success in the futures market. Platforms like E-Futures International and CannonPro offer powerful tools and features that enable traders to execute informed trades and manage risks effectively. By leveraging the expertise of a knowledgeable commodity broker and focusing on continuous learning, traders can navigate the complexities of trading futures with confidence.

Cannon Trading Company stands out as a premier choice for traders looking to combine cutting-edge technology with exceptional support and robust risk management practices. By following the tips outlined in this article and maintaining a disciplined approach, traders can maximize their potential in the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

|

|

|

|

|

|

The corn futures contract holds a pivotal place in the world of futures trading, serving as a key tool for agricultural producers, investors, and speculators alike. Its history, evolution, and future prospects provide a fascinating lens through which to explore the complexities of the trading futures market. This article delves into the origins of the corn futures contract, traces its development over time, forecasts its trajectory for 2025, and examines why Cannon Trading Company is a standout brokerage in this domain.

The concept of futures trading emerged in the 19th century, coinciding with the industrialization of agriculture in the United States. Farmers, processors, and distributors faced volatile prices due to unpredictable weather, market demand, and global economic conditions. To address this, the Chicago Board of Trade (CBOT), established in 1848, pioneered standardized contracts for agricultural commodities.

Corn, being a staple crop with vast economic significance, became one of the first commodities to have a futures contract. The introduction of the corn futures contract allowed farmers to lock in prices for their crops before harvest, thereby mitigating the risks associated with fluctuating prices. Similarly, buyers like millers and exporters benefited from the ability to secure a consistent supply at predictable costs. The contract was initially straightforward, detailing a specific quantity of corn to be delivered at a future date, with quality and delivery standards set to minimize disputes.

Over the decades, the corn futures contract underwent significant transformations to meet the changing demands of the market. The CBOT implemented innovations to enhance liquidity, transparency, and accessibility in futures trading. By the mid-20th century, electronic trading platforms replaced the open outcry system, making it easier for traders worldwide to participate.

Advancements in technology allowed for the introduction of mini and micro corn futures contracts, enabling smaller traders to access the market. Margin requirements and position limits were refined to ensure market stability while accommodating both large-scale institutional investors and individual speculators. Additionally, the rise of algorithmic trading brought new efficiencies and challenges to the trading futures landscape.

As global trade expanded, the corn futures market reflected the crop’s international importance. Corn’s applications diversified, with demand increasing for its use in ethanol production, livestock feed, and processed foods. This broadened the participant base for corn futures contracts, attracting not only agricultural stakeholders but also energy companies, food manufacturers, and hedge funds.

Looking ahead to 2025, the corn futures contract is poised for further evolution. Several trends are shaping its trajectory:

When engaging in trading futures, selecting the right brokerage is crucial. Cannon Trading Company has earned its reputation as a top-tier firm, consistently rated 5 out of 5 stars on TrustPilot. With decades of experience in the futures trading industry, Cannon Trading combines expertise, technology, and exceptional customer service to offer unparalleled support to traders.

The enduring relevance of the corn futures contract lies in its ability to provide stability and opportunity in an unpredictable market. For farmers, it is a lifeline, enabling them to secure income regardless of market conditions. For investors and speculators, it offers a chance to capitalize on price movements driven by factors like weather, trade policies, and global demand.

In today’s interconnected world, trading futures is more than a financial activity—it’s a way to manage risks and contribute to the smooth functioning of essential supply chains. The versatility of the corn futures contract ensures its place as a cornerstone of the futures trading ecosystem.

The corn futures contract is a testament to the ingenuity of the trading futures market, evolving from its humble beginnings in 19th-century Chicago to a sophisticated global instrument. Its adaptability to changing market conditions and technological advancements underscores its resilience and relevance.

As we look to 2025, the corn futures market is set to embrace innovations that enhance efficiency, sustainability, and inclusivity. For those seeking to navigate this dynamic landscape, Cannon Trading Company offers the expertise, tools, and support needed to excel in futures trading. With its stellar reputation, free trading platforms, and decades of experience, Cannon Trading is the brokerage of choice for those engaging in corn futures contracts and beyond.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

Introduced in April 1982 by the Chicago Mercantile Exchange (CME), the S&P 500 Futures Contract represented a turning point in financial markets. Before its debut, traders had limited tools to hedge or speculate on the broader U.S. equity market. The S&P 500 index, comprising 500 of the largest publicly traded companies in the U.S., was already a key benchmark of market performance. By creating a derivative tied to the index, the CME provided traders and institutions with a liquid, leveraged way to manage risk or profit from market movements.

This new financial instrument quickly gained traction. Unlike individual stocks, S&P 500 Futures Contracts allowed participants to trade the entire market with a single position. It was a game-changer for portfolio managers, hedge funds, and individual traders alike.

Over the decades, the S&P 500 Futures Contract has undergone significant evolution. Initially, the contract was accessible only to institutional players with deep pockets. The margin requirements and notional value of the contract were high, making it impractical for smaller traders. However, the CME’s introduction of E-mini S&P 500 Futures in 1997 dramatically expanded accessibility.

These smaller contracts mirrored the original S&P 500 Futures Contract but with reduced notional value and margin requirements. Retail traders could now participate in the same market as institutional giants, leveling the playing field and increasing liquidity. The introduction of Micro E-mini S&P 500 Futures in 2019 further democratized futures trading, enabling even smaller trades with minimal financial commitment.

Technological advancements have also played a significant role. The advent of electronic trading platforms in the late 1990s transformed the market, making trading faster, more transparent, and widely accessible. Today, traders around the globe execute futures SP trades with just a few clicks, relying on real-time data and advanced analytics to inform their decisions.

As we approach 2025, the S&P 500 Futures Contract remains a cornerstone of global financial markets. It serves three primary purposes:

In recent years, rising geopolitical tensions, pandemic-related economic shocks, and rapid technological innovation have contributed to heightened market volatility. This volatility has increased the appeal of S&P 500 Futures Contracts, as traders capitalize on swift market movements.

Looking ahead to 2025, several trends are likely to shape the future of the S&P 500 Futures Contract:

For traders looking to capitalize on the opportunities offered by the S&P 500 Futures Contract, choosing the right brokerage is critical. Cannon Trading Company stands out as a premier choice for several compelling reasons.

The S&P 500 Futures Contract offers unparalleled flexibility and potential. Whether you aim to hedge against market risk, speculate on short-term price movements, or diversify your portfolio, this contract is a powerful tool. Partnering with a trusted brokerage like Cannon Trading Company amplifies these advantages, ensuring that you have the resources, support, and technology needed to excel in futures trading.

Trading prowess often hinges on timing, knowledge, and execution. With Cannon Trading Company by your side, you can navigate the complexities of the S&P 500 Futures Contract with confidence, turning market challenges into opportunities for growth.

The journey of the S&P 500 Futures Contract is a testament to the innovation and resilience of global financial markets. From its inception in 1982 to its modern iterations, the contract has continually adapted to the needs of traders and investors. As we approach 2025, its relevance remains stronger than ever, promising new opportunities amid evolving market dynamics.

For traders seeking to unlock the full potential of S&P 500 Futures Contracts, partnering with an experienced and reputable brokerage like Cannon Trading Company is a winning strategy. With its stellar reputation, advanced tools, and commitment to client success, Cannon Trading Company is the ultimate ally for navigating the exciting world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In this issue:

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

https://m.cqg.com/stonexfutures

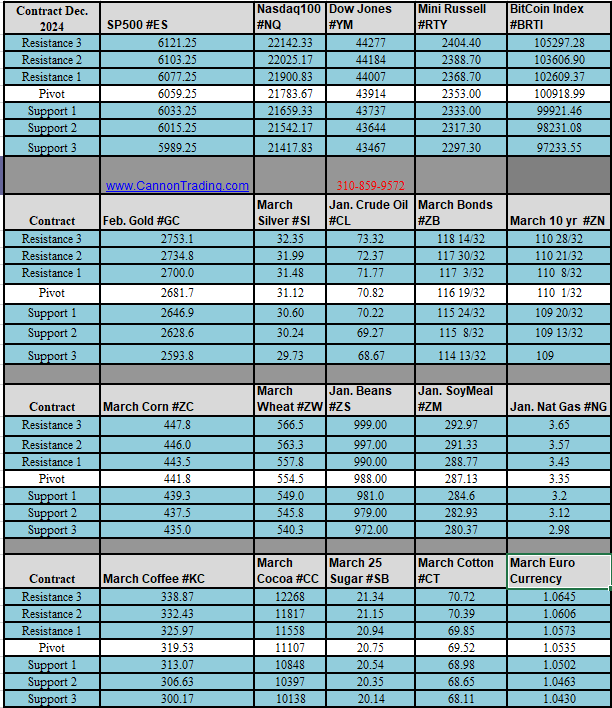

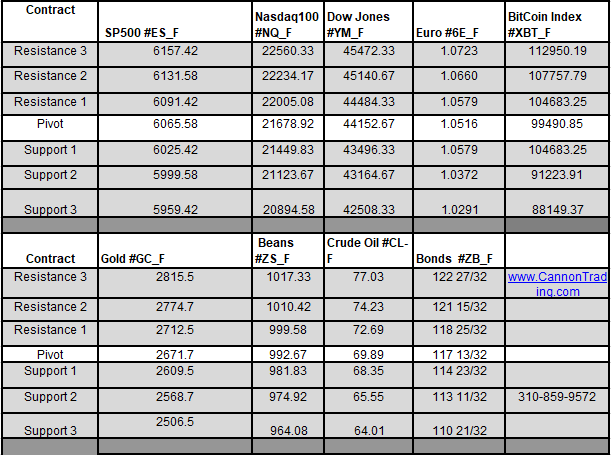

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Prominent Earnings Next Week:

FED SPEECHES:

Economic Data week:

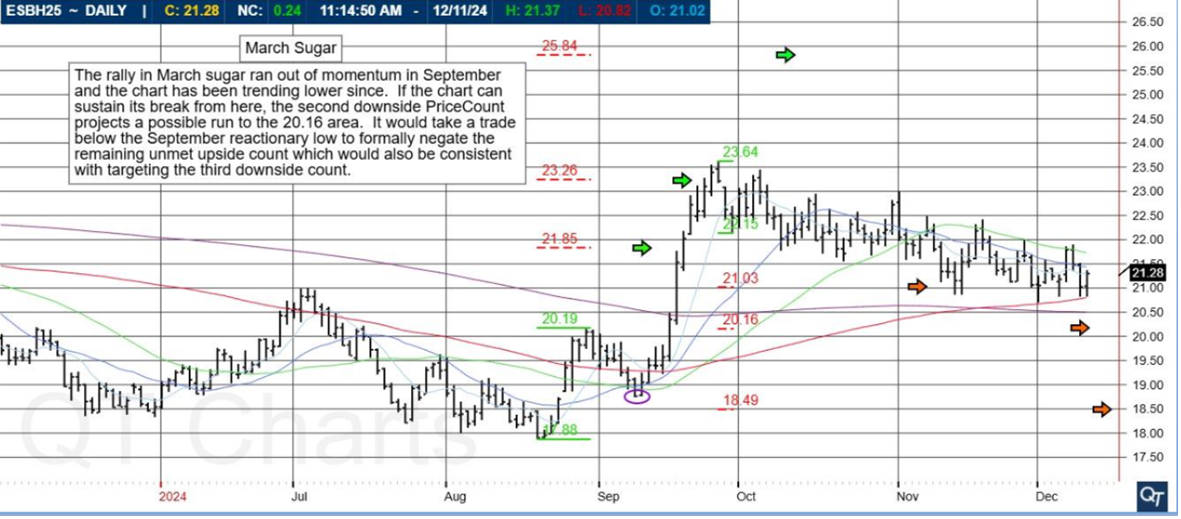

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March Sugar

The rally in March sugar ran out of momentum and the chart has been trending lower since. If the chart can sustain its break from here, the second downside PriceCount projects a possible run to the 20.16 area. It would take a trade below the September reactionary low to formally negate the remaining unmet upside count which would also be consistent with targeting the third downside count.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

Nasdaq 100 Mini

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 150 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

|

|