START TRADING MARCH CURRENCY FUTURES AS WELL!

Triple Witching

Heads up traders:

Triple Witching is near. For those of you trading stock index futures – any size S&P 500, Nasdaq, Dow Jones, Russell 2000 – remember that this Friday at 8:30 A.M. Central Time, those contracts’ December futures expire and will no longer be available for trading. If you happen to hang on to any Dec. contracts past that time, they will automatically be offset via the cash settlement price of that contract. For you stock index futures options traders, if you to hang on to any Dec. options, the cash settlement price will determine whether your options are in or out of the money, in which case they will either expire worthless or be instantly exercised/assigned, valued and offset by the cash settlement price. Stock options also expire this Friday, thus the triple witching expression (no supernatural phenomena will appear at this time).

Final Settlement Procedures

Quarterly settlement of S&P 500, E-mini S&P 500, S&P MidCap 400, E-mini S&P MidCap 400, S&P 500 Citigroup/Growth and Value and SPCTR Index futures and options on futures are based on a Special Opening Quotation of the relevant underlying index. The Special Opening Quotation for each index is based on the opening price of each component stock in that index on expiration Friday.

Special Opening Quotations (SOQ) generally differ from the opening index value of each index because all stocks do not open immediately. For example, on typical days surveyed by CME Group, most S&P stocks open quickly, with around 95% open within 15 minutes and 98% open within 30 minutes. Other indexes with larger numbers of stocks may take longer to open.

Please contact your broker if you have any questions about your positions. And remember, the next front month for these contracts – March – is already well traded and available.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

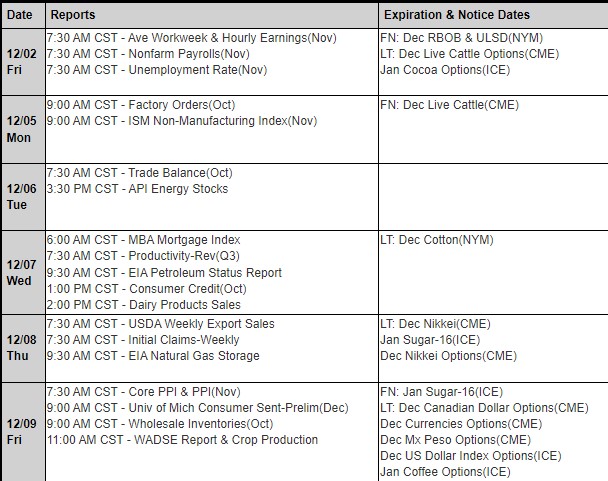

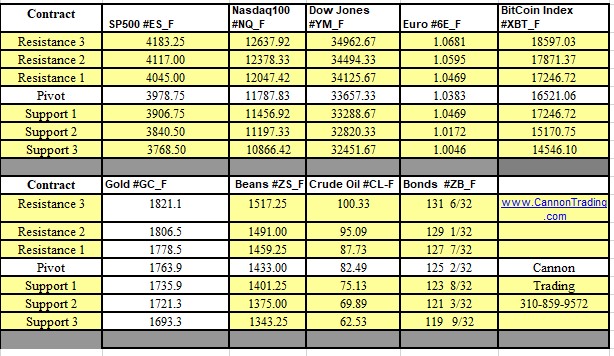

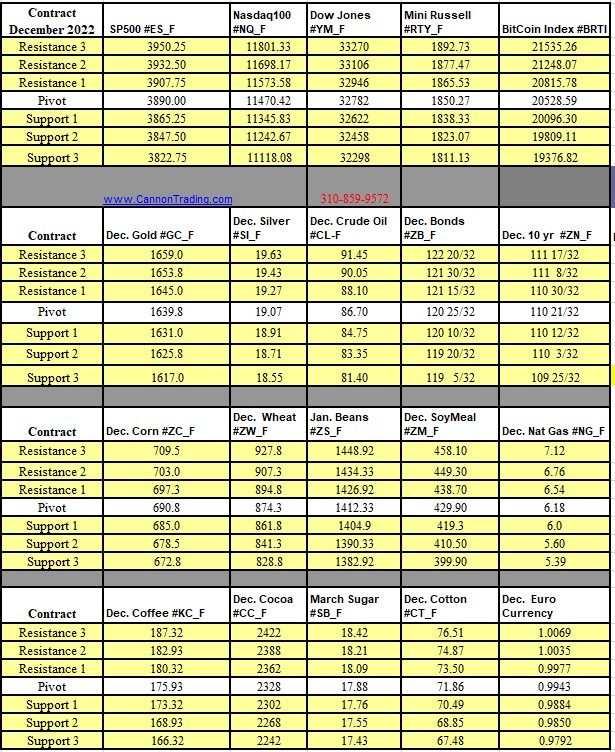

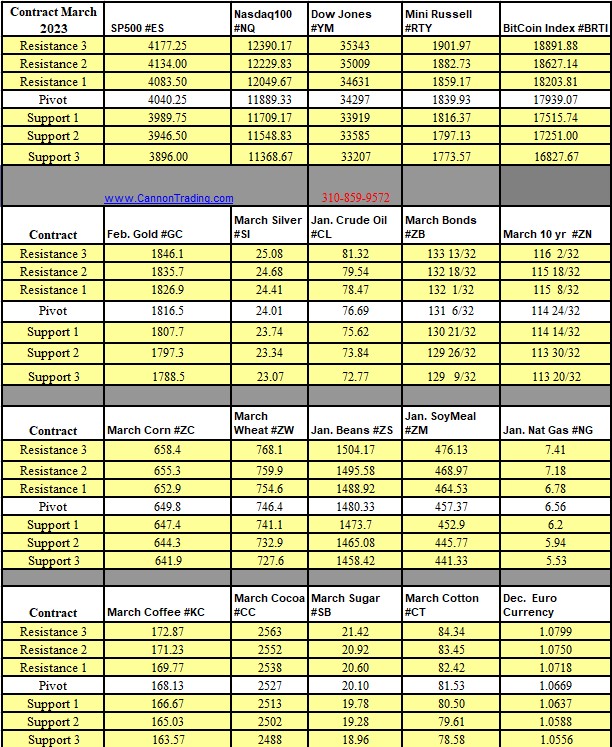

Futures Trading Levels

for 12-16-2022

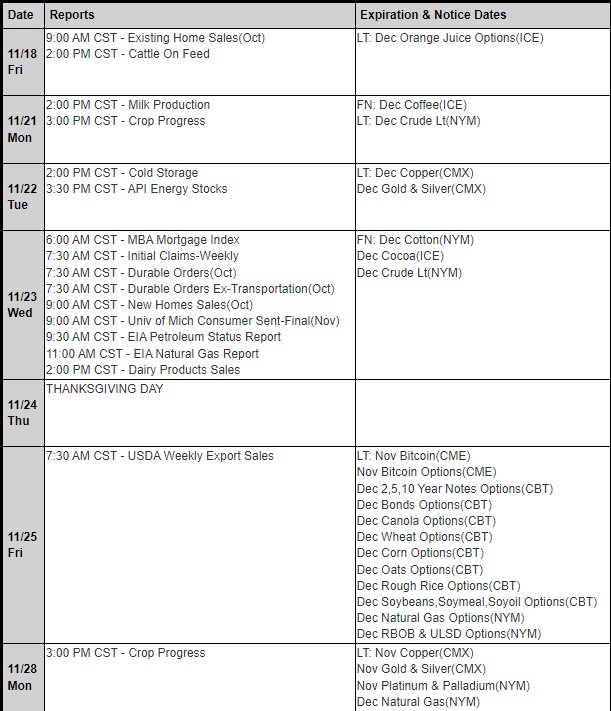

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.