Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for February 7, 2012

1. Market Commentary

Hello traders,

Thin volume in many markets today with SP500 pretty much closing unchanged.

Tomorrow should bring a different trading environment as we have a more than a few reports scheduled.

Here are some notes about the main types of trading days as I see it:

My opinion is that there are 3 main types of trading days.

1. Most common is two sided trading action with swings up and down – this type of trading day is most suitable using support and resistance levels along with overbought/oversold indicators such as RSI and &R.

2. Strong trending day, mostly one directional – this type of trading day is the least common, many times will happen on Mondays and maybe 3-5 times a month at most – this type of trading day is most suitable for using pull backs from the main trend to re-enter with the direction of the trend.

DMI and ADX are good studies to use for this type of trading days.

3. Slow and/ or choppy trading day – this type of trading day is best suited for taking small profits from the market by looking at FIB retracement levels and order flow.

Good question is how can one asses what type of trading day we will have while the market is still trading….I am doing some work about it and will be happy to hear feedback via email but here are some initial observations:

Was the overnight session a wide, two sided trading range? If the answer is yes, good chances for similar trading day during the primary session ( primary session is when the cash/ stock market is open)

Mondays have the highest chance for trending days

The behavior of the first hour of trading can also suggests the type of action for the rest of the day.

If the first 30 minutes have good volume, better chances for type 1 or type 2 trading days.

low volume during first 30 minutes can suggest a choppy (type 3 trading day)

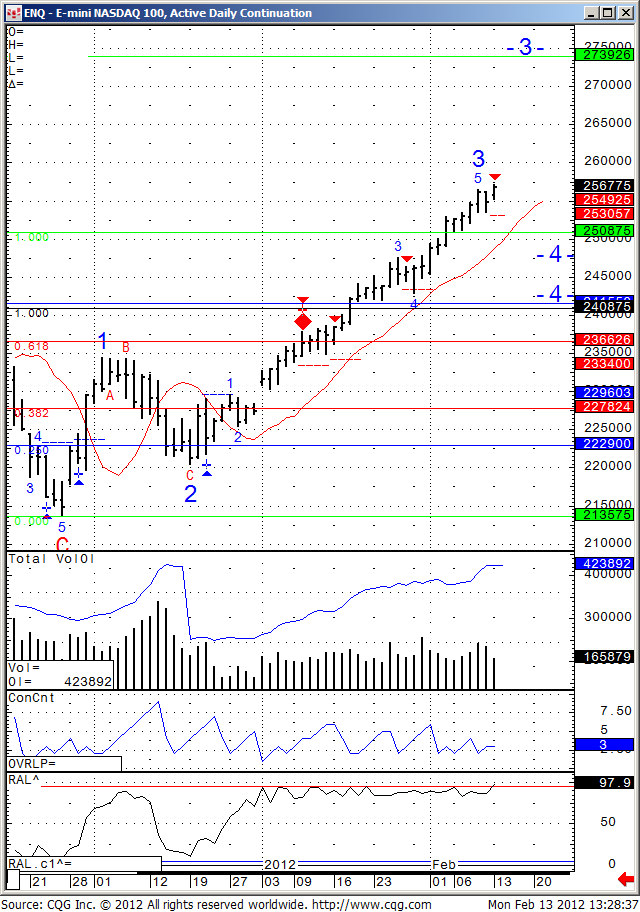

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (Dec. 2011) |

SP500

(big & Mini) |

Nasdaq100

(big & Mini) |

Dow Jones

(big & Mini) |

Mini Russell |

| Resistance Level 3 |

1348.00 |

2540.92 |

12833 |

836.10 |

| Resistance Level 2 |

1344.15 |

2532.83 |

12810 |

832.50 |

| Resistance Level 1 |

1341.70 |

2527.67 |

12797 |

829.00 |

| Pivot Point |

1337.85 |

2519.58 |

12774 |

825.40 |

| Support Level 1 |

1335.40 |

2514.42 |

12761 |

821.90 |

| Support Level 2 |

1331.55 |

2506.33 |

12738 |

818.30 |

| Support Level 3 |

1329.10 |

2501.17 |

12725 |

814.80 |

Continue reading “3 Main Types of Trading Days | Support and Resistance Levels”