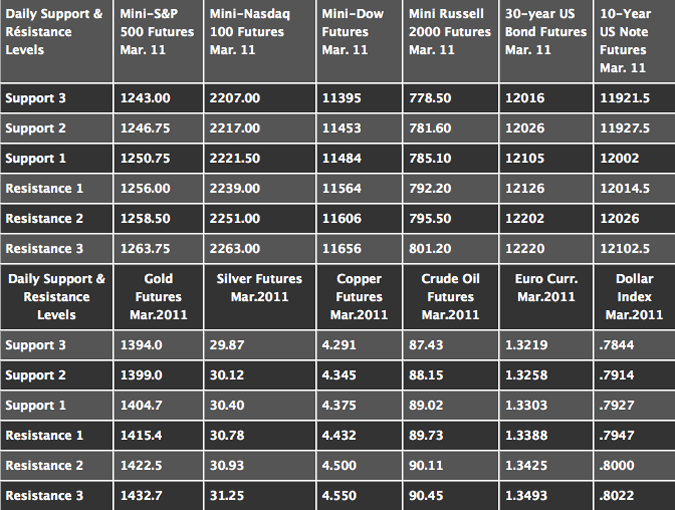

Updated: 31-Dec-10 08:49 ET

This Week’s Calendar

Continue reading “Daily Support and Resistance Levels for December 31, 2010”

The futures market comprises mainly of two players, namely, the hedgers and the speculators. While the former use futures as a safety or protection blanket, the latter is a group of traders who handle the trading accounts of those investing in the futures.

Futures trading can be arisky business that can require guidance and consultancy. Whether you are an individual or a firm, you need to be well-versed with the rules of the game. Futures brokers are always there to help you with advice and help you in matters related to futures trading. A rule of futures trading is that one canonly use those funds that have been termed as risk capital.

We at Cannon Trading help your understanding of the big and small things about futures brokers and trading. Apart from that, we also aid you in making the most out of the market; and, no matter how volatile and risky it is we offer the best advice we possibly can on trading. Under this category of futures broker, we write about the latest and informative articles that you should read to get equipped on the recent events in the futures markets.

Updated: 31-Dec-10 08:49 ET

Continue reading “Daily Support and Resistance Levels for December 31, 2010”

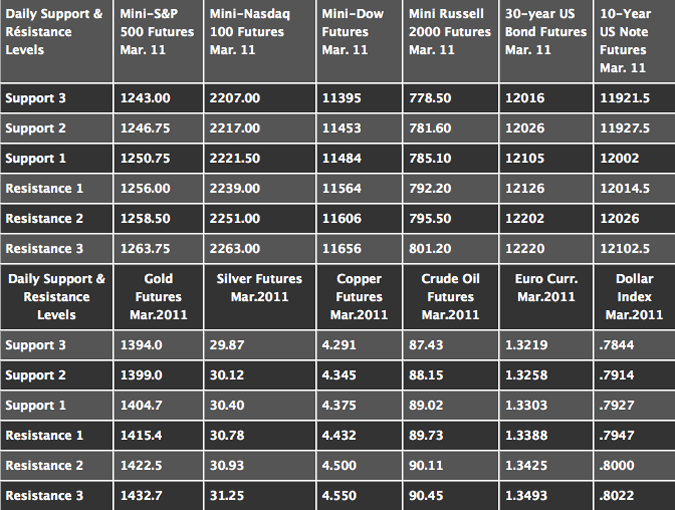

Updated: 28-Dec-10 09:01 ET

Market is acting a bit funny….reason i am saying that is that we are trading at relatively HIGH prices, over 52 weeks highs, yet the volatility is at a very low level….

What i have noticed over the years is the wave pattern of volatility….from extremely high volatility to extremely low volatility and goes again….so now the question is when is the next wave of higher volatility starts?

Have a great weekend, successful trading week ahead ( only 4 trading days next week, with Thursday packed with economic numbers).

I will be out of the office until Jan. 3rd but you will receive levels and reports published by colleague here at cannon.

happy Holidays and great trading in 2011! Continue reading “Futures Trading Levels and Economic Reports for December 20, 2010”

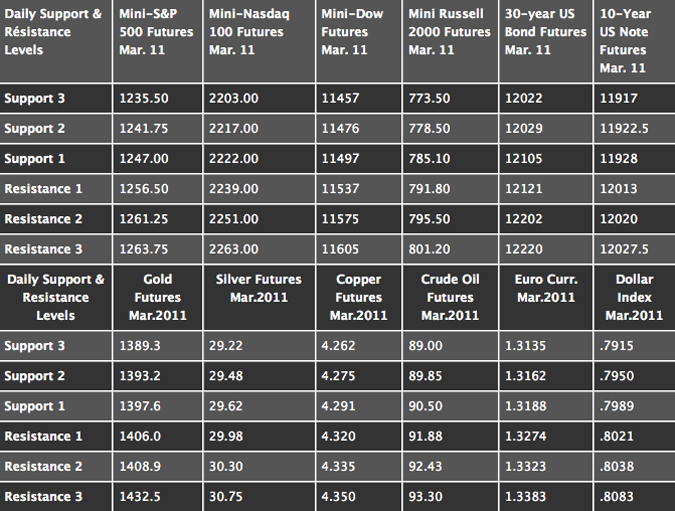

We are heading into the last two weeks of 2010 with only 4 days of trading next week and generally lower volume during this period of the year. Keep that in mind when trading.

Some days you will see very slow, choppy trading while other days you may see some volatile and exaggerated moves because of the lower volume.

Keep a trading journal, write notes on how this time of the year is affecting the markets and trading and refer back to these notes when needed. Continue reading “Futures Trading Levels and Economic Reports for December 17, 2010”

Market feels bit heavy right now but then again it felt heavy more than a few times over past few weeks only to find some more legs and go higher….so either way you plan on trading this market, make it exactly that….have a plan and then trade your plan.

Our Weekly Newsletter is Ready for Your Review:

**************************************************************

https://www.cannontrading.com/community/newsletter/

************************************************************** Continue reading “Futures Trading Levels and Weekly Newsletter for December 16th 2010”

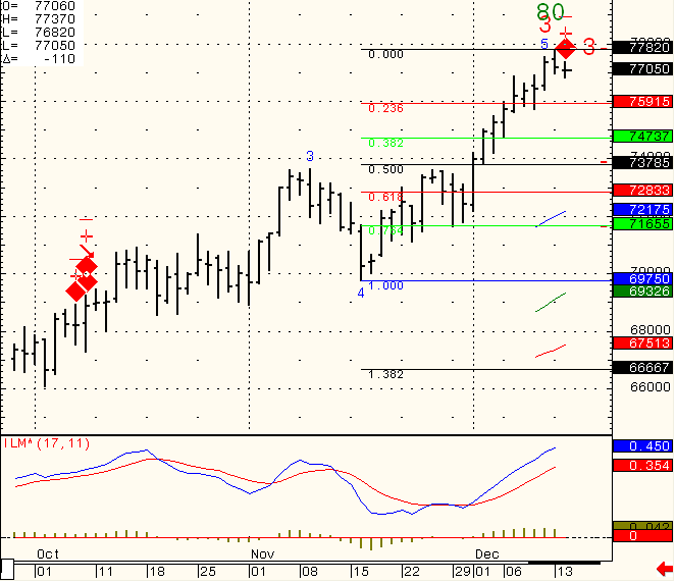

FOMC is behind us and the market is heading into the final little stretch of the year, going into that last two weeks of 2010 along with the holiday season and what may be lower volume period.

In between, I see a possibility for a pull back on the Mini Russell 2000 if prices can break below 767.00 basis the march contract. Daily chart for your review below:

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”

Continue reading “Futures Trading Levels and Economic Reports for December 15, 2010”