Jump to a section in this post:

1. Market Commentary and Thanksgiving Day Trading Schedule

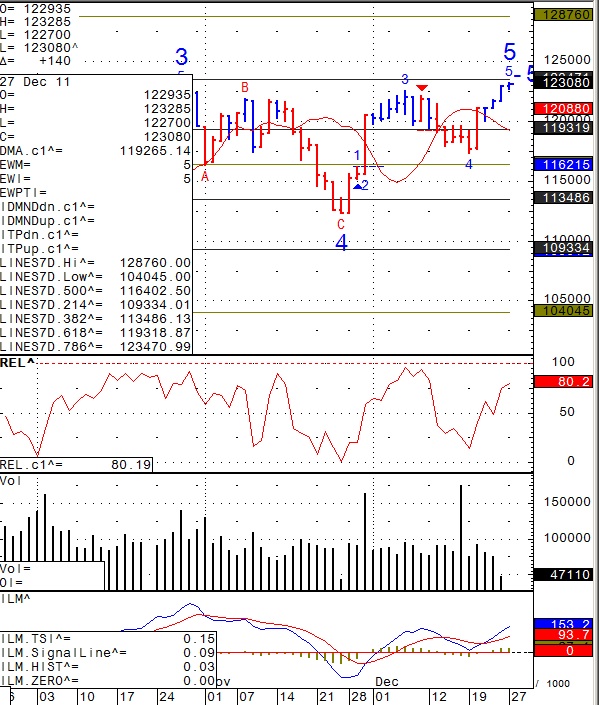

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

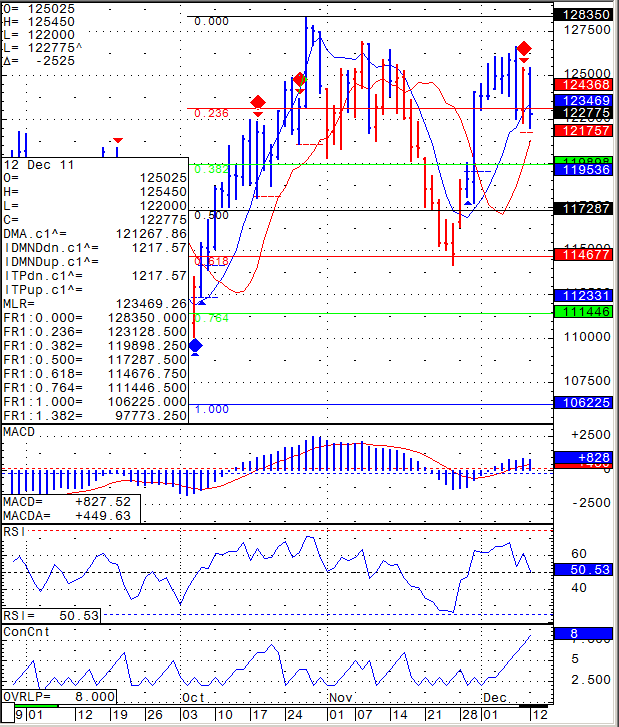

5. Daily Mini S&P Chart

6. Economic Reports for Wednesday, November 23, 2011

Market Commentary and Thanksgiving Day Trading Schedule

Happy Thanksgiving to all of you!

Make sure you pay attention to trading hours for both Thursday and Friday this week.

Detailed hours are below the chart.

As far as market outlook, my view last week came true and the question now is how far this sell off will continue.

From Nov. 17th blog: Bearish close today on stock index futures and as I mentioned yesterday, a break below 1204 on the Dec. SP 500 can trigger another leg down.

Thanksgiving Day Trading Schedule

Wednesday, November 23 Hours

CME Group (Floor)

Regular Close

NYMEX (Floor)

Regular Close

GLOBEX

Regular Close/Open

* Exceptions: Livestock, GSCI, Lumber, Crude Palm Oil, Weather, Grain, Ethanol and Dairy products

ICE

Regular Close/Open

EUREX

Regular Close

OneChicago

Regular Close

NYSE

Regular Close

Forex

Regular Close

Thursday, November 24 Hours

CME Group (Floor)

Closed

NYMEX (Floor)

Closed

GLOBEX

Closed: Livestock, GSCI, Lumber, Crude Palm Oil, Weather, Grain, Ethanol and Dairy products

10:30 am Close: Equity products

12:00 pm Close: Interest Rate, Foreign Exchange, Real Estate and Forestry products

12:15 pm Close: Green Exchange, NYMEX, COMEX and DME products

*Trading Resumes at the times listed below*

5:00 pm Open: Equity, Interest Rate, Foreign Exchange, Crude Palm Oil, Livestock, GSCI, Forestry, Weather, Real Estate, Green Exchange and NYMEX/COMEX/DME products

6:00 pm Open: CBOT/KCBT/MGEX Grain and Ethanol products

*Dairy products will remain closed until their regularly scheduled open on Sunday, November 27th

ICE

Closed: Soft and Open outcry products

10:30 am Close: Index products

12:00 pm Close: Financial products

EUREX

Closed: Hurricane Futures, US, Canadian and Brazilian Equity Derivatives (No cash payment in USD)

*All other products regular close

OneChicago

Closed

NYSE

Closed

Forex

Regular Close

Friday, November 25 Hours

CME Group (Floor)

Closed: Dairy

12:00 pm Close: Foreign Exchange, Interest Rates, Commodities, GSCI, Weather and Real Estate products

12:02 pm Close: CME Commodity options

12:15 pm Close: Equity products

12:30 pm Close: CBOT Mini-Grains

NYMEX (Floor)

12:30 pm Close

GLOBEX

Closed: Dairy products

12:00 pm Close: Agricultural, CBOT Grain futures & options, Ethanol, KCBT Grain, Forestry, Weather and GSCI products

12:02 pm Close: CME Commodity options

12:15 pm Close: Equity, Interest Rate, Foreign Exchange, Real Estate, MGEX Grain and KOSPI 200 products

12:30 pm Close: CBOT Mini-Grains

12:45 pm Close: Green Exchange and NYMEX/COMEX/DME products

ICE

11:45 Close: Open Outcry Soft products

12:00 Close: Soft and Open Outcry Financial products

12:15 Close: Financial, Index and Open Outcry Index products

EUREX

Regular Close

OneChicago

12:00 pm Close

NYSE

12:00 pm Close

Forex

Regular Close

*All times listed in Central Time

The above calendar is compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Please visit CME at:

http://www.cmegroup.com/tools-information/holiday-calendar/files/2011-thanksgiving.pdf

and the ICE exchange at

https://www.theice.com/marketdata/calendar/CalendarList.shtml?calendar=Holiday&calendar=SpecialTradingHours&markets=ICE%20Futures%20Europe&markets=ICE%20Futures%20Canada&markets=ICE%20OTC&markets=ICE%20Futures%20U.S.&markets=ICE%20Trust%20U.S.&markets=ICE%20Clear%20Europe%20CDS Continue reading “Thanksgiving Day Trading Schedule | Support and Resistance Levels”

Continue reading “Daily chart of the Dow Jones cash index | Support and Resistance Levels”

Continue reading “Daily chart of the Dow Jones cash index | Support and Resistance Levels”