On Friday I wrote the following regarding today’s session:

I have no idea of what to expect of this market for next week. Probably more volatility?

I guess I will wait and see price action Sunday night and Monday morning before forming an opinion.

Well after today’s price action I favor the downside as I see the close today to be bearish to neutral.

As I wrote before, you can have the right market direction and feel for the market and still lose… Maybe more important is the trading plan, i.e entry level, potential targets and stops etc. or to make it short….PLAN YOUR TRADE, TRADE YOUR PLAN.

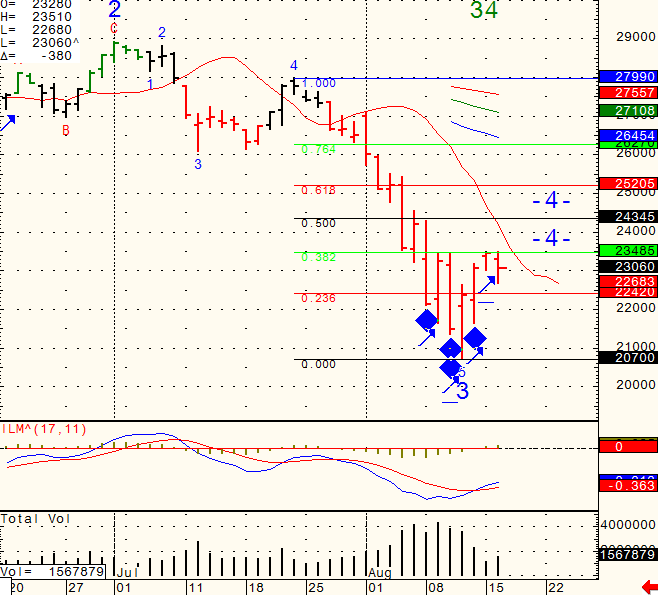

Daily chart of the DOW JONES CASH index for your review below:

Daily Futures chart of the Dow Jones Cash Index from August 22nd, 2011

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Continue reading “Futures Trading Levels, Trading Plans”