Cannon Trading / E-Futures.com

Good reading/Articles in our weekly newsletter about trading psychology. I recommend reading to further your trading education. Continue reading “Futures Trading Levels, Recommended Trading Psychology Reading”

Futures trading is done by two main parties, one of which is the hedger and the other one is the speculator. Where a speculator is there to trade for either their own accounts or that of their clients, a hedger always uses futures as a possible protection from losses. Hedgers can also be described as individuals or business owners who are more risk averse. Speculators and hedgers are likely to benefit from futures trading if the trader has a strong ability to analyze the markets and understands that future behavior. Though futures can behigh risk, they offer an equally high return and are thus very tempting.

In case you are new to futures trading you need to understand how things work. We at Cannon Trading are there to help with your understanding of all the elements of futures trading and also counsel and advise you with the same. Our knowledge base featured on our website, is a store house of information. In order to know every aspect of futures trading, you must read through these articles that have been listed in this category archive. Go through it and get better informed!

Cannon Trading / E-Futures.com

Good reading/Articles in our weekly newsletter about trading psychology. I recommend reading to further your trading education. Continue reading “Futures Trading Levels, Recommended Trading Psychology Reading”

Cannon Trading / E-Futures.com

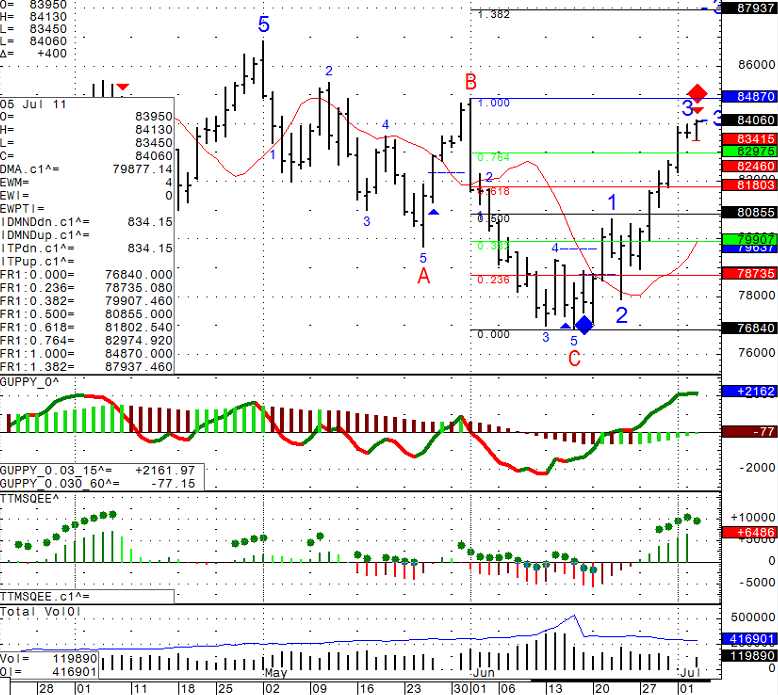

Lower volume to resume trading after the fourth of July long weekend.

Summer season sometimes have different characteristics than other times of the year. Pay attention to reports and trading volume.

Daily chart of the mini Russell for your review below. I think if market can take out 833.00 we may see a deeper correction, otherwise the path of less resistance will continue to be to the upside.

Continue reading “Futures Trading Levels, Lower Volume After Weekend”

Continue reading “Futures Trading Levels, Lower Volume After Weekend”

Cannon Trading / E-Futures.com

HAPPY 4TH OF JULY!!

Click for a PDF of the CME Group Holiday Calendar

CME Group (Floor)

Regular Close

NYMEX (Floor)

Regular Close

GLOBEX

3:15 pm Close: Interest Rate, Foreign Exchange, GSCI, Wood Pulp, Crude Palm Oil and Green Exchange products

* All other products regular close

ICE

3:15 pm Close: Financial and Index products

* All other products regular close

EUREX

Regular Close

OneChicago

Regular Close

NYSE

Regular Close

Forex

Regular Close

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Regular Open

* Exceptions – Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products closed

ICE

Regular Open

* Exceptions – Soft and Open outcry products closed

EUREX

Regular Open

* Exceptions – US, Brazilian, Canadian Equity Derivatives and Hurricane Futures closed

OneChicago

Closed

NYSE

Closed

Forex

Regular Open

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Closed: Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products

10:30 am Close: Equity products

12:00 pm Close: Interest Rate, Financial, Foreign Exchange, Real Estate, and Wood Pulp products

12:15 pm Close: NYMEX/COMEX/DME and Green Exchange products

*Trading Resumes at the times listed below*

5:00 pm Open: Equity, Interest Rate, Foreign Exchange, Dairy, Crude Palm Oil, GSCI, Weather, Real Estate, Wood Pulp, NYMEX/COMEX/DME and Green Exchange products

5:30 pm Open: Financial products

6:00 pm Open: CBOT/KCBT/MGEX Grain and Ethanol products

ICE

Closed: Softs and Open outcry products

10:30 am Close: Index products

12:00 pm Close: Financial products

EUREX

Closed: US, Brazilian, Canadian Equity Derivatives and Hurricane Futures

*No cash payment in USD

OneChicago

Closed

NYSE

Closed

Forex

Regular Close

The above calendar is compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Continue reading “Futures Trading Levels, Holiday Trading Hours”

Cannon Trading / E-Futures.com

Wishing all of you a great trading month in July and Happy 4th of July weekend!

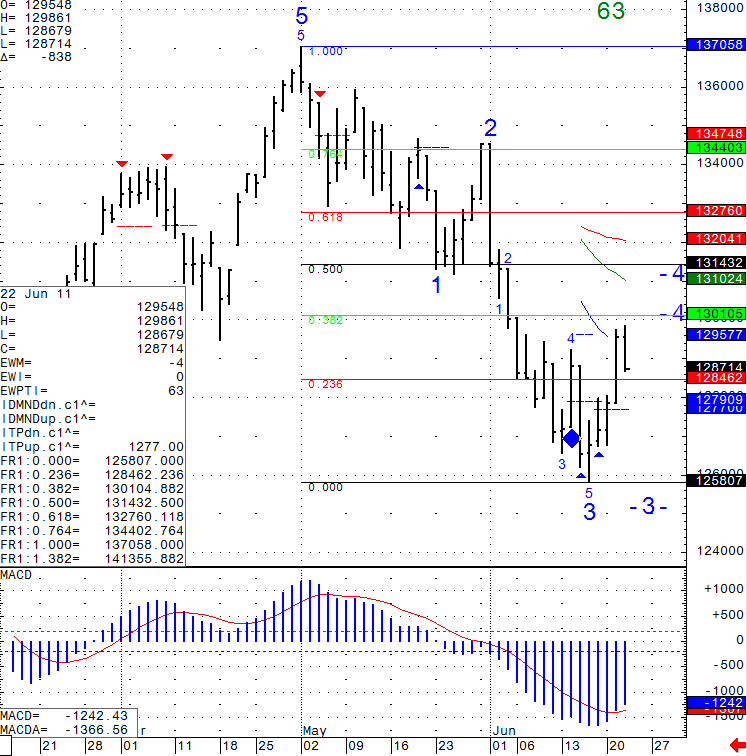

Daily chart of Mini SP 500 for review below, followed by Holiday hours.

The 1321 to 1323 area may prove to be hard resistance to break. Also last few months I have noticed a rally the last day of the month, followed by a sell off the first or second trading of the month….**

CME Group (Floor)

Regular Close

NYMEX (Floor)

Regular Close

GLOBEX

3:15 pm Close: Interest Rate, Foreign Exchange, GSCI, Wood Pulp, Crude Palm Oil and Green Exchange products

* All other products regular close

ICE

3:15 pm Close: Financial and Index products

* All other products regular close

EUREX

Regular Close

OneChicago

Regular Close

NYSE

Regular Close

Forex

Regular Close

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Regular Open

* Exceptions – Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products closed

ICE

Regular Open

* Exceptions – Soft and Open outcry products closed

EUREX

Regular Open

* Exceptions – US, Brazilian, Canadian Equity Derivatives and Hurricane Futures closed

OneChicago

Closed

NYSE

Closed

Forex

Regular Open

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Closed: Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products

10:30 am Close: Equity products

12:00 pm Close: Interest Rate, Financial, Foreign Exchange, Real Estate, and Wood Pulp products

12:15 pm Close: NYMEX/COMEX/DME and Green Exchange products

*Trading Resumes at the times listed below*

5:00 pm Open: Equity, Interest Rate, Foreign Exchange, Dairy, Crude Palm Oil, GSCI, Weather, Real Estate, Wood Pulp, NYMEX/COMEX/DME and Green Exchange products

5:30 pm Open: Financial products

6:00 pm Open: CBOT/KCBT/MGEX Grain and Ethanol products

ICE

Closed: Softs and Open outcry products

10:30 am Close: Index products

12:00 pm Close: Financial products

EUREX

Closed: US, Brazilian, Canadian Equity Derivatives and Hurricane Futures

*No cash payment in USD

OneChicago

Closed

NYSE

Closed

Forex

Regular Close

The above calendar is compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Continue reading “Futures Trading Levels, July 4th weekend Trading Hours”

Cannon Trading / E-Futures.com

CME Group (Floor)

Regular Close

NYMEX (Floor)

Regular Close

GLOBEX

3:15 pm Close: Interest Rate, Foreign Exchange, GSCI, Wood Pulp, Crude Palm Oil and Green Exchange products

* All other products regular close

ICE

3:15 pm Close: Financial and Index products

* All other products regular close

EUREX

Regular Close

OneChicago

Regular Close

NYSE

Regular Close

Forex

Regular Close

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Regular Open

* Exceptions – Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products closed

ICE

Regular Open

* Exceptions – Soft and Open outcry products closed

EUREX

Regular Open

* Exceptions – US, Brazilian, Canadian Equity Derivatives and Hurricane Futures closed

OneChicago

Closed

NYSE

Closed

Forex

Regular Open

CME Group (Floor)

ClosedNYMEX (Floor)

Closed

GLOBEX

Closed: Dairy, Crude Palm Oil, Livestock, GSCI, Lumber, Weather, CBOT/KCBT/MGEX Grains, Ethanol, TRAKRS and Dow UBS ER products

10:30 am Close: Equity products

12:00 pm Close: Interest Rate, Financial, Foreign Exchange, Real Estate, and Wood Pulp products

12:15 pm Close: NYMEX/COMEX/DME and Green Exchange products

*Trading Resumes at the times listed below*

5:00 pm Open: Equity, Interest Rate, Foreign Exchange, Dairy, Crude Palm Oil, GSCI, Weather, Real Estate, Wood Pulp, NYMEX/COMEX/DME and Green Exchange products

5:30 pm Open: Financial products

6:00 pm Open: CBOT/KCBT/MGEX Grain and Ethanol products

ICE

Closed: Softs and Open outcry products

10:30 am Close: Index products

12:00 pm Close: Financial products

EUREX

Closed: US, Brazilian, Canadian Equity Derivatives and Hurricane Futures

*No cash payment in USD

OneChicago

Closed

NYSE

Closed

Forex

Regular Close

The above calendar is compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Continue reading “Futures Trading Levels, Independence Day Weekend Trading Schedule”

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer Continue reading “Futures Trading Levels, Invitation to Exclusive Day Trading Webinar”

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer Continue reading “Futures Trading Levels, Invitation to Exclusive Day Trading Webinar”

Cannon Trading / E-Futures.com

This Wednesday, June 29th, Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 9:00 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Space is limited: Reserve your Webinar seat now!

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.4.11 (Tiger®) or newer Continue reading “Futures Trading Levels, Invitation to Exclusive Day Trading Webinar”

Cannon Trading / E-Futures.com

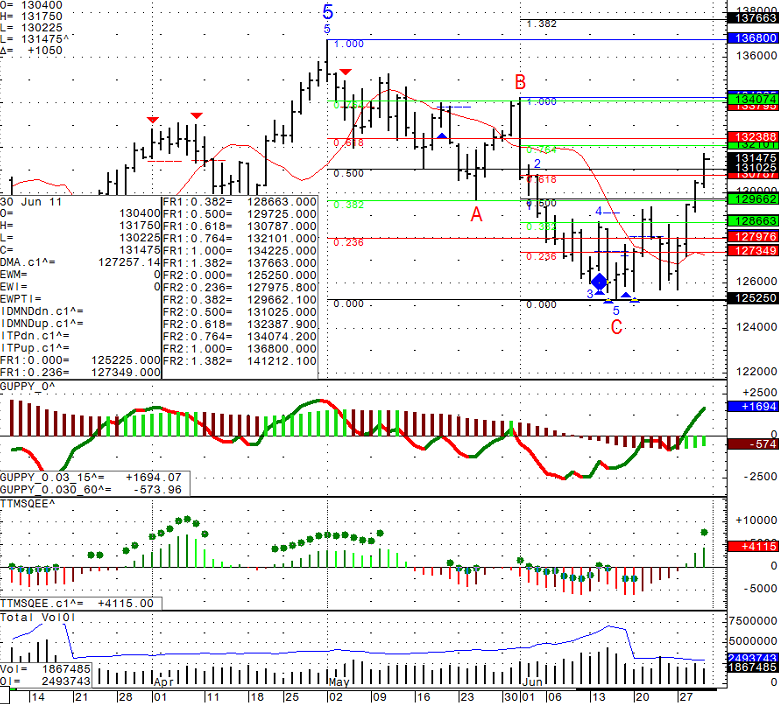

Overnight news sent crude oil tumbling….I thought it would be interesting to share a weekly chart of Crude Oil futures for your review.

The International Energy Agency will release 60 million barrels of oil from strategic government stockpiles held by industrialized consumer nations in a bid to push down oil prices, the 28-member group announced on Thursday.

The announcement comes after OPEC failed to raise production at a meeting on June 8 and despite assurances from OPEC’s biggest producer Saudi Arabia that it would lift supplies unilaterally.

Continue reading “Futures Trading Levels, Crude Oil Tumbles in Light of OPEC and IEA News”

Cannon Trading / E-Futures.com

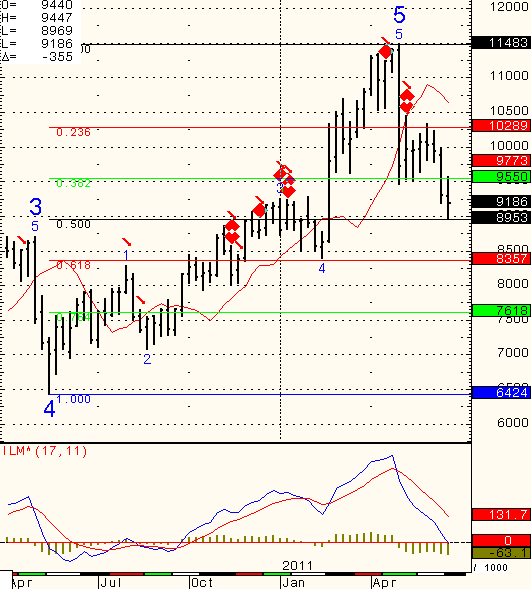

Once in a while I like to take a look at the actual underlying product for the future I am trading. In the case of the mini SP500, the actual product is the SP500 cash index. Below is a daily chart of the SP500 cash index, courtesy of CQG charting software.

Based on the tools I use and have confidence in, I will look for failure against the 1301 level and/ or a break back below 1284 as a sign that selling may resume towards the previous lows around 1258 cash basis. As always, use your own judgement in trading, know the time frame you like to trade, your risk tolerance etc.

Continue reading “Futures Trading Levels, Looking at the Underlying Product of Futures”

Continue reading “Futures Trading Levels, Looking at the Underlying Product of Futures”