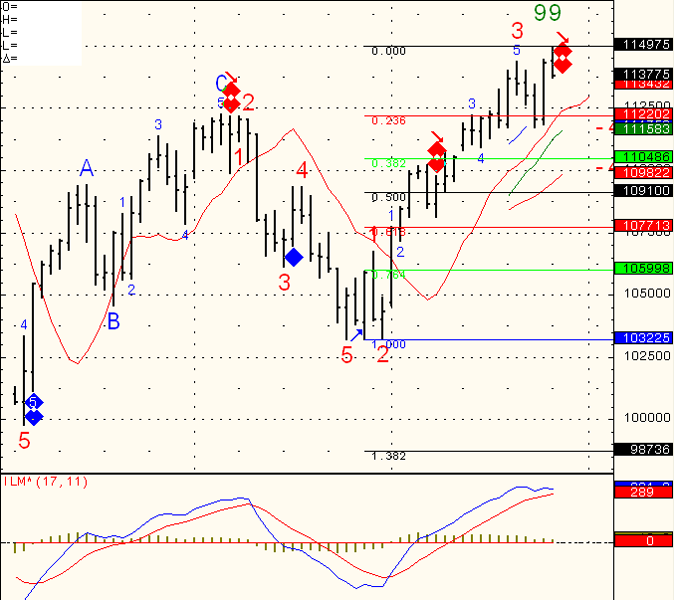

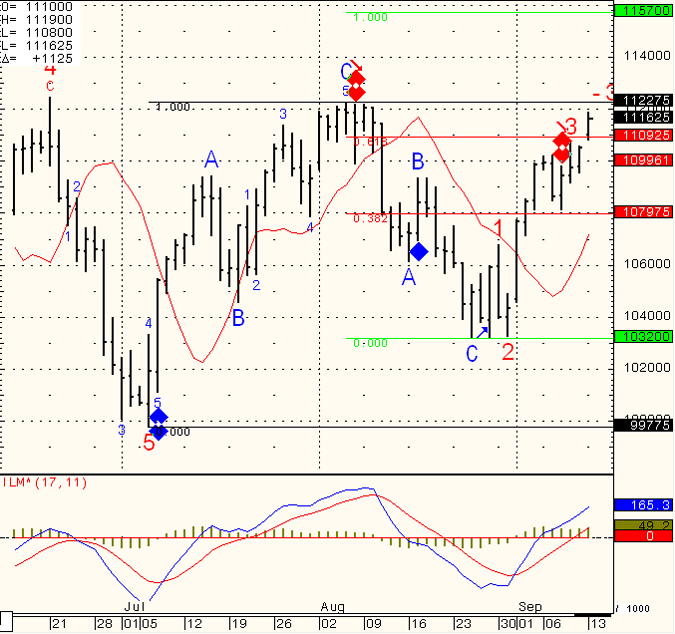

Our short “trigger” of 1123 basis Dec. SP500 did not materialize and kept us out of a short swing position, so far for a good reason. I will keep watching for what I call price confirmation over the next couple of days.

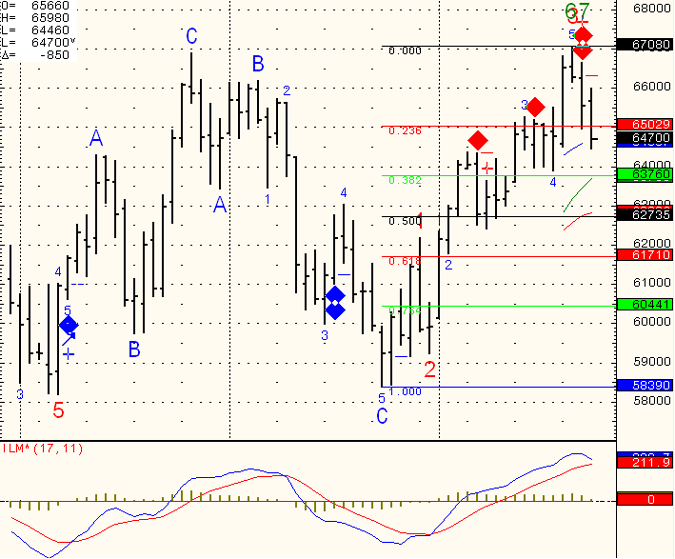

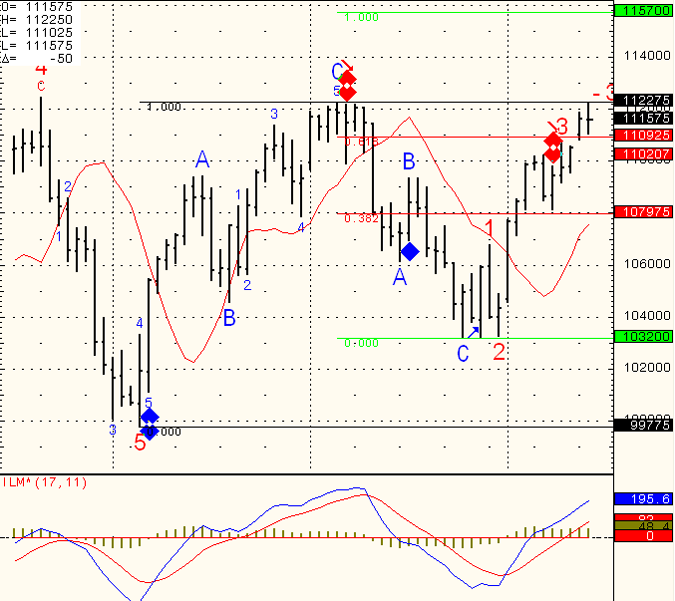

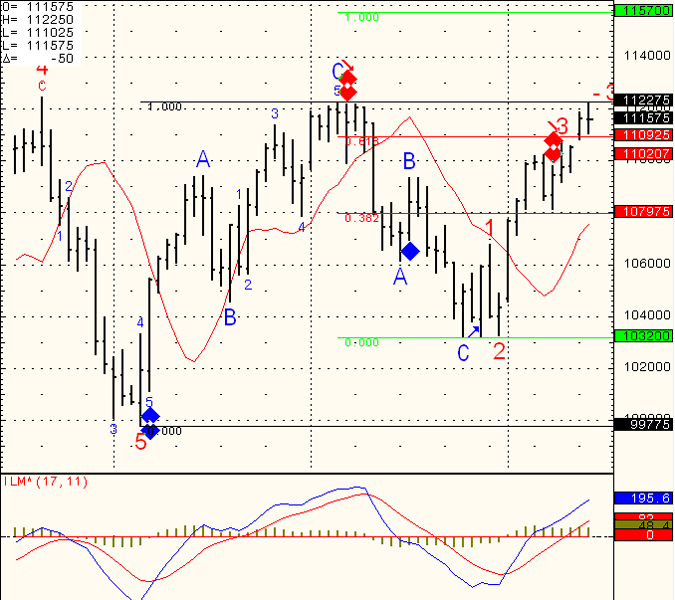

On a different note, if you like to view my intraday chart of the mini SP 500, euro currency ( as in the screen shot below from today’s session) and sometimes other markets, along with my intraday buy and sell set ups, trading concept, money and trade management please visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

( NO REPEAT TRIALS )