|

|

|

|

Futures trading is done by two main parties, one of which is the hedger and the other one is the speculator. Where a speculator is there to trade for either their own accounts or that of their clients, a hedger always uses futures as a possible protection from losses. Hedgers can also be described as individuals or business owners who are more risk averse. Speculators and hedgers are likely to benefit from futures trading if the trader has a strong ability to analyze the markets and understands that future behavior. Though futures can behigh risk, they offer an equally high return and are thus very tempting.

In case you are new to futures trading you need to understand how things work. We at Cannon Trading are there to help with your understanding of all the elements of futures trading and also counsel and advise you with the same. Our knowledge base featured on our website, is a store house of information. In order to know every aspect of futures trading, you must read through these articles that have been listed in this category archive. Go through it and get better informed!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In this issue:

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

https://m.cqg.com/stonexfutures

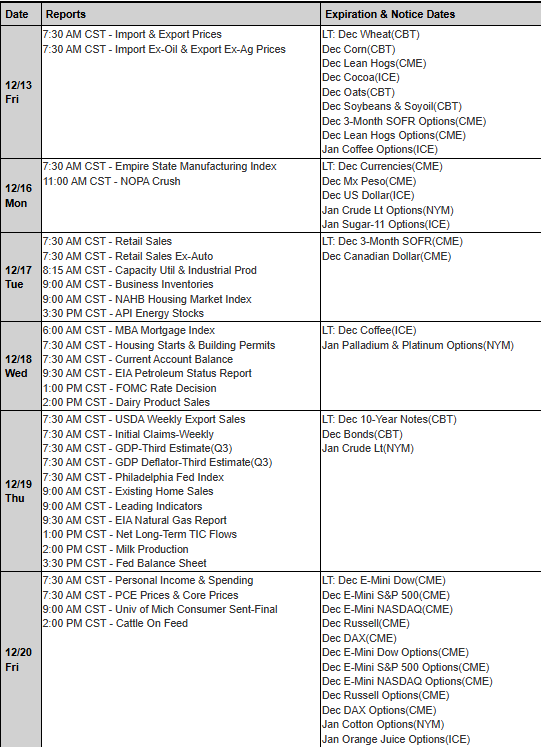

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Prominent Earnings Next Week:

FED SPEECHES:

Economic Data week:

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

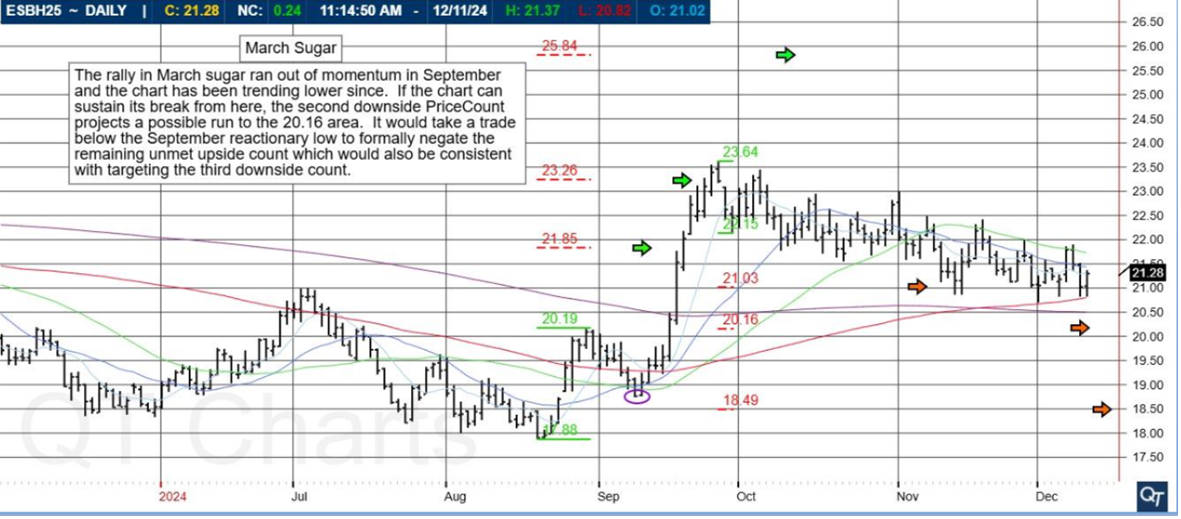

March Sugar

The rally in March sugar ran out of momentum and the chart has been trending lower since. If the chart can sustain its break from here, the second downside PriceCount projects a possible run to the 20.16 area. It would take a trade below the September reactionary low to formally negate the remaining unmet upside count which would also be consistent with targeting the third downside count.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

Nasdaq 100 Mini

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 150 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|