Jump to a section in this post:

1. Market Commentary

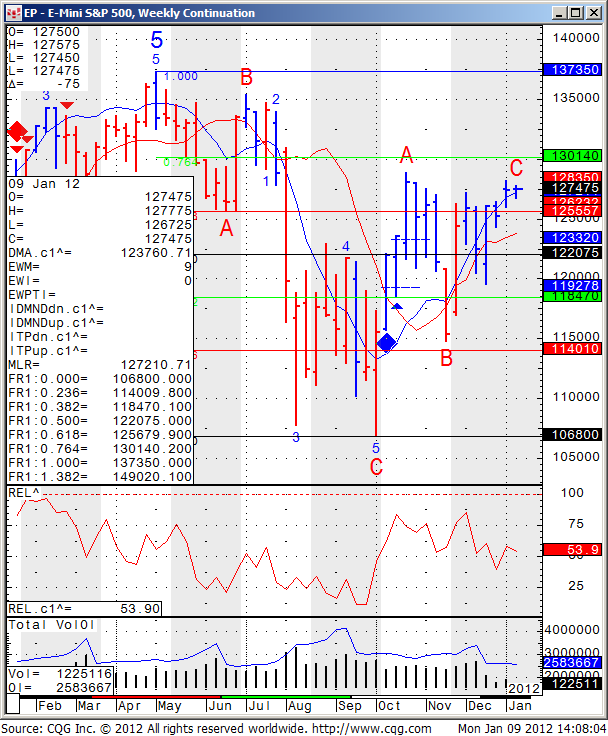

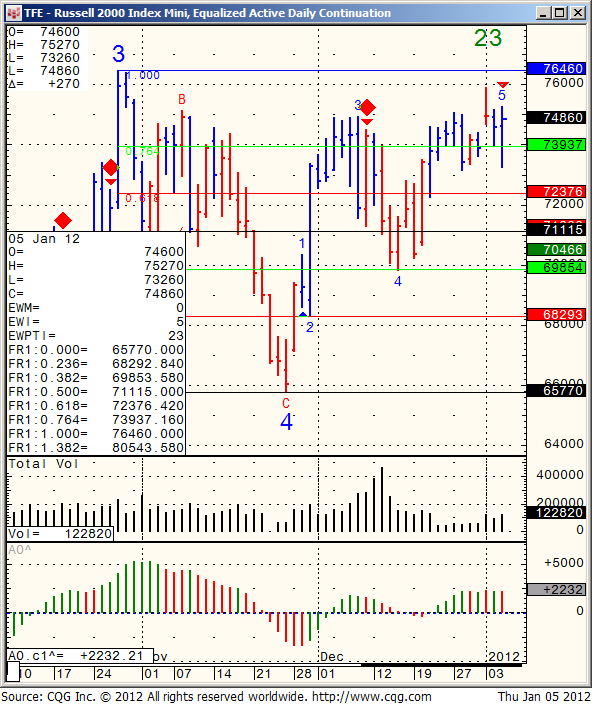

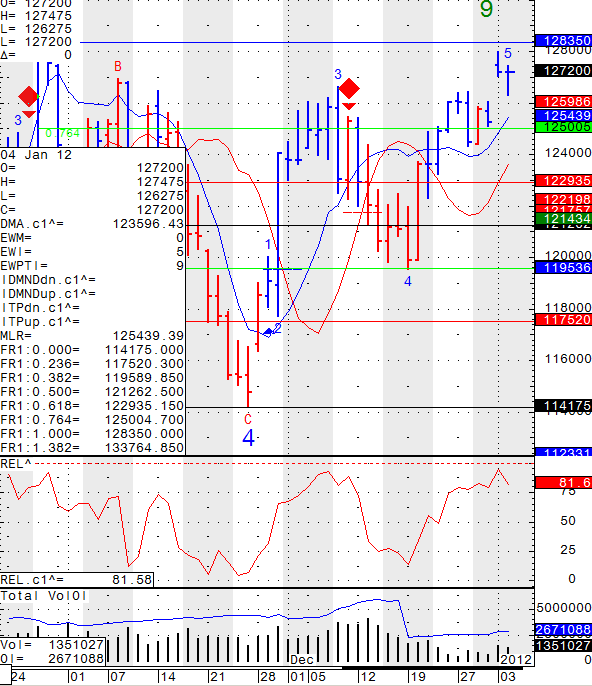

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5. Economic Reports for Thursday, January 12, 2012

1. Market Commentary

Cannon Trading Education

8 Steps to Successful Futures Day Trading

Introduction

My name is Ilan Levy-Mayer and I am the Vice President and Senior Broker at Cannon Trading. I came up with the following personal observations after serving online traders worldwide for more than 14 years. The following steps are guides to progress, and are not necessarily in sequential order. Some of them are always required, but each trader is different and will relate to these stages in their own ways. While attempting to learn and progress, one must keep in mind that futures trading is risky and can involve significant losses.

1.Education

Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Understanding this information is essential to trading. The second type of education is ongoing: learning about trading techniques, the evolution of markets, different trading tools, and more.

2.Find a System

I am definitely not advising you to go on the web and subscribe to a “black box” system (using buy/sell triggers if don’t know why they are being generated). What I am advising is developing a trading technique: a general set of rules and a trading concept. As you progress, you may want to put the different rules and indicators into a computerized system, but the most important factor is to have a focus and a plan. Don’t just wake up in the morning and trade “blank.” Continue reading “8 Steps to Successful Futures Day Trading | Support and Resistance Levels”