Cannon Futures Weekly Newsletter Issue # 1136

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – Trading MICRO Bitcoin/Ether on a Regulated Exchange

- Trading Resource of the Week – Educational Videos

- Hot Market of the Week – Live Cattle

- Brokers’ Trading System of the Week

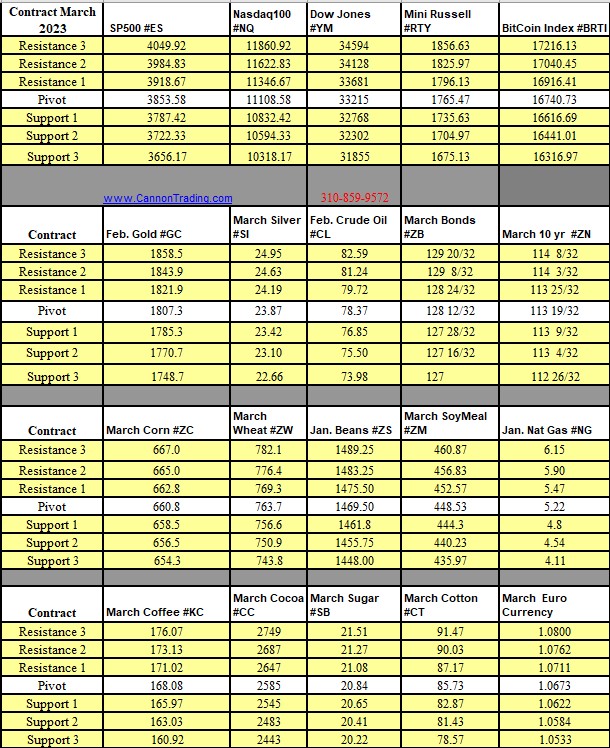

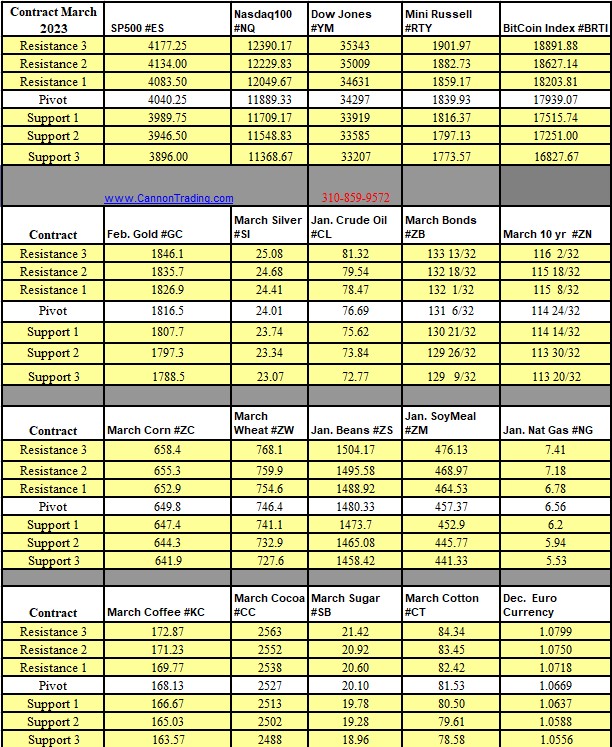

- Trading Levels for Next Week

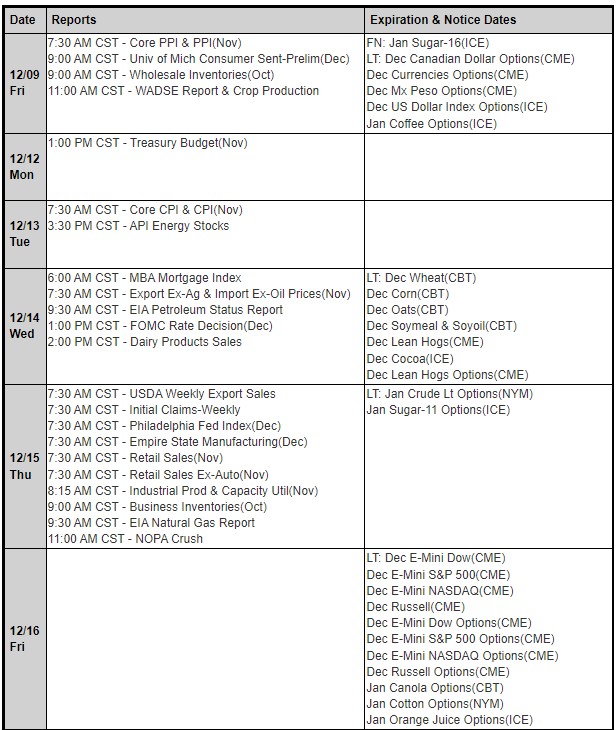

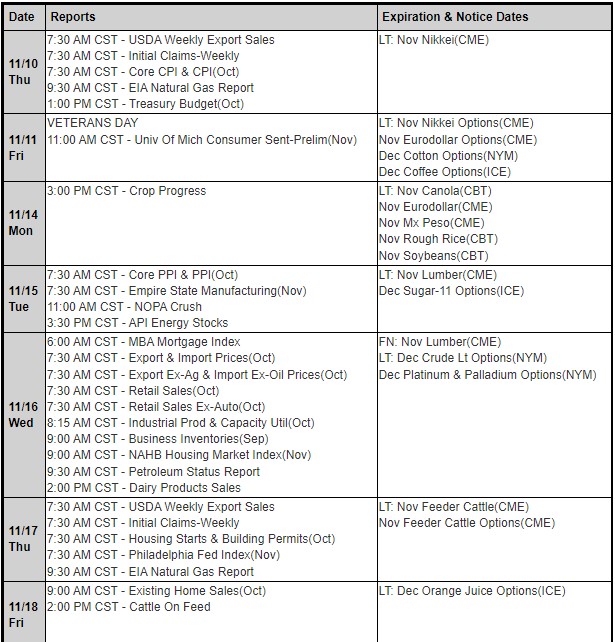

- Trading Reports for Next Week

Trading Updates:

- Important Notices – Micro Bitcoin and MICRO Ether futures fees discount – Trading Bitcoin and Ether Futures on a REGULATED exchange

- CME Alternative Investment Product Fee Schedules

- (NEW) Note 4 – Effective through August 31, 2023, the Exchange Fees for all Globex, EFP, EFR, Block and BTIC transactions in Micro Bitcoin Futures will be discounted to $0.70 for members and to $1.00 for non-members.

- (NEW) Note 5 – Effective through August 31, 2023, the Exchange Fees for all Globex, EFP, EFR, Block and BTIC transactions in Micro Ether Futures will be discounted to $0.07 for members and to $0.10 for non-members.

- CME Other Fees and Discounts

- Event Contracts – Cash Settlement Fee waiver extended through August 31, 2023

-

Trading Resource of the Week

- Cannon’s own YouTube Channel!

-

Trading Levels for Next Week

Weekly Levels

-

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading