In this post:

1. Market Commentary

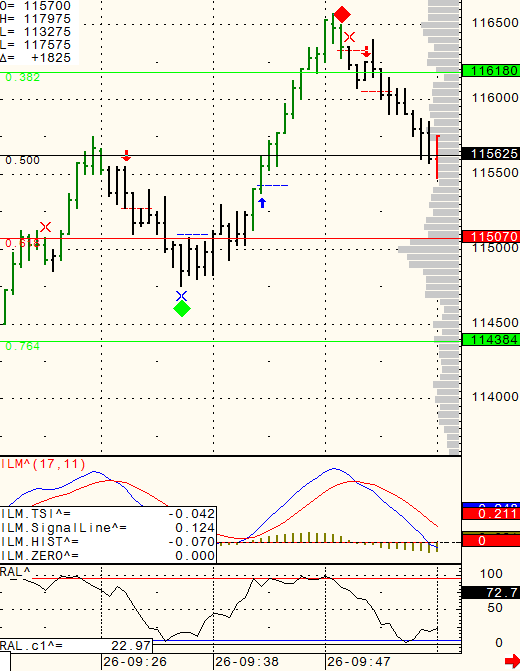

2. Support and Resistance Levels

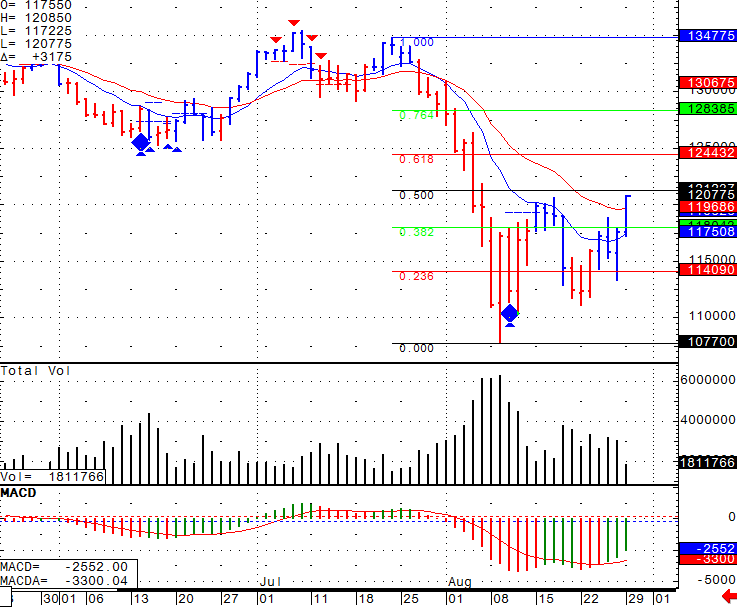

3. Daily Mini S&P 500 Futures Chart

4. Economic Reports

5. Earnings Releases

1. Market Commentary

Front month for Equities (eminis), currencies, bonds and financials and many other markets is now December. You should not be trading almost any September contract of any market.

Note to our clients who are trading with TransactAT:

The latest version is now TransactAT 5.2.2 (download). The newer version can be installed over the older version. Please contact you broker if you need any help.

FOMC tomorrow and before that more than a few economic numbers.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

If you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market- FAST.

My observations suggest choppy, low volume up until announcement, followed by some some sharp volatile moves right during and after the announcement. However, with tomorrow early morning reports, we may see more volatility during first couple of hours as well.

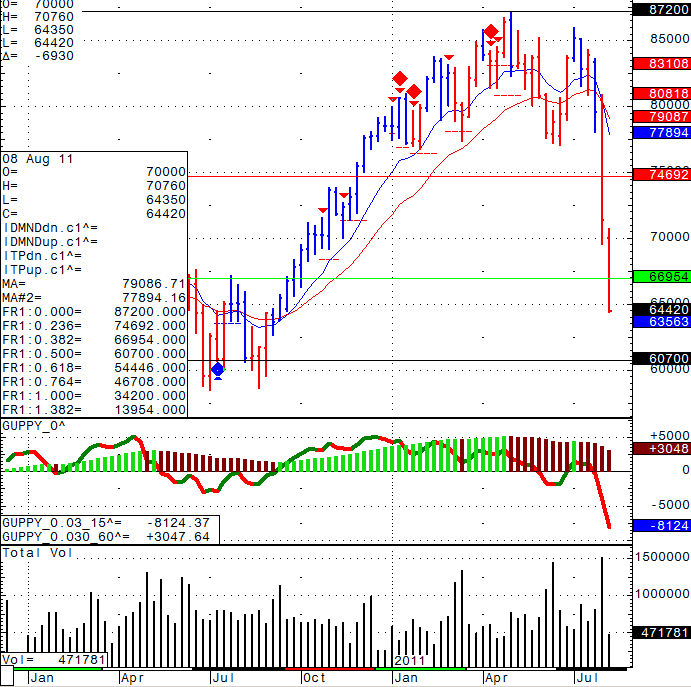

My SWING trading model is currently short the mini Russell from 693 ( target around 672, stop around 716) which may not suite everyone’s stomach ahead of the what maybe volatile overnight and tomorrows FOMC session, but chart for your review below.

If you would like to be included on my SWING trade ideas, send me an email. Continue reading “Trade With Caution, FOMC Day Tomorrow | Support and Resistance Levels”