Cannon Futures Weekly Letter Issue # 1182

- Important Notices – President’s Day Schedule

- Trading Resource of the Week – Trade Alerts via Text/email

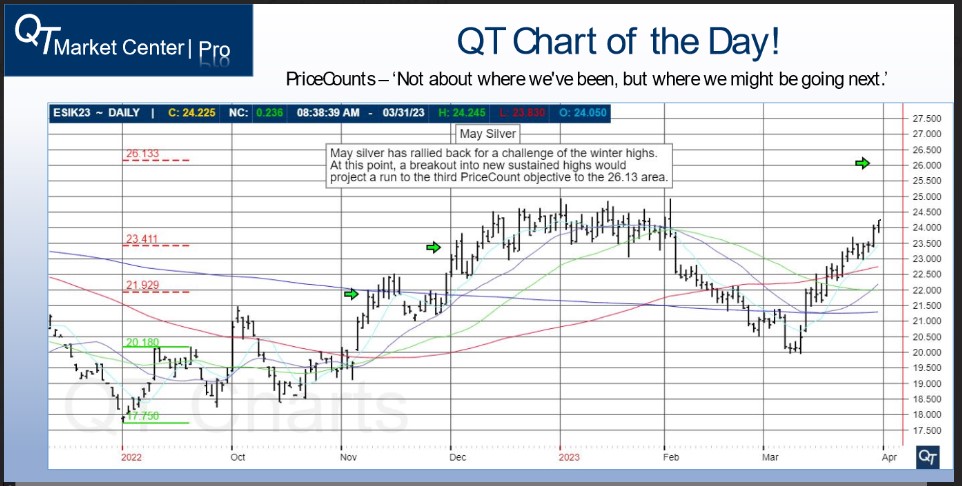

- Hot Market of the Week – April Crude Oil

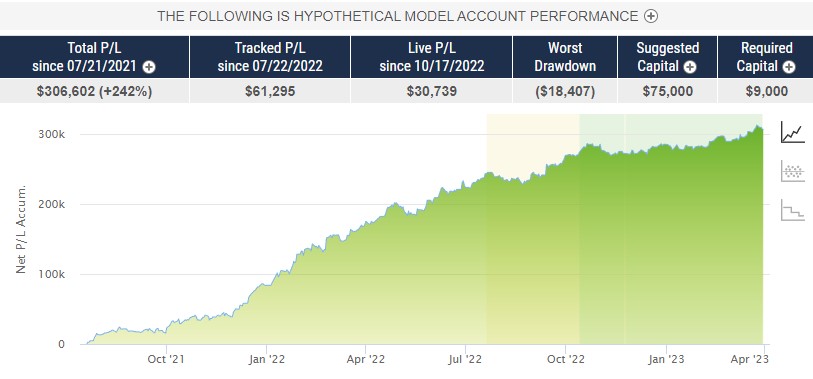

- Broker’s Trading System of the Week – Unleaded Gasoline Swing Trading System

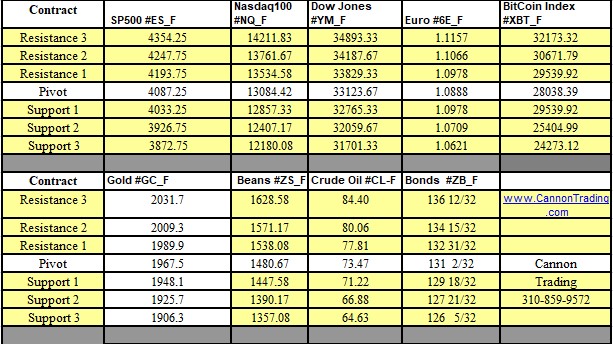

- Trading Levels for Next Week

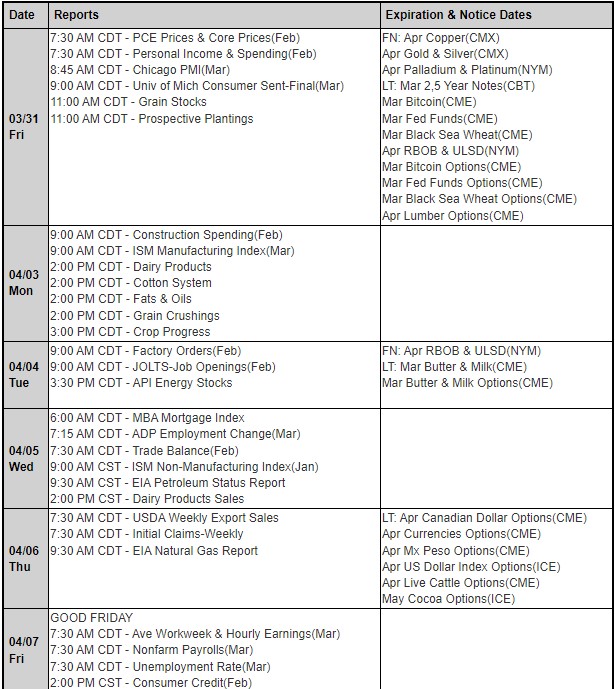

- Trading Reports for Next Week

Important Events Coming Up –

- Earnings next week: NVIDIA, Walmart, Home Depot…. Light Data.

- 4 Fed Speakers.

- Market may look toward US Budget talks deadline 3/1/24

- President’s Day is this Monday, view modified Schedule here.

Trading Resource of the Week : Real Time Email Alerts Directly to your Phone!

- You will receive an email each time there is an entry or exit in a simple language along with the current price for that specific market.

- A licensed series 3 broker at your fingertips

- Email alerts available to US and Canada and Int’l clients

- Alerts available for: Stock Indices, Grains, Metals, Rates, Currencies, Meats & Softs

- Open an account* and receive the Trade Alerts free for 3 months ($357 value)

- See an example of a recent trade alert for Gold Futures in the image below – the trade was still active as of Friday, Feb. 16th

- Hot Market of the Week – April Crude Oil

-

Broker’s Trading System of the Week

Daily Levels for February 19th/20th 2024

Trading Reports for Next Week

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

cc

cc