|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When exploring the best futures trading platform to enhance your trading experience, platforms like E-Futures International and CannonPro stand out as exemplary choices for their robust features, intuitive interfaces, and tools tailored to effective risk management. Trading futures requires a deep understanding of market dynamics, leveraging the right tools, and adopting strategies that minimize risk while optimizing returns. This article will delve into the top ten tips for using these futures trading platforms, highlight aspects where your broker can provide more insights, and explore key risk elements that traders must address. We will also discuss why Cannon Trading Company is a stellar choice for trading futures with a strong emphasis on risk management.

Before diving into specific tips, it is essential to understand why trading platforms like E-Futures International and CannonPro are integral to trading futures successfully. These platforms provide advanced charting tools, market analysis, and real-time data feeds, enabling traders to make informed decisions. Coupled with the guidance of a knowledgeable commodity broker, these platforms empower both novice and experienced traders to navigate the complexities of the futures market.

While trading platforms offer a wealth of tools and features, the role of a commodity broker remains indispensable. Brokers can provide the following insights:

Trading futures inherently involves risks that must be carefully managed. These include:

Why Awareness Matters: Understanding these risks allows traders to implement safeguards like diversification, proper position sizing, and hedging strategies.

Cannon Trading Company has earned its reputation as one of the best futures trading platforms for several reasons:

Selecting the best futures trading platform is a critical step toward achieving success in the futures market. Platforms like E-Futures International and CannonPro offer powerful tools and features that enable traders to execute informed trades and manage risks effectively. By leveraging the expertise of a knowledgeable commodity broker and focusing on continuous learning, traders can navigate the complexities of trading futures with confidence.

Cannon Trading Company stands out as a premier choice for traders looking to combine cutting-edge technology with exceptional support and robust risk management practices. By following the tips outlined in this article and maintaining a disciplined approach, traders can maximize their potential in the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In this issue:

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

https://m.cqg.com/stonexfutures

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Prominent Earnings Next Week:

FED SPEECHES:

Economic Data week:

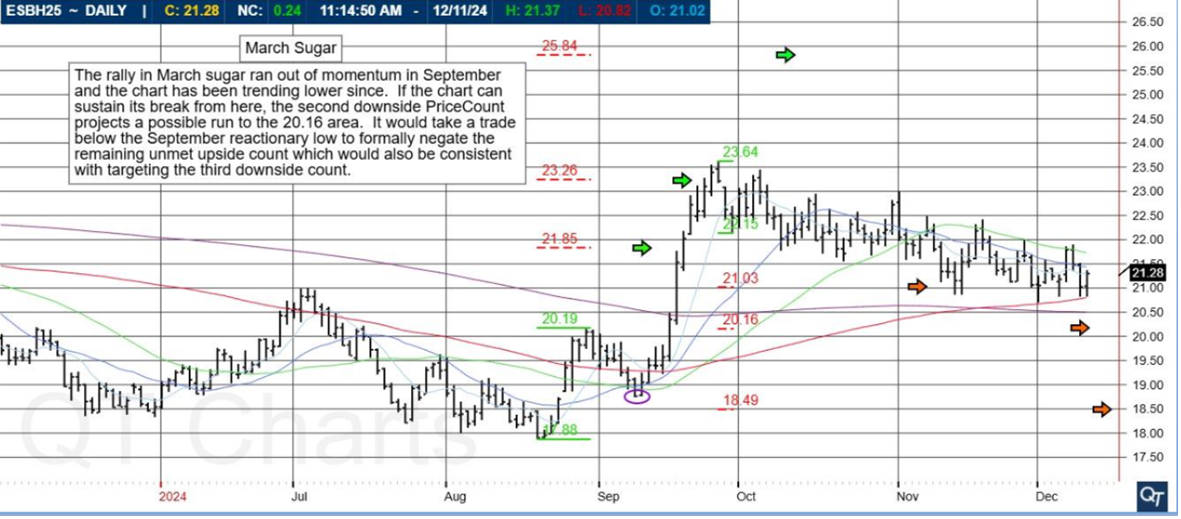

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March Sugar

The rally in March sugar ran out of momentum and the chart has been trending lower since. If the chart can sustain its break from here, the second downside PriceCount projects a possible run to the 20.16 area. It would take a trade below the September reactionary low to formally negate the remaining unmet upside count which would also be consistent with targeting the third downside count.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

Nasdaq 100 Mini

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 150 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

As financial markets continue to experience unprecedented levels of volatility, futures brokers in the USA play an increasingly critical role in helping traders navigate the complexities of futures trading. Heading into 2025, the unpredictability of global economic conditions, geopolitical events, and shifting monetary policies underscore the need for strategic intervention by futures brokers. Traders face unique challenges and opportunities in these conditions, making the guidance of experienced professionals more valuable than ever.

In this article, we will examine how futures brokers in the USA can assist their clients in managing volatility, offering ten actionable techniques supported by real-life trades, case studies, and hypotheticals. We will also explore why Cannon Trading Company, a leading futures broker with a stellar reputation, is an exceptional choice for traders seeking stability in turbulent times.

One of the primary ways futures brokers help clients manage volatility is through hedging. By taking opposing positions in the futures market, traders can protect themselves against adverse price movements in underlying assets. For example:

Through personalized hedging strategies, futures brokers in the USA provide peace of mind to clients worried about market swings.

Another effective technique is trading options on futures contracts. These instruments provide traders the right, but not the obligation, to buy or sell futures at a specific price. For instance:

Options on futures trading offer traders a way to benefit from volatility while managing risk.

Spread trading, which involves taking offsetting positions in related contracts, is another volatility management tool. Examples include calendar spreads (trading futures with different expiration dates) and intercommodity spreads.

This strategy reduces exposure to absolute price volatility and focuses on relative price movements.

Stop-loss orders are a critical tool for managing downside risk in volatile markets. A futures broker can work with clients to establish stop-loss levels tailored to their risk tolerance.

Stop-loss orders ensure disciplined trading futures even in chaotic market conditions.

Futures brokers often provide clients with advanced charting tools and technical analysis to identify key market levels. These insights help traders execute informed decisions.

By leveraging technical analysis, futures brokers in the USA empower clients to act decisively.

Diversification is a time-tested approach to mitigating risk. Futures brokers can guide traders in creating portfolios with exposure to various asset classes, such as commodities, equities, and currencies.

This strategy minimizes reliance on a single market segment.

Modern futures brokers in the USA offer access to real-time data and expert commentary to help clients anticipate and respond to market moves.

Access to accurate, up-to-date information is a cornerstone of successful trading futures.

Effective execution can make or break a trade during periods of high volatility. Experienced futures brokers employ smart order routing and execution algorithms to reduce slippage.

Top-tier execution is an often-underestimated advantage provided by reputable futures brokers in the USA.

Education is vital for empowering traders to manage risk. Many futures brokers, including Cannon Trading, provide webinars, market reports, and one-on-one consultations.

Educational resources ensure traders are equipped to make informed decisions in volatile markets.

In a fast-paced environment, the right trading platform can be the difference between success and failure. Leading futures brokers in the USA provide clients with access to state-of-the-art platforms tailored to their needs.

The ability to trade seamlessly across markets enhances resilience in volatile times.

Cannon Trading Company is a standout in the crowded field of futures brokers in the USA, offering unmatched experience, client support, and technological resources. Here’s why Cannon is an excellent choice for traders concerned about market volatility:

For traders seeking a reliable partner in futures trading, Cannon Trading delivers expertise, technology, and trustworthiness.

As we approach 2025, market volatility is likely to remain a defining feature of financial markets. Futures brokers in the USA play an indispensable role in helping traders navigate these challenges through hedging, diversification, advanced execution, and education. From stop-loss orders to real-time insights, the techniques outlined above demonstrate the breadth of strategies available to clients.

With a proven track record, comprehensive platform offerings, and a commitment to client success, Cannon Trading Company is uniquely positioned to assist traders in managing risk and capitalizing on opportunity in the world of futures trading. By leveraging the resources and expertise of leading futures brokers, traders can approach market volatility with confidence and resilience.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In this issue:

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

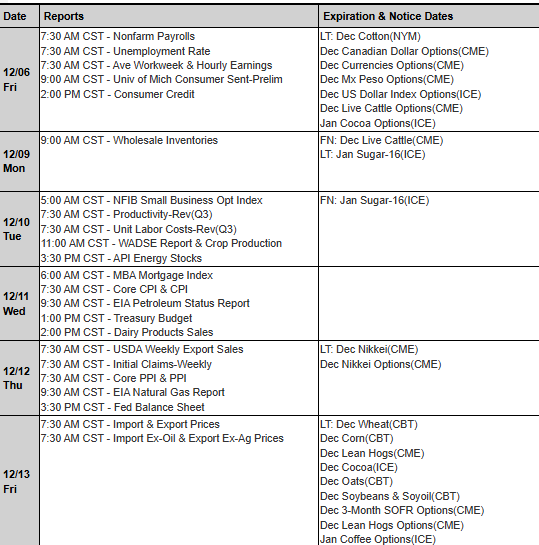

294 corporate earnings reports and a number of meaningful Economic data releases including Consumer Price Index (CPI) and Producer Price Index (PPI). It’s also the beginning of the Fed Blackout period and the Monthly USDA World Agriculture Supply and Demand (WASDE)report will also be next week!

Prominent Earnings Next Week:

FED SPEECHES:

Economic Data week:

|

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

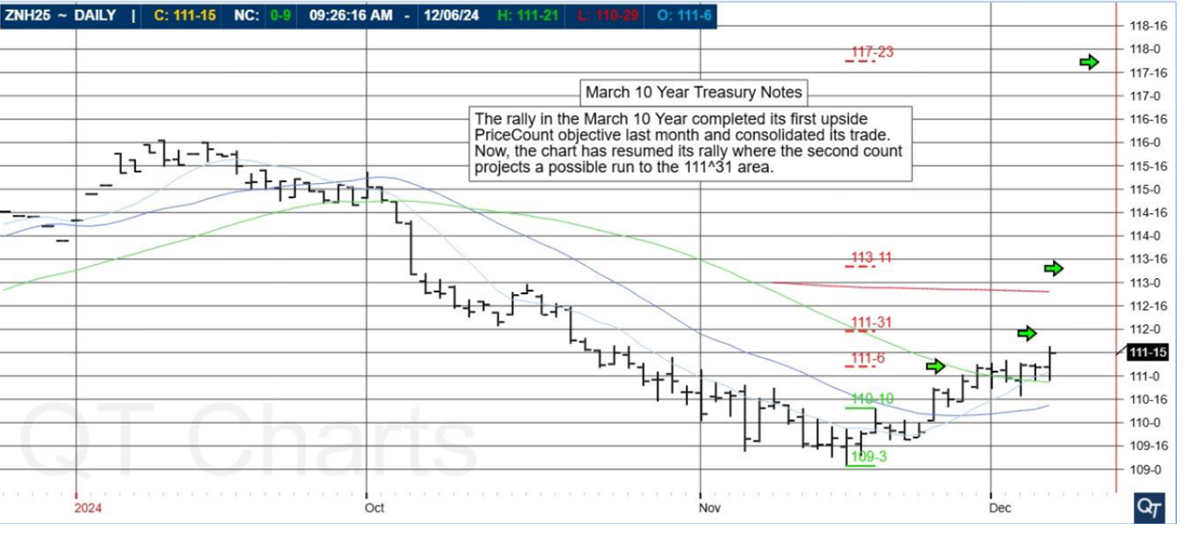

March 10 Year Treasury Notes

The rally in the March 10 Year completed its first upside PriceCount objective last month and consolidated its trade. Now, the chart has resumed its rally where the second count projects a possible run to the 111^31 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

Mid Cap SP400

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 110 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Commodity brokerage is a cornerstone of the global financial markets, connecting traders to opportunities in futures and options. Among the many players in this competitive industry, Cannon Trading Company has emerged as a trusted name, celebrated for its enduring commitment to excellence, innovation, and client success. Established in 1988, Cannon Trading’s journey reflects the evolution of the futures markets and exemplifies why it continues to stand out as a top-tier choice for traders.

Cannon Trading Company began its journey in Los Angeles in 1988, founded with the vision of empowering traders to access the dynamic world of futures and options markets. From its inception, the firm was committed to delivering exceptional customer service and personalized guidance—a philosophy that remains at the heart of its operations today. At a time when commodity brokers were largely confined to traditional office-based interactions, Cannon Trading sought to redefine the client experience by embracing accessibility and transparency.

The 1990s were a transformative decade for the financial industry, as the advent of the internet revolutionized how markets operated. Recognizing the potential of this technological leap, Cannon Trading became an early adopter of online trading. By developing and offering some of the industry’s first online trading platforms, the firm empowered futures traders to execute trades with speed and efficiency, breaking barriers that had previously limited market access.

This pioneering move positioned Cannon Trading as a forward-thinking commodity brokerage, setting it apart from competitors who were slower to adapt. For the first time, traders could manage their portfolios, analyze market data, and execute trades—all from the comfort of their homes. Cannon’s embrace of online trading not only enhanced its reputation as an innovative futures broker but also laid the groundwork for the modern futures trading landscape.

As the futures markets evolved, so did Cannon Trading. Over the decades, the firm has built a reputation as a trusted commodity broker, offering clients access to a wide range of markets, including agricultural commodities, energy products, metals, financial futures, and indices. This breadth of expertise has made Cannon Trading a one-stop solution for traders looking to diversify their portfolios and explore opportunities in multiple asset classes.

Cannon Trading’s team of professional futures brokers brings decades of combined experience to the table, helping clients navigate the complexities of futures trading. Whether a client is new to the markets or an experienced futures trader, Cannon’s brokers provide tailored advice, technical analysis, and risk management strategies to help them achieve their trading goals.

One of the hallmarks of a reliable commodity brokerage is its adherence to industry standards and regulations. Cannon Trading is a proud member of the National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). These affiliations underscore the company’s commitment to maintaining the highest levels of integrity, transparency, and compliance in its operations.

Cannon Trading has also earned a stellar reputation among its clients, reflected in its consistent 5 out of 5-star ratings on TrustPilot. This recognition speaks volumes about the firm’s dedication to client satisfaction and the quality of its services. In an industry where trust is paramount, Cannon Trading has built a legacy of reliability that few commodity brokers can match.

In today’s competitive trading environment, access to robust tools and technology is essential for success. Cannon Trading offers a suite of free trading platforms, catering to the diverse needs of its clients. Whether a trader prefers a user-friendly interface for basic order execution or advanced charting and algorithmic trading capabilities, Cannon’s platforms provide the functionality required to excel in futures trading.

Some of the popular platforms offered by Cannon Trading include:

These platforms are complemented by real-time market data, advanced charting tools, and educational resources, ensuring that Cannon’s clients have everything they need to succeed in trading futures.

Cannon Trading’s success is rooted in its unwavering commitment to its clients. Unlike many commodity brokers who prioritize transactional relationships, Cannon takes a consultative approach, focusing on building long-term partnerships. The firm’s brokers take the time to understand each client’s unique needs, trading style, and risk tolerance, tailoring their recommendations accordingly.

This personalized approach is particularly valuable for new futures traders, who often require guidance to navigate the complexities of the market. Cannon’s brokers provide educational resources, one-on-one consultations, and continuous support, empowering clients to make informed decisions and build their confidence in futures trading.

As the futures markets continue to evolve, Cannon Trading remains at the forefront of innovation. The firm has embraced advancements in algorithmic trading, artificial intelligence, and data analytics, ensuring that its clients have access to the latest tools and strategies. By staying ahead of industry trends, Cannon Trading continues to solidify its position as a leading commodity brokerage.

Cannon’s focus on education is another key factor in its success. The firm regularly publishes market analysis, trading tips, and educational content, helping its clients stay informed about market developments. This commitment to education reflects Cannon’s belief that an informed trader is a successful trader.

With over three decades of experience, Cannon Trading offers a unique combination of expertise, innovation, and client-focused service. Here are some of the key reasons why traders continue to choose Cannon as their futures broker:

Cannon Trading Company has come a long way since its humble beginnings in Los Angeles in 1988. From pioneering online trading in the 1990s to serving as a trusted futures broker in today’s fast-paced markets, Cannon Trading has consistently demonstrated its commitment to innovation, integrity, and client success. Its decades of experience, regulatory excellence, and top-tier client ratings make it an unparalleled choice for traders looking to navigate the exciting world of futures trading.

Whether you’re an experienced futures trader or just starting your journey in trading futures, Cannon Trading offers the expertise, tools, and support you need to achieve your goals. As a leading name in commodity brokerage, Cannon Trading Company stands as a shining example of what a modern commodity broker should be.

The NQ futures contract, also known as the Nasdaq-100 futures contract or the E-mini Nasdaq-100 futures contract, is a cornerstone of modern futures trading. Representing 100 of the largest non-financial companies listed on the Nasdaq stock exchange, this contract is highly favored for its liquidity, volatility, and utility in both speculative and hedging strategies. In this article, we delve into the origins, evolution, and impact of the NQ futures contract, exploring its top historical turning points, contract size evolution, hedging applications, and why Cannon Trading Company stands out as a premier choice among futures brokers.

At its inception, the Nasdaq-100 futures contract was designed with a larger notional value, making it suitable primarily for institutional investors. With the introduction of the E-mini Nasdaq-100 futures contract, the size was reduced to 20 times the index’s value, significantly increasing accessibility.

Today, traders can choose from multiple contract sizes:

This tiered structure ensures that traders of all scales—from retail investors to institutional hedgers—can find a product that aligns with their risk tolerance and trading objectives.

The NQ futures contract is not just for speculation—it’s a powerful hedging tool. For investors with significant exposure to Nasdaq-listed equities, trading the NQ futures contract or its options can mitigate potential losses during market downturns.

Example 1: Protecting a Technology-Heavy Portfolio

Imagine an investor with a $500,000 portfolio heavily concentrated in technology stocks like Apple, Microsoft, and Nvidia. If the investor anticipates a short-term decline in the tech sector, they can sell NQ futures contracts to offset potential losses. A single E-mini Nasdaq-100 futures contract moves in $20 increments for each point change in the index, offering precise risk management.

Example 2: Using Options on NQ Futures

Options on the Nasdaq-100 futures contract provide additional flexibility. For example:

Options on E-mini Nasdaq-100 futures contracts are particularly popular due to their smaller contract size and manageable margin requirements, making them an excellent tool for hedging Nasdaq exposure.

When trading Nasdaq-100 futures contracts, selecting the right futures broker is critical. Cannon Trading Company consistently earns accolades from traders for several compelling reasons:

The NQ futures contract has evolved from its origins as a tool for institutional hedging to a versatile instrument accessible to all levels of traders. From the introduction of the Nasdaq-100 index to the launch of Micro E-mini contracts, the product’s history is marked by innovation and adaptation to market needs. Today, the combination of diverse contract sizes, robust hedging applications, and user-friendly platforms makes the Nasdaq-100 futures contract a cornerstone of futures trading.

For those seeking a reliable futures broker to navigate this dynamic market, Cannon Trading Company stands out. With its free trading platform, 5-star TrustPilot ratings, experienced brokers, and commitment to regulatory excellence, Cannon Trading offers unparalleled support for traders of E-mini Nasdaq-100 futures contracts and beyond. Whether hedging a portfolio or exploring speculative opportunities, partnering with a trusted broker like Cannon Trading ensures a seamless and rewarding trading experience.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In this issue:

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

503 corporate earnings reports and a number of meaningful Economic data releases.

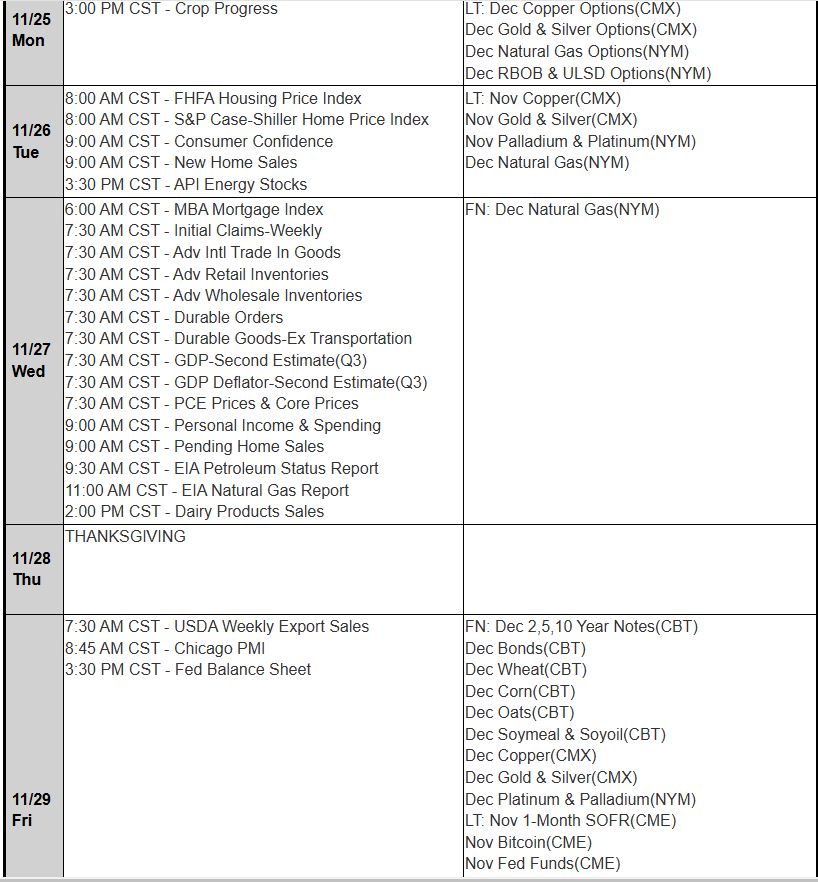

FOMC Minutes 1:00P.M. Central this upcoming Tuesday!, highlights Thanksgiving week data points. No Fed speakers.

Prominent Earnings this Week:

FED SPEECHES:

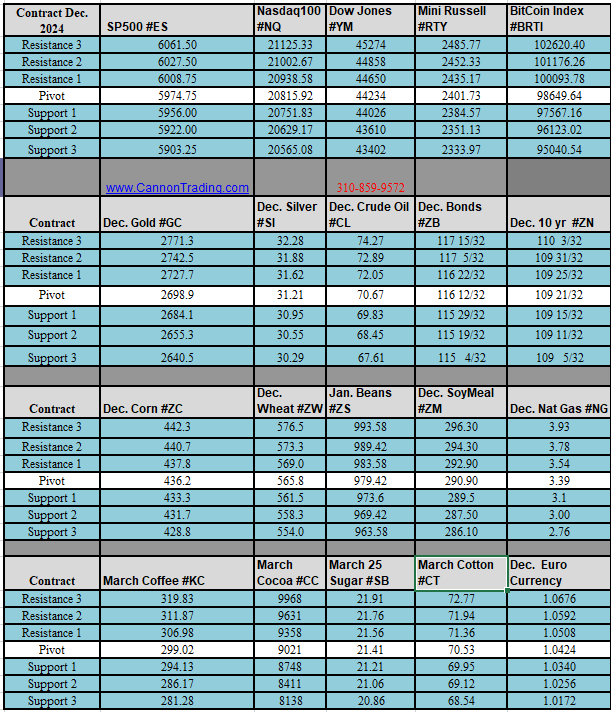

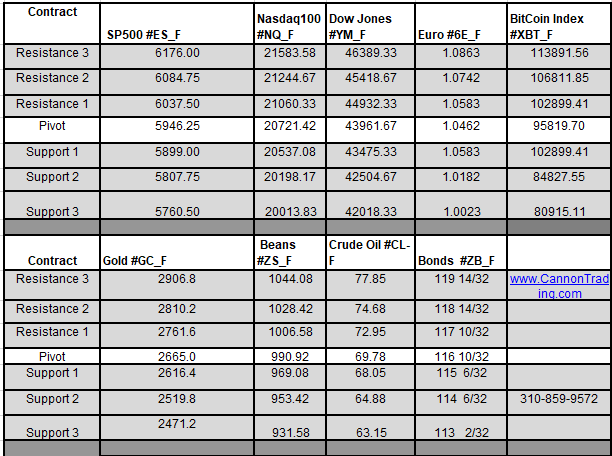

Economic Data week:

Thanksgiving 2024 Holiday Schedule for CME Exchange HoursClick here for the detailed schedule

|

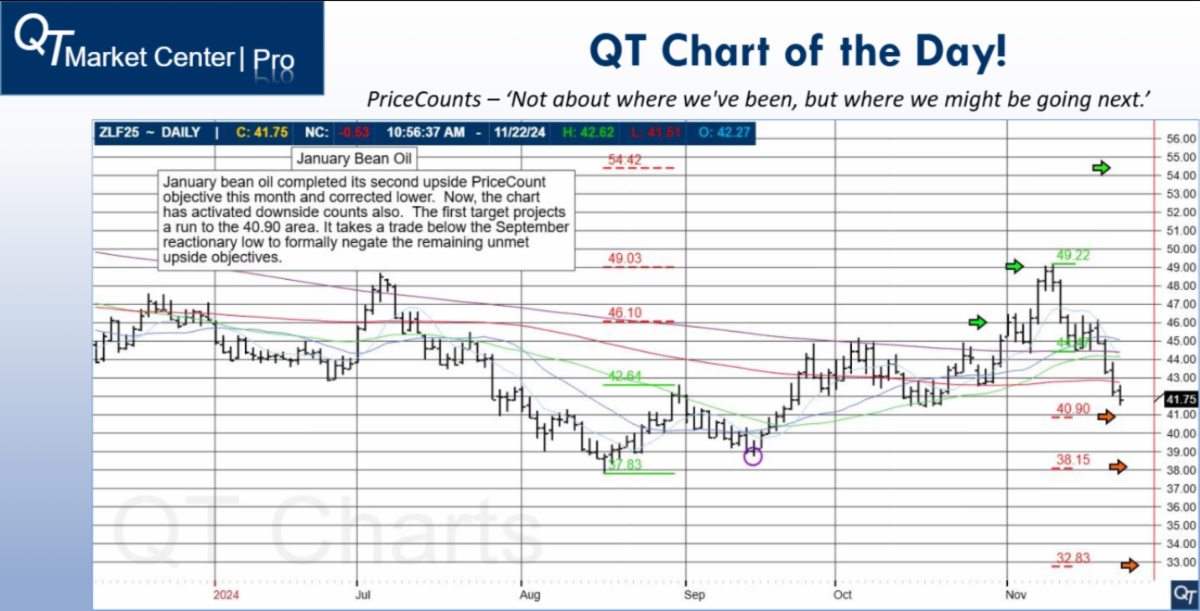

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

January Bean Oil

January bean oil completed its second upside PriceCount objective this month and corrected lower. Nw, the chart has activated downisde counts also. The first target projects a run to the 40.90 area. It takes a trade below the September reactionary low to formally negate the remaining unmet upside objectives.

PriceCounts – Not about where we’ve been , but where we might be going next!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.