Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

In today’s blog, note about change to Russell contract size, current front month and reminder to vote for us!

Dear Traders,

Hope everyone enjoyed a nice Thanksgiving holiday break and ready for a full trading week.

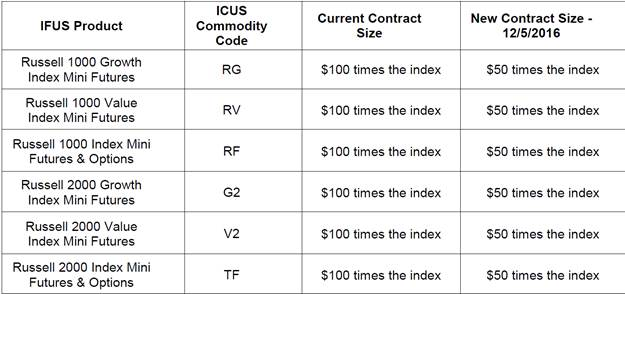

Effective on trade date Monday, December 5th, ICE Futures US will change the contract size in the following Russell products:

Bottom line for 95% of traders out there is:

Mini Russell 2000 used to be that one point was $100 or 1 tick was $10. As of next Monday, one point will be worth $50 and each tick will be $5.

- Front month for Gold is February.

- Silver front month is March.

- Front month for most grains is March.

- Crude oil and Natural gas are January.

If you enjoy our blog and the information we share, please vote for us as #1 under the “Blog Section” and provide us with the strength and energy to continue and providing you with the best tips and information on this blog!!

You can vote daily, both for the blog and for Cannon Brokerage services!!

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Levels for Trade Date of 11.29.2016

| Contract Dec. 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2218.67 | 4915.25 | 19208 | 1361.90 | 102.68 |

| Resistance 2 | 2214.08 | 4897.50 | 19167 | 1354.40 | 102.15 |

| Resistance 1 | 2207.42 | 4878.25 | 19124 | 1342.10 | 101.72 |

| Pivot | 2202.83 | 4860.50 | 19083 | 1334.60 | 101.20 |

| Support 1 | 2196.17 | 4841.25 | 19040 | 1322.30 | 100.77 |

| Support 2 | 2191.58 | 4823.50 | 18999 | 1314.80 | 100.24 |

| Support 3 | 2184.92 | 4804.25 | 18956 | 1302.50 | 99.81 |

| Contract | Feb. Gold | March Silver | Jan. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1218.0 | 17.33 | 50.50 | 154 26/32 | 1.0803 |

| Resistance 2 | 1209.0 | 17.14 | 49.07 | 154 11/32 | 1.0749 |

| Resistance 1 | 1202.4 | 16.92 | 47.99 | 154 2/32 | 1.0681 |

| Pivot | 1193.4 | 16.72 | 46.56 | 153 19/32 | 1.0627 |

| Support 1 | 1186.8 | 16.50 | 45.48 | 153 10/32 | 1.0559 |

| Support 2 | 1177.8 | 16.31 | 44.05 | 152 27/32 | 1.0505 |

| Support 3 | 1171.2 | 16.09 | 42.97 | 152 18/32 | 1.0437 |

| Contract | March Corn | March Wheat | Jan. Beans | March SoyMeal | Jan. Nat Gas |

| Resistance 3 | 355.0 | 424.1 | 1080.33 | 339.50 | 3.48 |

| Resistance 2 | 353.0 | 421.7 | 1070.17 | 334.40 | 3.41 |

| Resistance 1 | 350.8 | 419.1 | 1063.08 | 331.30 | 3.38 |

| Pivot | 348.8 | 416.7 | 1052.92 | 326.20 | 3.31 |

| Support 1 | 346.5 | 414.1 | 1045.8 | 323.1 | 3.3 |

| Support 2 | 344.5 | 411.7 | 1035.67 | 318.00 | 3.22 |

| Support 3 | 342.3 | 409.1 | 1028.58 | 314.90 | 3.18 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 3:54pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueNov 29 | 2:00am | EUR |

German Import Prices m/m

|

0.6% | 0.1% | ||||

| All Day | EUR |

German Prelim CPI m/m

|

0.1% | 0.2% | |||||

| 2:45am | EUR |

French Consumer Spending m/m

|

0.2% | -0.2% | |||||

| 3:00am | EUR |

Spanish Flash CPI y/y

|

0.5% | 0.7% | |||||

| 4:30am | GBP |

Net Lending to Individuals m/m

|

4.8B | 4.7B | |||||

| GBP |

M4 Money Supply m/m

|

0.2% | -0.4% | ||||||

| GBP |

Mortgage Approvals

|

66K | 63K | ||||||

| Tentative | EUR |

Italian 10-y Bond Auction

|

1.60|1.3 | ||||||

| 8:30am | USD |

Prelim GDP q/q

|

3.0% | 2.9% | |||||

| USD |

Prelim GDP Price Index q/q

|

1.5% | 1.5% | ||||||

| 9:00am | USD |

S&P/CS Composite-20 HPI y/y

|

5.3% | 5.1% | |||||

| 9:15am | USD |

FOMC Member Dudley Speaks

|

|||||||

| 10:00am | USD |

CB Consumer Confidence

|

101.3 | 98.6 | |||||

| 12:40pm | USD |

FOMC Member Powell Speaks

|

|||||||

| 7:01pm | GBP |

GfK Consumer Confidence

|

-4 | -3 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.