Dear Traders,

Get Real Time updates and more on our private FB group!

We had a few conversations in the office last week and the topics included:

breakout trading, counter trend trading, trend following and such.

While the answer usually reveals itself after the fact, the following information shared by

By Gabe Vasquez of Transparent Trading Solutions

is helpful in our opinion:

Three-Sigma is a statistical calculation where the data is within three standard deviations from the mean. The mean can be an average price or average daily range. The premise is, when prices moves too far, too fast, outside of this statistical anomaly, mean reversions (pullback, or reversals) may occur with a high degree of probability

The Keltner Chanel is a volatility-based technical indicator composed of three separate lines. The middle line is an exponential moving average (EMA) of the price. Additional lines are placed above and below the EMA. The upper band is typically set two times the ATR above the EMA, and the lower band is typically set two times the ATR below the EMA.

The bands expand and contract as volatility (measured by ATR) expands and contracts.

Since most price action will be encompassed within the upper and lower bands (the channel), moves outside the channel can signal trend change or an acceleration of the trend. The direction of the channel, such as up, down, or sideways, can also aid identifying the trend direction of the asset.

Keltner channels have multiple uses and how they are used will largely depend on the settings a trader uses. A longer EMA will mean more lag in the indicator, so the channels won’t respond as quickly to the price changes. A shorter EMA will mean the bands react quickly to price changes but will make it harder to identify a true trend direction.

A bigger multiplier of the ATR to create the bands will mean a larger channel. The price hit the bands less often. A smaller multiplier means the bands will be closer together and the price will reach or exceed the bands more often.

**You are about to leave the Cannon Trading website. No responsibility is assumed to any such statement or any expression of opinion herein. Readers are urged to exercise their own judgement. Good Trading!

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

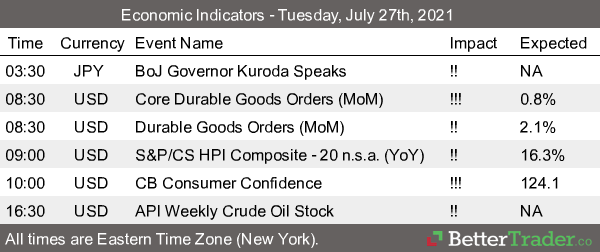

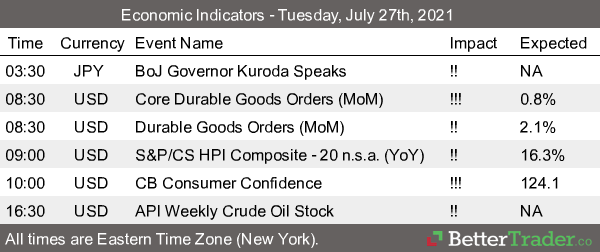

Futures Trading Levels

7-27-2021

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.