_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

WTF Just Happened??

At approximately 11:57 A.M., Pacific Time / 2:57 P.M. Eastern Time, I overheard one of my colleagues yell, “WTF just happened to the mini S&P?”

As I looked at my screen I saw the market taking a fast nose dive –an almost 8-point slide in less than 30 seconds – only to bounce right back to the price where it was originally trading.

So I decided to try and decipher the mystery.

You can see a 10-second chart below showing when the sell-off occurred. Here are my guesses:

1. A very large ALGO trade hit the market when the bid levels were relatively thin. The algo was using hourly charts and the order was entered right before the prior 1-hour bar was completed. My guess is that the trade was 10,000 lots or more. It took the market down 8 full points.

2. Someone entered a FAT FINGER TRADE and may very well have lost their job because they entered a 10,000-lot order instead of a 1,000- or even a 100-lot order.

3. The market is just trading much higher than it used to 2 or 3 years ago and the volume is not what it used to be during volatile times. Instead of seeing 500 orders at the nearby bid and offer, there were only 100 orders bid/offered on each side of the market. As a result, it took the market a few points to absorb large orders. If done by mistake or not, erratic moves like that can happen. It’s possible large investors/institutions were involved.

Click on image below to enlarge

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

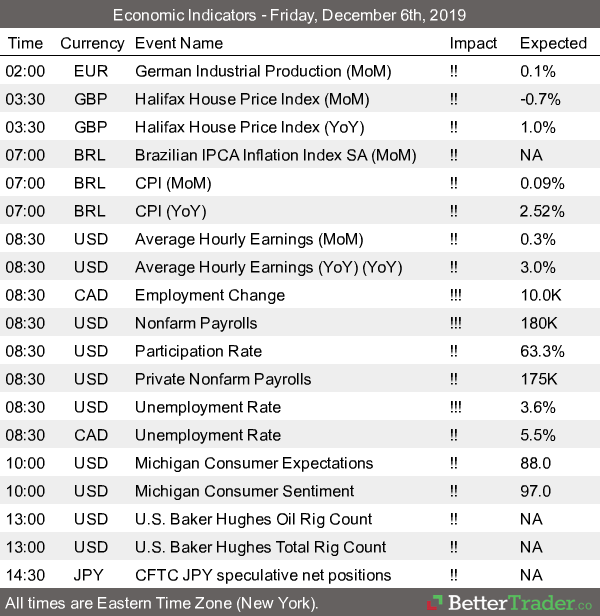

Futures Trading Levels

12-06-2019

Economic Reports, source:

bettertrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.