Cannon Futures Weekly Newsletter Issue # 1042

Dear Traders,

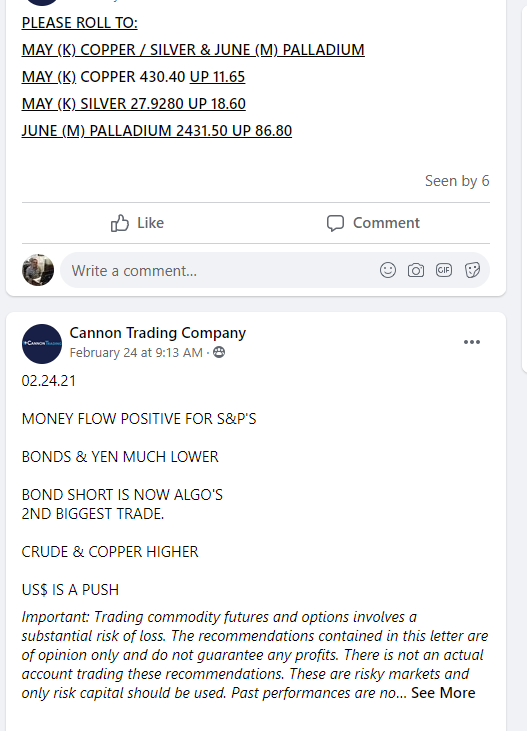

Get Real Time updates and more on our private FB group!

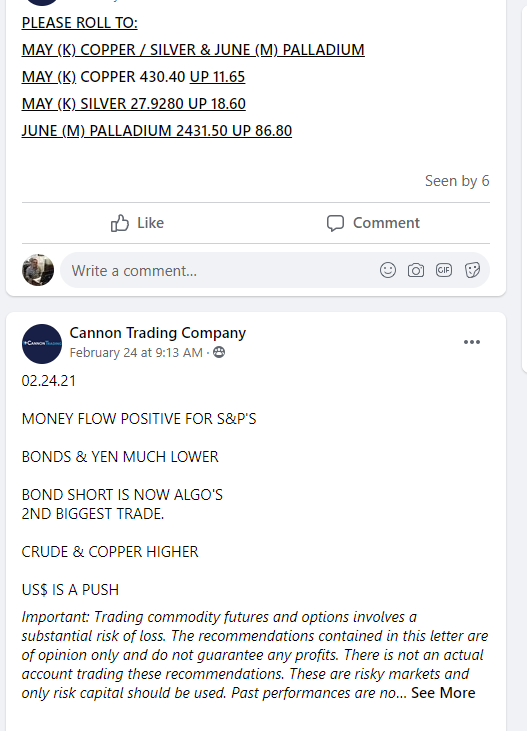

Examples of info shared intraday can be seen below in the screen shots!!

Gold Futures, Silver Futures

Trading 101: Five Fatal Flaws of Trading

Why Do Traders Lose?

From our friend Senior Analyst Jeffrey Kennedy.

Eliott WaveIf you’ve been trading for a long time, you no doubt have felt that a monstrous, invisible hand sometimes reaches into your trading account and takes out money. It doesn’t seem to matter how many books you buy, how many seminars you attend or how many hours you spend analyzing price charts, you just can’t seem to prevent that invisible hand from depleting your trading account funds.

Which brings us to the question: Why do traders lose? Or maybe we should ask, ‘How do you stop the Hand?’ Whether you are a seasoned professional or just thinking about opening your first trading account, the ability to stop the Hand is proportional to how well you understand and overcome the Five Fatal Flaws of trading. For each fatal flaw represents a finger on the invisible hand that wreaks havoc with your trading account.

Fatal Flaw No. 1 – Lack of Methodology

If you aim to be a consistently successful trader, then you must have a defined trading methodology, which is simply a clear and concise way of looking at markets. Guessing or going by gut instinct won’t work over the long run. If you don’t have a defined trading methodology, then you don’t have a way to know what constitutes a buy or sell signal. Moreover, you can’t even consistently correctly identify the trend.

How to overcome this fatal flaw? Answer: Write down your methodology. Define in writing what your analytical tools are and, more importantly, how you use them. It doesn’t matter whether you use the Wave Principle, Point and Figure charts, Stochastics, RSI or a combination of all of the above. What does matter is that you actually take the effort to define it (i.e., what constitutes a buy, a sell, your trailing stop and instructions on exiting a position). And the best hint I can give you regarding developing a defined trading methodology is this: If you can’t fit it on the back of a business card, it’s probably too complicated.

Fatal Flaw No. 2 — Lack of Discipline

When you have clearly outlined and identified your trading methodology, then you must have the discipline to follow your system. A Lack of Discipline in this regard is the second fatal flaw. If the way you view a price chart or evaluate a potential trade setup is different from how you did it a month ago, then you have either not identified your methodology or you lack the discipline to follow the methodology you have identified. The formula for success is to consistently apply a proven methodology. So the best advice I can give you to overcome a lack of discipline is to define a trading methodology that works best for you and follow it religiously.

Copper daily chart for your review below. The volatility across many markets did not skip copper for sure.

Larger Image Chart here.To have a FREE trial to the ALGOS shown in the chart, including the diamonds,

click here.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

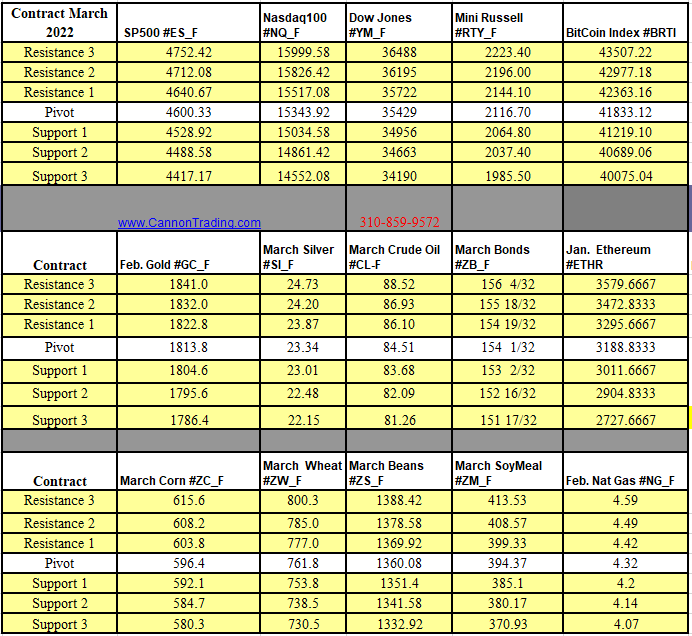

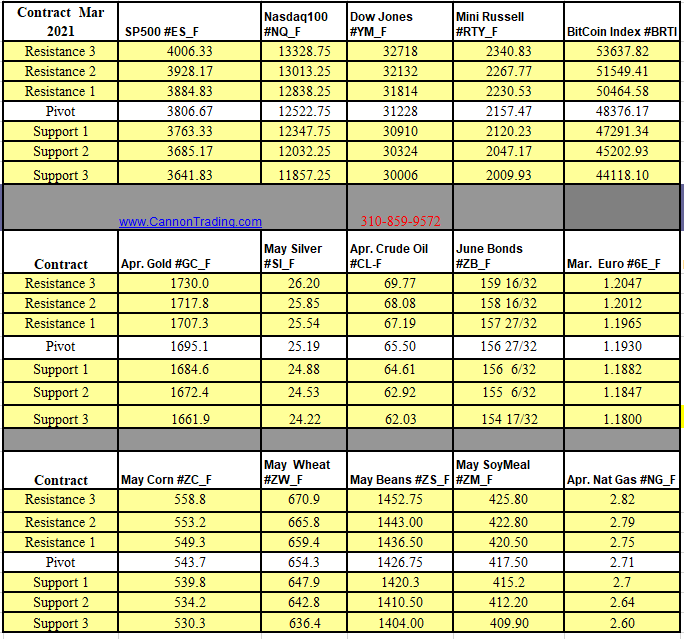

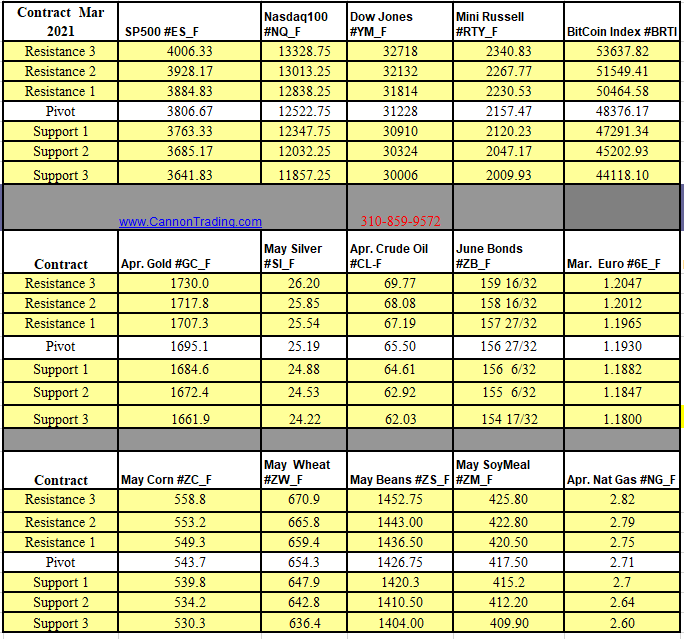

Futures Trading Levels

3-08-2021

Weekly Levels

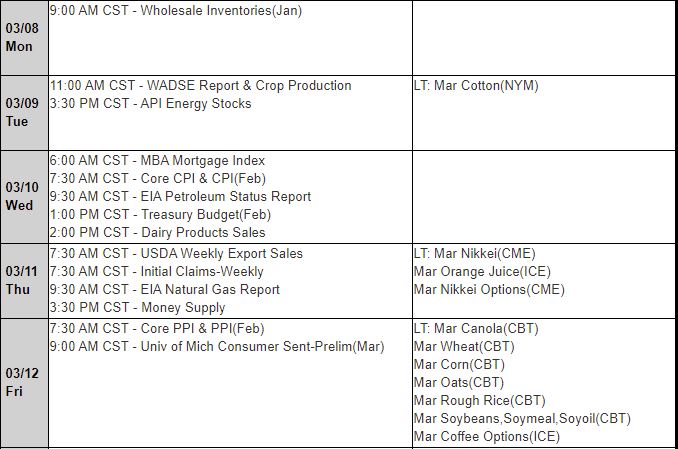

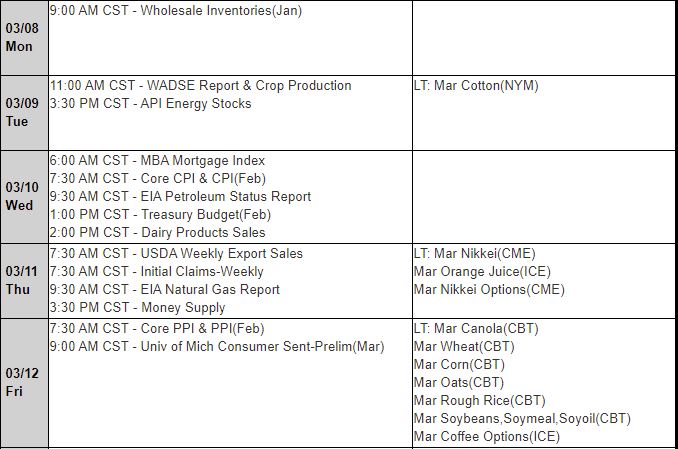

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading