Big volume and HUGE volatility over the past two weeks. DEFINITELY changed the day trading environment.

The winning philosophy in market environment like this, is to be VERY picky with entry points that will provide for good risk / reward entry. That means that sometimes you will need to be able to risk NOT getting in a trade / “miss the trade” rather than chase the trade and let the high voltality “shake you out of the market”. Another method to cope with increased volatility is to simply reduce your trading size. Wishing everyone a good, relaxing weekend and recharge for another wild week to come!

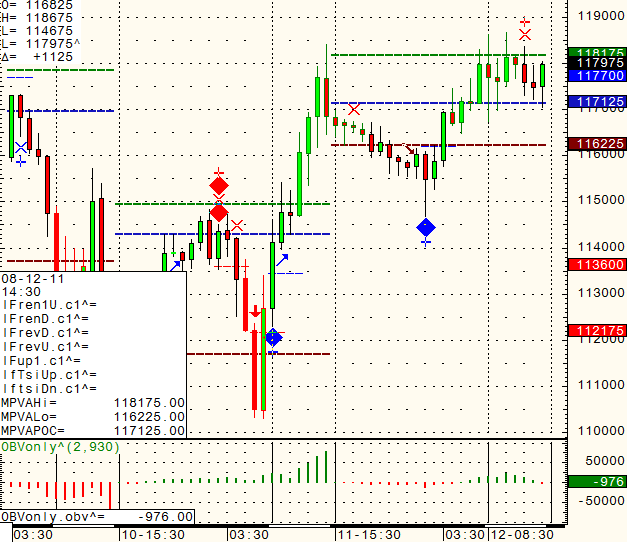

Hourly Futures chart of the mini S&P 500 from August 12th, 2011

Would you like to have access to my DIAMOND ALGO as shown above and be able to apply for any market and any time frame? The screen shot above is of the Mini S&P 500.

If so, please send me an email with the following information:

- Are you currently trading futures?

- Charting software you use?

- If you use sierra or ATcharts, please let me know the user name so I can enable you.

- Markets you currently trading?

GOOD TRADING!

TRADING LEVELS!

Economic Reports Monday August 15th, 2011

Empire State Manufacturing Index

8:30am USD

TIC Long-Term Purchases

9:00am USD

NAHB Housing Market Index

10:00am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!