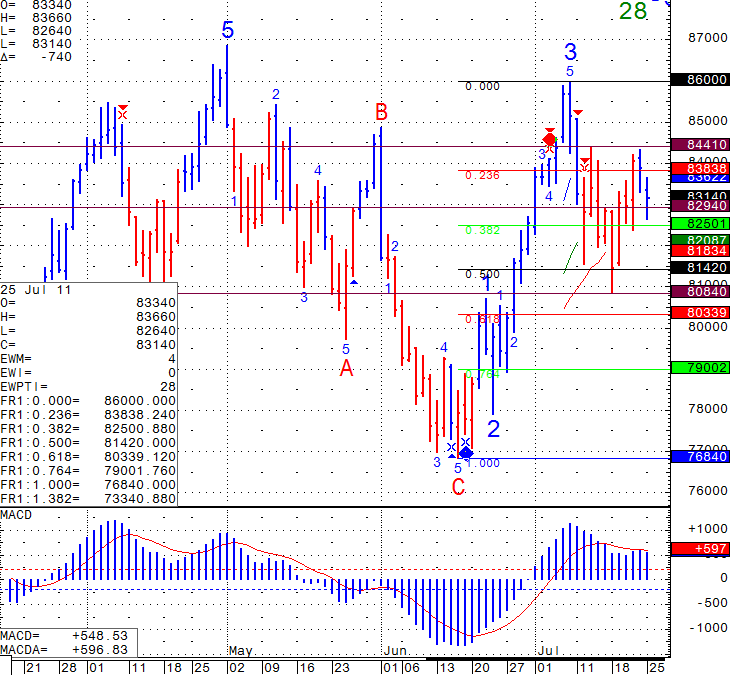

With the US Debt battle taking place, I will speculate that we can see wide trading ranges but should remain between the 808.40 ( July 18th low) to 843.90 ( July 13th high) basis the Sept. Mini Russell 2000. Definitely a wide range and possibility of volatility picking up.

Know the risk you are comfortable with each time you enter a trade.

Daily Chart of the Mini Russell from July 25th 2011

Would you like to have access to my DIAMOND ALGO as shown above and be able to apply for any market and any time frame? The screen shot above is of the Mini Dow from today.

If so, please send me an email with the following information:

- Are you currently trading futures?

- Charting software you use?

- If you use sierra or ATcharts, please let me know the user name so I can enable you.

- Markets you currently trading?

GOOD TRADING!

TRADING LEVELS!

Economic Reports Tuesday July 26th, 2011

S&P/CS Composite-20 HPI y/y

9:00am USD

CB Consumer Confidence

10:00am USD

New Home Sales

10:00am USD

Richmond Manufacturing Index

10:00am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!