Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday January 29, 2016

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Tomorrow is the last trading day for January 2016.

We also have quite a bit of economic numbers to watch for.

An example I like to share from my trading journal is regarding trading the 30 year bonds. my notes say that usually on the last trading day of the month, bonds will have some very big moves during the 15:45 to 14:00 central time which corresponds to the close of the pit session. Go back in your 10 minute charts and see what bonds do on the last trading day of the month towards the close of the pit session.

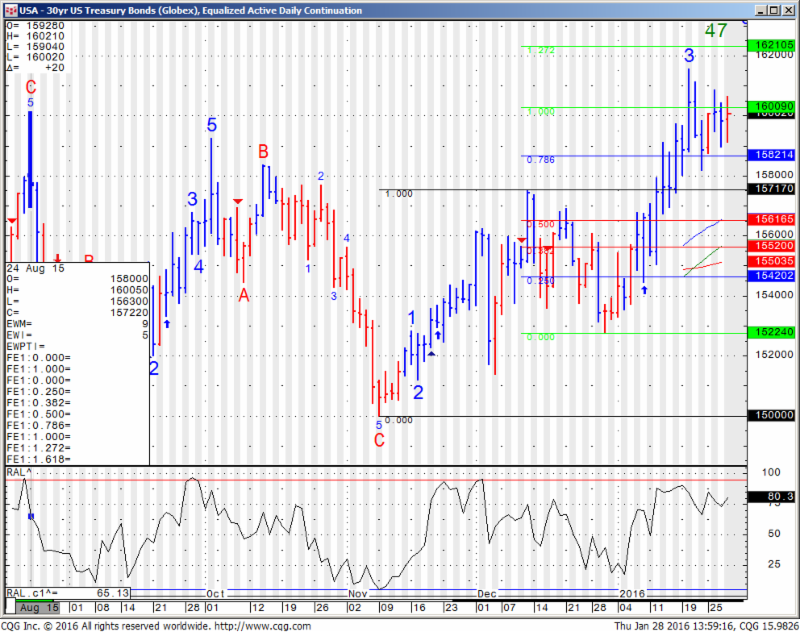

Talking about bonds…daily Heiken-Ashi chart of US Bonds for your review below:

GOOD TRADING

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract March 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 1937.17 | 4290.33 | 16386 | 1025.50 | 99.72 |

| Resistance 2 | 1919.83 | 4244.67 | 16221 | 1019.30 | 99.44 |

| Resistance 1 | 1900.42 | 4198.08 | 16099 | 1008.20 | 99.02 |

| Pivot | 1883.08 | 4152.42 | 15934 | 1002.00 | 98.74 |

| Support 1 | 1863.67 | 4105.83 | 15812 | 990.90 | 98.32 |

| Support 2 | 1846.33 | 4060.17 | 15647 | 984.70 | 98.04 |

| Support 3 | 1826.92 | 4013.58 | 15525 | 973.60 | 97.62 |

| Contract | Apr. Gold | March Silver | Mar. Crude Oil | Mar. Bonds | March Euro |

| Resistance 3 | 1140.1 | 14.97 | 38.19 | 162 13/32 | 1.1095 |

| Resistance 2 | 1133.3 | 14.76 | 36.51 | 161 17/32 | 1.1037 |

| Resistance 1 | 1123.9 | 14.50 | 35.11 | 160 28/32 | 1.0996 |

| Pivot | 1117.1 | 14.29 | 33.43 | 160 | 1.0938 |

| Support 1 | 1107.7 | 14.03 | 32.03 | 159 11/32 | 1.0897 |

| Support 2 | 1100.9 | 13.82 | 30.35 | 158 15/32 | 1.0839 |

| Support 3 | 1091.5 | 13.56 | 28.95 | 157 26/32 | 1.0798 |

| Contract | Mar. Corn | Mar. Wheat | Mar Beans | Mar. SoyMeal | March Nat Gas |

| Resistance 3 | 374.1 | 482.5 | 892.58 | 278.93 | 2.42 |

| Resistance 2 | 372.2 | 479.8 | 887.42 | 276.17 | 2.32 |

| Resistance 1 | 368.8 | 476.0 | 877.58 | 271.53 | 2.28 |

| Pivot | 366.9 | 473.3 | 872.42 | 268.77 | 2.18 |

| Support 1 | 363.6 | 469.5 | 862.6 | 264.1 | 2.1 |

| Support 2 | 361.7 | 466.8 | 857.42 | 261.37 | 2.04 |

| Support 3 | 358.3 | 463.0 | 847.58 | 256.73 | 1.99 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:16pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriJan 29 | 1:30am | EUR | French Prelim GDP q/q | 0.2% | 0.3% | ||||

| 2:00am | EUR | German Retail Sales m/m | 0.3% | 0.2% | |||||

| 2:45am | EUR | French Consumer Spending m/m | 0.6% | -1.1% | |||||

| EUR | French Prelim CPI m/m | -0.9% | 0.2% | ||||||

| 3:00am | EUR | Spanish Flash CPI y/y | 0.1% | 0.0% | |||||

| EUR | Spanish Flash GDP q/q | 0.8% | 0.8% | ||||||

| 4:00am | EUR | M3 Money Supply y/y | 5.2% | 5.1% | |||||

| EUR | Private Loans y/y | 1.5% | 1.4% | ||||||

| 5:00am | EUR | CPI Flash Estimate y/y | 0.4% | 0.2% | |||||

| EUR | Core CPI Flash Estimate y/y | 0.9% | 0.9% | ||||||

| 8:30am | USD | Advance GDP q/q | 0.8% | 2.0% | |||||

| USD | Advance GDP Price Index q/q | 1.2% | 1.3% | ||||||

| USD | Employment Cost Index q/q | 0.6% | 0.6% | ||||||

| USD | Goods Trade Balance | -60.0B | -60.5B | ||||||

| 9:45am | USD | Chicago PMI | 45.4 | 42.9 | |||||

| 10:00am | USD | Revised UoM Consumer Sentiment | 93.1 | 93.3 | |||||

| USD | Revised UoM Inflation Expectations | 2.4% |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.