Get Real Time updates and more on our private FB group!

The market’s Hypersensitivity to new data and the week in store

By John Thorpe

This is a busy week for tea leaf releases on the US economy, we won’t see CPI nor will be get the grand Unemployment numbers that come out the first Friday of every month.

Both of those numbers rank as the two most equity and Bond market impactful reports released by the US. Right behind those numbers however will be stirring their equity index drink this week,

Tomorrow, May 24th

8:45 am CT PMI Flash ( what will be the acceleration or deceleration of private sector output for May? )

9:00 CT New Home Sales ( are raising interest rates impacting new sales? If so , to what degree?)

11:20 CT Fed Chair Jerome Powell speaks at NCAIED 2022 Reservation Economic Summit..( I’ll remind everyone , no matter the venue, when the Fed Chair speaks the market is listening)

Wednesday

7:30 Durable Goods orders!

9:30 EIA petroleum numbers.. (crude can sway the indices.. how are the energy related stocks responding)

Thursday

7:30 CT GDP (this is the second estimate of the 1st quarter level of US economic activity)

And Jobless claims ! this will be a very busy start to the day…

Be aware of these release times and your positions during these times, adjust your size appropriately to heightened risk.. also look for intraday trend shifts following these impactful numbers,

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

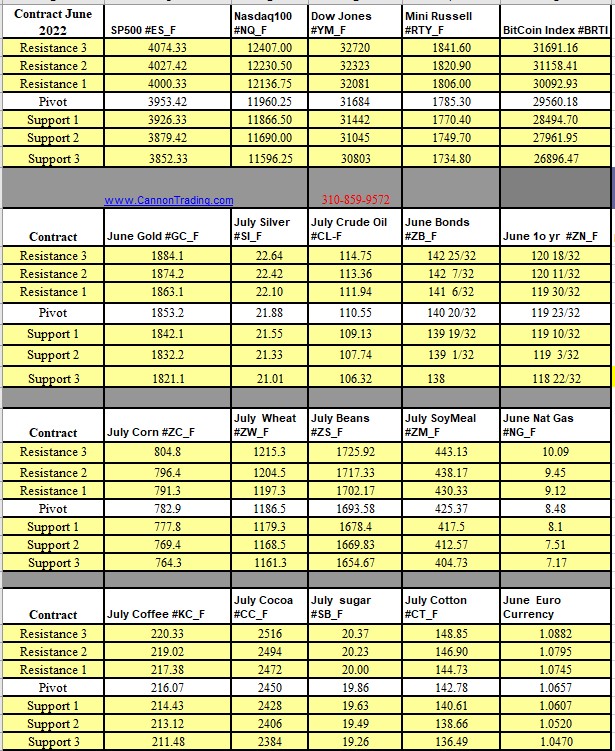

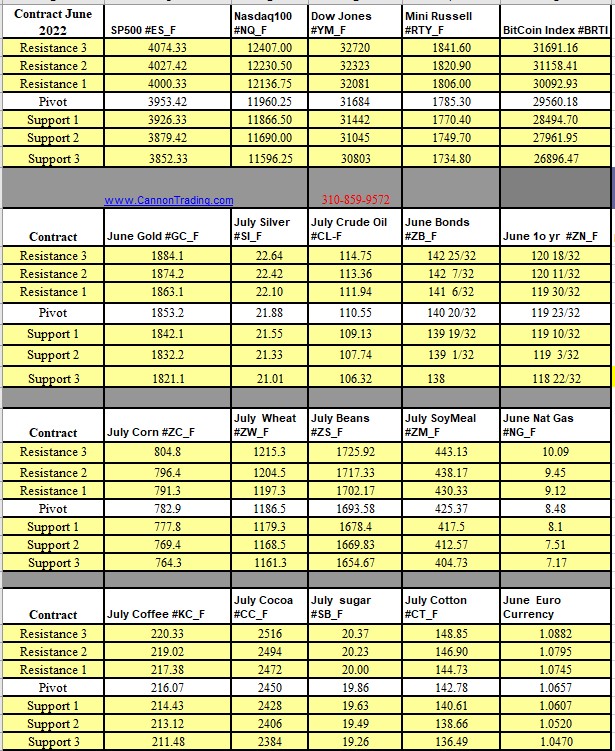

Futures Trading Levels

05-24-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.