Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

Movers and Shakers

By John Thorpe, Senior Broker

With Equities quietly trading in a consolidation phase since September 19th, Interest rates following, the precious metals ,once again surprised many traders with their mid-day selloff after last week’s Highest weekly Silver close since May of this year Silver down $1.30 or $6500.00 from yesterdays close per contract.

Gold lower by $33.00 @ 2634.00,

The US Dollar continuing to firm up after it’s end of Q3 Low, trading over 2 cents higher at 1.0227 ending it’s 2.5 month long slide after flirting with 14 month lows of 99.22. .

The Energy complex Dropping significantly today Crude off 4.25 %, the products off 3.5 to 4 % as the menace that’s called Milton is racing East toward the Florida Gulf Coast,

Atlanta Fed Pres. Bostic was quoted “ Hurricanes have significant potential implications for US economy over the next couple quarters”

So, with the Fed Funds, Interest rate markets and Equities range bound waiting for tomorrows FOMC Minutes @ 11:00 am CDT, and the looming Cat 5 potential Catastrophe, In addition to Heightened middle east tensions, Vigilance is the word and may be an opportunity to use options to enhance or protect your trading portfolio. Here is a fresh take by the EIA on short term price expectations in the winter months for the entire energy complex, freshly produced today! Take a look!. https://www.eia.gov/outlooks/steo/report/perspectives/2024/10-winterfuels/article.php

FOMC Minutes tomorrow as well as Crude Oil Inventories

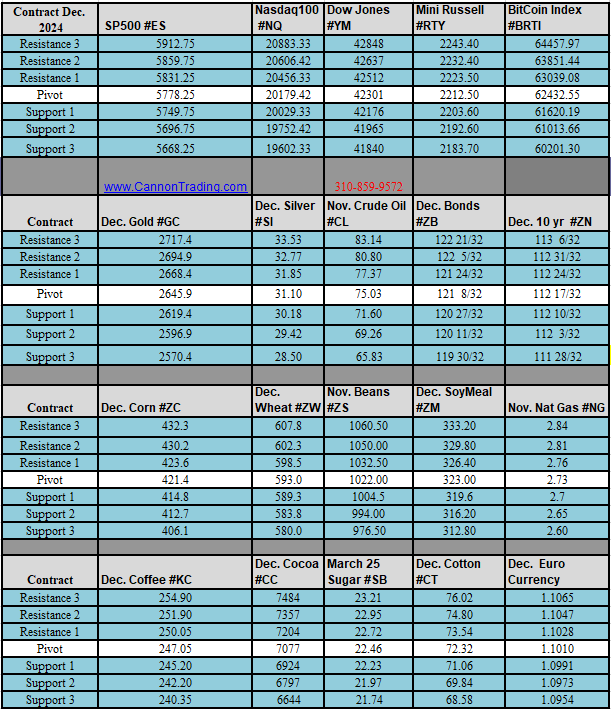

Daily Levels for October 9, 2024

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading. #Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology