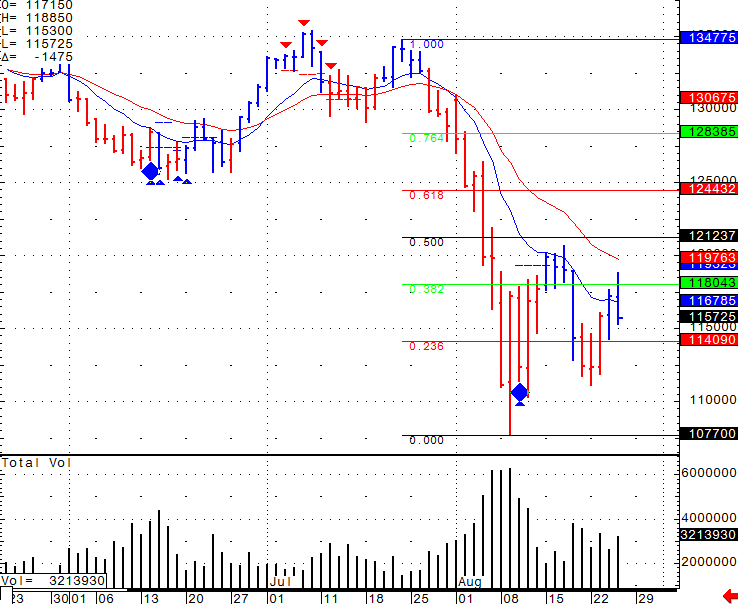

I am going to write exactly what I shared yesterday. VALID and worthy….but to add I also included a chart of the mini SP with some levels to watch for. 1197 is my resistance and 1141 is support. As mentioned below, we expect HIGH VOLATILITY!

We expect volatility to peak as we approach Friday, ahead of the weekend with Fed Chairman Bernanke speaking In Jackson Hole and Quarterly GDP numbers due early.

Plan for the unexpected. If you are a swing / position trader make sure you have enough “cushion” to sustain these volatile moves and make sure you understand your margin requirements and obligations.

On a different note, GREAT article about “Beliefs” and Trading by Dr. Janice Dorn in our weekly newsletter.

Daily Futures chart of the S&P 500 from August 25th, 2011

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

GOOD TRADING!

TRADING LEVELS!

Economic Reports Friday August 26th, 2011

Prelim GDP q/q

8:30am USD

Prelim GDP Price Index q/q

8:30am USD

Revised UoM Consumer Sentiment

9:55am USD

Revised UoM Inflation Expectations

9:55am USD

Fed Chairman Bernanke Speaks

10:00am USD

Jackson Hole Symposium

Day 2 All Day

Economic Reports Saturday August 27th, 2011

Jackson Hole Symposium

Day 3 All Day

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!