What to Expect the Last Two Trading Days of the Week

By Mark O’Brien, Senior Broker

General: albeit the eighth straight interest rate hike by the Federal Reserve since last March, today’s 25-basis point increase was the smallest move of the streak – with its target range now set to 4.5 – 4.75 percent. In its policy statement, Central Bank officials signaled that while “inflation has eased somewhat,” the fight against inflation has not come to an end and that the Fed “will stay the course until the job is done.” Translation: more hikes are on the way.

Yesterday, the International Monetary Fund raised its 2023 global growth outlook slightly, from their last projected contraction to 2.9% form 2022, to a slightly less discouraging 2.7%. They pointed to “surprisingly resilient” demand in the United States and Europe, an easing of energy costs and the reopening of China’s economy after Beijing abandoned its strict COVID-19 restrictions.

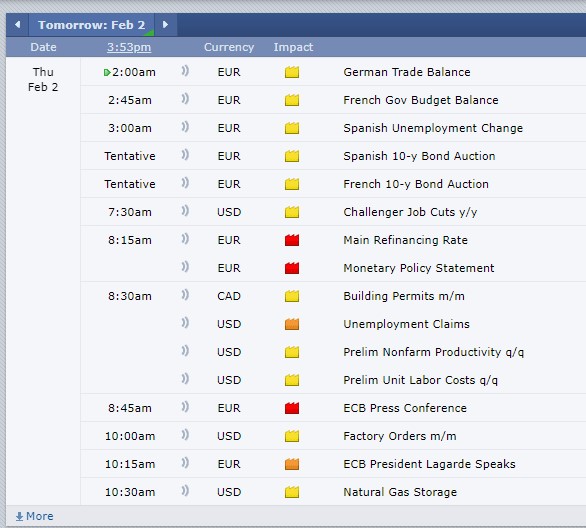

Tomorrow the European Central Bank will meet to determine their own next move in that region’s battle against inflation. They’re almost certain to notch rates up another 50 basis points up to 2.5 percent on their deposit facility, as it’s termed. And similar to the attention paid to Fed chair Jerome Powell’s words, all ears will be honed in on ECB President Christine Lagarde’s communications on the central bank’s guidance and future decisions.

All this is taking place amidst the backdrop of slight improvements in U.S. and Chinese economic expectations. One could make the case that the green shoots indicating signs of improvement for the economy mentioned in the Jan. 18 blog at the very least haven’t withered.

And speaking of not withering, while the outlook for the South American soybean crop remains a concern, traders have started removing the weather premium from prices.

This could contribute to an asset-wide decline in volatility and leave markets prone to trending – up or down.

A Cannon broker will be able to assist, provide feedback and answer any questions.

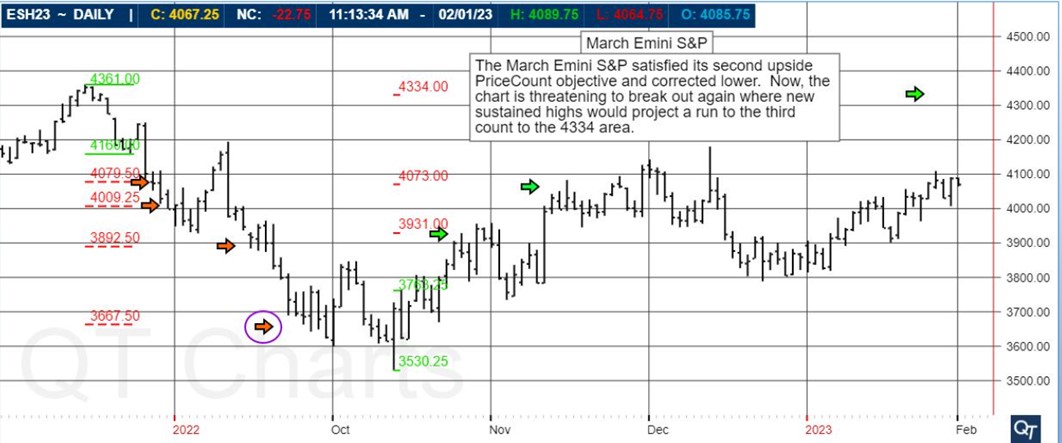

Chart below is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

PriceCounts – Not about where we’ve been , but where we might be going next!

March mini SP 500 possible PriceCounts Scenario below

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 02-02-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.