The Micro S&P 500 Futures contract (also known as standard & poor’s 500 index futures, sp500 index futures, futures sp, standard and poor’s 500 future, futures sp500), introduced by the CME Group in May 2019, represents a significant innovation in the world of derivatives trading. It was designed to provide smaller retail traders access to the S&P 500 index, one of the most critical benchmarks in global markets. This futures contract has since revolutionized how traders interact with the Standard & Poor’s 500 Index (S&P 500), broadening market accessibility and enhancing liquidity in a highly capital-intensive market.

This article will explore the rationale behind the creation of the Micro S&P 500 Futures contract, examine how it helps traders, review its history, and discuss the positive impact it has had on markets. Additionally, we will highlight Cannon Trading Company as a prime broker choice for trading these contracts.

Rationale Behind the Micro S&P 500 Futures Contract

The creation of the Micro standard & poor’s 500 index futures contract was driven by a few crucial considerations: accessibility, risk management, and increasing demand for fractional exposure to large indices. Let’s break down these factors:

1. Accessibility for Smaller Investors

The S&P 500, comprising 500 large-cap U.S. companies, is one of the most widely tracked indices globally. It represents about 80% of the total U.S. stock market by market capitalization. Traditionally, traders could gain exposure to this index through the standard & poor’s 500 index futures contract, often referred to as the E-mini S&P 500. However, this contract, with its higher margin requirements and significant exposure size, was inaccessible for many retail traders and smaller institutional players.

The E-mini S&P 500 contract, for example, represents $50 per point move in the index, creating a large notional value. Many retail traders found the contract too large for their capital and risk appetite. This barrier meant that small or medium-sized traders were unable to participate fully in the futures market tied to one of the world’s most important indices.

The Micro sp500 index futures contract, with a value of $5 per index point, offers one-tenth the size of the E-mini. By scaling down the contract, the CME Group made the S&P 500 index much more accessible to a broader range of participants, from beginner traders to those looking to hedge smaller portfolios.

2. Risk Management

Large contracts often create disproportionate risks for smaller traders who have limited capital. The introduction of the micro contract allows for more precise risk management, enabling traders to fine-tune their exposure to the market without taking on excessive financial burden. A trader can use multiple micro contracts to build the desired position size instead of being forced into the larger exposure of a single E-mini or full-sized contract.

The flexibility afforded by micro contracts means that smaller traders can still hedge their portfolios, speculate on market movements, or engage in day trading without overexposing themselves. Traders can better align their futures trading strategies with their capital and risk tolerance.

3. Fractional Exposure to Large Indices

The demand for fractional exposure across various asset classes has been growing, not just in futures markets but also in equity markets and cryptocurrencies. Micro contracts are the futures market’s response to this trend, allowing traders to gain exposure to the same price movements in a large index like the S&P 500 but on a smaller, fractional scale.

How the Micro S&P 500 Futures Contract Helps Traders

The introduction of the Micro sp500 index futures contract has provided several advantages to traders, offering flexibility and enhanced market participation. Here are a few critical ways in which the contract benefits traders:

1. Lower Margin Requirements

One of the primary benefits of the Micro futures sp contract is the lower margin requirement compared to its larger counterparts. Margin is the amount of capital required to open and maintain a futures position, and smaller contracts naturally come with lower margin requirements. For retail traders, lower margin requirements mean that they can participate in the market without needing substantial capital reserves.

For example, if the initial margin for an E-mini S&P 500 contract is around $16,060, the micro contract’s margin would be approximately one-tenth of that, around $1,606. This reduction in margin requirements opens the door for more traders to participate in the futures markets without requiring a large account balance.

2. Increased Liquidity

The introduction of the Micro futures sp Futures contract has led to increased liquidity in the S&P 500 futures markets. As more retail traders enter the market, the volume of contracts traded increases, which generally improves market efficiency and reduces the bid-ask spreads. Tighter spreads mean that traders can enter and exit positions with lower transaction costs, further benefiting those who trade frequently, such as day traders or swing traders.

3. Fine-Tuned Position Sizing

Traders often want to control the size of their positions carefully to manage risk or to hedge a specific portion of a portfolio. The larger contract size of the E-mini can be too big for traders who want to make smaller trades, or who want to hedge small amounts of equity. The micro contract allows for a more granular approach to position sizing. Traders can scale up or down based on their risk profile by simply buying more or fewer micro contracts.

4. Diversified Strategies

With the availability of micro contracts, traders can employ more diversified trading strategies. For example, instead of committing all their capital to one E-mini contract, traders can spread their capital across multiple micro contracts or even across different indices and futures markets. This diversification can help mitigate risk and increase potential returns.

History of the Micro S&P 500 Futures Contract

The S&P 500 futures market began in 1982, when the Chicago Mercantile Exchange (now the CME Group) first introduced the full-sized S&P 500 futures contract. This contract quickly gained popularity among institutional investors as a way to gain exposure to the U.S. stock market. Over the years, the S&P 500 futures market grew, but it remained primarily accessible to institutional traders because of its large contract size and capital requirements.

In 1997, CME introduced the E-mini standard and poor’s 500 future contract, which represented one-fifth the size of the full contract. The E-mini revolutionized the S&P 500 futures market by making it accessible to smaller traders while still retaining appeal for institutions. The E-mini became the most popular futures contract globally, with daily volumes exceeding one million contracts at times.

As market participation continued to evolve, the demand for even smaller contract sizes became apparent. With retail trading platforms booming and the rise of smaller traders, the Micro E-mini standard and poor’s 500 future contract was launched in May 2019. This contract was designed specifically to meet the growing demand for a more accessible product with lower margin requirements, smaller contract sizes, and greater flexibility for a wider range of market participants.

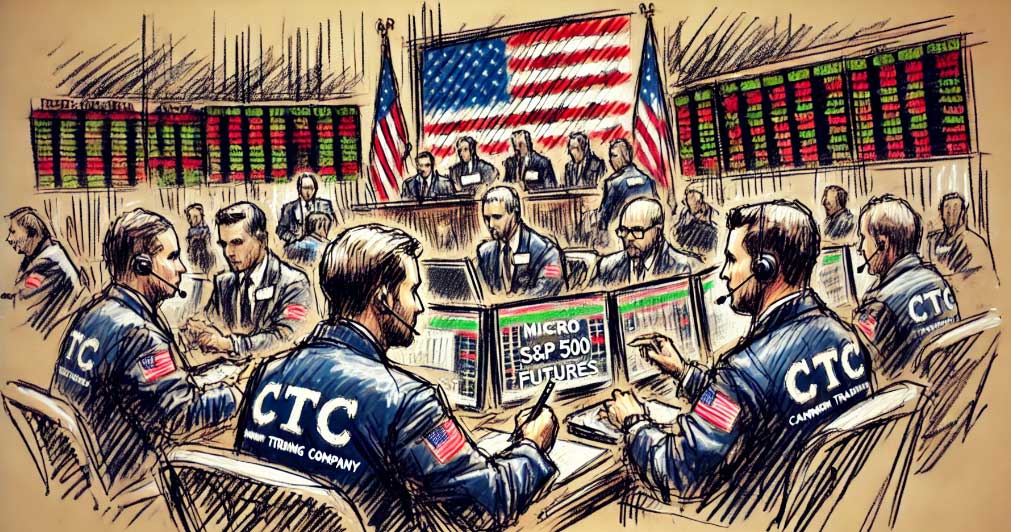

Cannon Trading Company: A Good Broker Choice for Micro S&P 500 Futures

For traders looking to participate in the Micro standard and poor’s 500 future market, Cannon Trading Company is a top-tier brokerage option. With over 35 years of experience in the futures market, Cannon Trading is known for its customer service, comprehensive platform offerings, and competitive pricing structures. Their expertise in the futures industry, including in the micro contracts market, makes them an excellent choice for both novice and seasoned traders.

Cannon Trading provides access to a range of platforms suitable for futures trading, including platforms optimized for Micro S&P 500 futures. Their commission structure is competitive, and they offer various educational resources to help traders succeed in the futures market.

Some benefits of using Cannon Trading for trading Micro S&P 500 Futures include:

- Low margins and fees: Competitive rates for micro contracts.

- Excellent customer support: Personalized service for traders of all levels.

- Education and research: Access to market insights, trading tools, and educational materials.

- Technology and platforms: Access to a variety of trading platforms tailored for futures trading, including advanced charting tools.

Positive Impact of the Micro S&P 500 Futures Contract on the Markets

The introduction of the Micro futures sp500 contract has had a profoundly positive impact on the markets, benefiting traders and the broader economy. Here’s how:

1. Increased Participation

The smaller contract size has democratized the futures market, allowing more retail investors to participate. The increased participation has led to higher liquidity in the futures market, particularly in the S&P 500 segment. Greater liquidity means that prices can be determined more efficiently, reflecting the true supply and demand in the market.

2. Enhanced Risk Management

Smaller contracts have also made it easier for retail investors to hedge their portfolios. Since the Micro futures sp500 are one-tenth the size of the E-mini, traders can take more precise hedge positions without over-committing their capital.

3. Improved Market Efficiency

With more participants and increased trading volume, market efficiency has improved. Higher liquidity generally leads to tighter bid-ask spreads, reducing trading costs for everyone involved. Moreover, the increased number of smaller trades can lead to a more accurate reflection of investor sentiment, helping to stabilize markets.

4. Opportunities for Learning and Growth

The micro contract also provides an excellent learning platform for new traders. With smaller notional value and margin requirements, traders can experiment with strategies, learn the mechanics of futures trading, and develop their skills without risking substantial amounts of capital. This opportunity for skill development benefits not only individual traders but also the broader market by cultivating a more informed and active trading community.

The Micro S&P 500 Futures contract has been a game-changer for the futures industry, opening up access to one of the most important stock market indices in the world. Its smaller contract size has made it easier for retail traders to participate, manage risk, and diversify their strategies. Brokers like Cannon Trading Company have become essential partners in facilitating this participation, offering the platforms, tools, and education needed to succeed in the micro futures market.

With the Micro futures sp500, both new and seasoned traders can enjoy the benefits of futures trading on a more accessible and manageable scale, driving greater liquidity, participation, and efficiency in the market as a whole.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading