Get Real Time updates and more on our private FB group!

New Contract to Hedge Mortgage Price Risk

by John Thorpe, Senior Broker

The

10 year note has been a benchmark of the mortgage industry and the CBOT division of the CME has had a 10 yr note futures contract for nearly 35 years it is based on a 6% coupon and a $100,000.00 face value. the symbol is

ZNU22. the initial margin is 1980.00 per 100,000.. Now you can trade the micro version and this one is yield based rather than Price based so for some, it will be easier to recognize against the current media stream of interest rate quotes on a percentage yield basis. If you have an opinion on the direction of interest rates, this is a low margin cost solution and the symbol is 10YN2 for the July contract that is cash(financially) settled! today’s last price is 2.965 or the rate of the 10 year note you would expect to see rather than 118.16 that represents the full sized contract.

The initial requirement is currently $264.00 it makes sense to have a few contracts running in the background of your portfolio to hedge interest rate price risk. the exchange lists the first 2 months rather than a quarterly cycle for you to trade.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

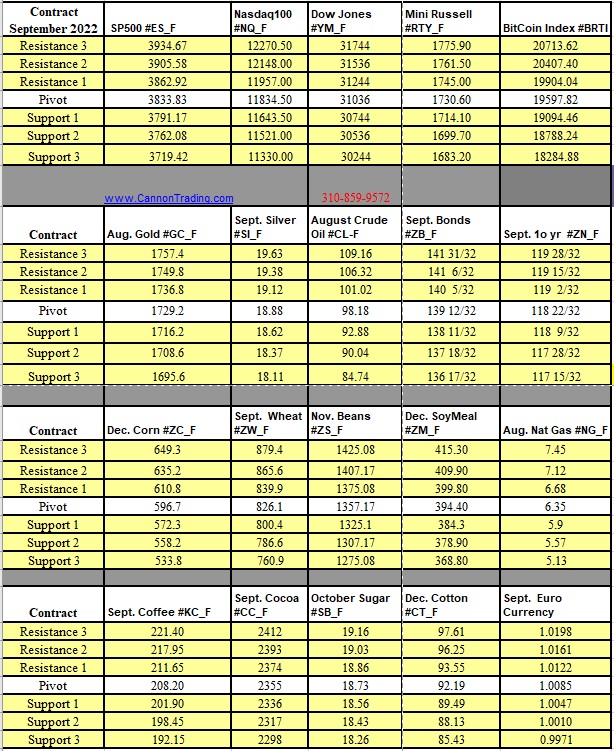

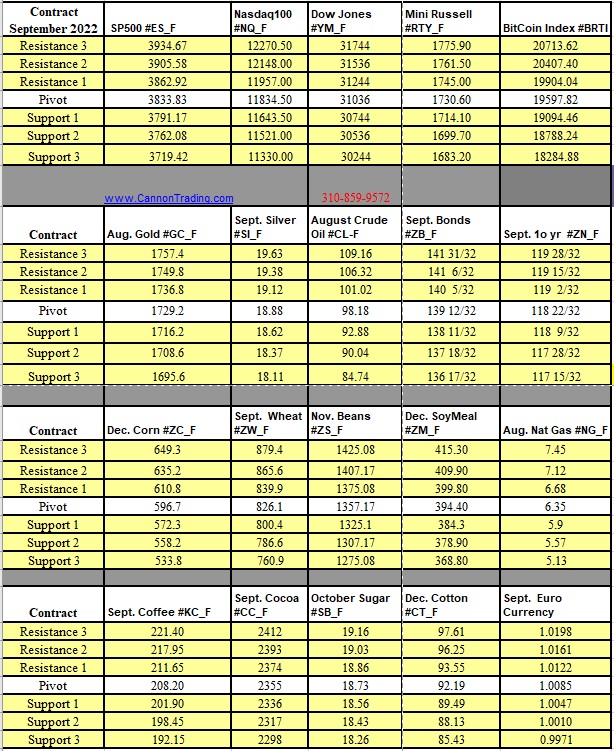

Futures Trading Levels

07-13-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.