The dynamic world of financial markets offers countless opportunities for traders and investors, with futures trading being one of the most potent yet complex avenues. At the heart of this domain lies a pivotal figure: the futures broker. Acting as the conduit between traders and exchanges, futures brokers not only facilitate transactions but also influence the success, transparency, and efficiency of a trader’s experience. In such a high-stakes environment, choosing the right futures broker is not just a matter of preference—it’s a strategic necessity.

This paper explores the core values that distinguish reputable futures brokers from those that are less favorable. We’ll delve into the ethical, operational, and regulatory standards that the best futures brokers uphold and contrast them with the behaviors and traits exhibited by questionable ones. We will also illustrate how Cannon Trading, a prominent name in futures trading, consistently exemplifies these positive traits, cementing its place among the best futures brokers in the industry.

What Are Futures Brokers?

A futures broker is a licensed professional or firm that executes orders to buy or sell futures contracts on behalf of clients. These contracts obligate the buyer to purchase—or the seller to sell—an asset at a predetermined future date and price. Trading futures allows investors to hedge risk or speculate on the direction of market prices for commodities, indices, currencies, and other instruments.

The futures broker plays several roles, including:

- Facilitating market access to exchanges

- Providing analytical tools and platforms

- Offering customer service and education

- Ensuring regulatory compliance

Because of the intricate nature of futures trading, brokers are often more than intermediaries—they are advisors, risk managers, and strategic partners.

Core Values of Reputable Futures Brokers

Reputable futures brokers are easy to identify by a distinct set of core values that underscore their operations and client relationships. These values ensure that the client’s interests are protected and the broker’s services are delivered with integrity and professionalism.

-

- Transparency

The best futures brokers maintain transparency in all aspects of their operations, including pricing, execution, and risk disclosures. Transparent brokers clearly outline:- Commission and fee structures

- Margin requirements

- Order execution procedures

- Conflicts of interest, if any

- Transparency

This clarity helps traders make informed decisions and minimizes the chances of unexpected costs.

-

- Integrity and Ethics

Ethical conduct is foundational to a reputable futures broker. This means:

-

-

- Honesty in client communications

- Ethical marketing and promotional practices

- Responsible advice and education

- Avoidance of excessive trading or “churning” accounts for commissions

-

The best futures brokers operate with integrity because they understand that long-term relationships are more valuable than short-term profits.

-

- Regulatory Compliance

All respected futures brokers are registered with and regulated by relevant authorities like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Adherence to these regulatory frameworks:- Protects client funds through segregation

- Reduces the likelihood of fraud or malfeasance

- Ensures proper dispute resolution mechanisms

- Regulatory Compliance

A broker’s good standing with regulatory bodies is a strong signal of their credibility.

-

- Technological Competence

A solid futures trading experience depends heavily on the broker’s technology. This includes:

-

-

- Robust trading platforms

- Real-time data feeds

- Fast execution speeds

- Customizable analytics tools

-

Futures brokers with top-tier platforms empower their clients with efficiency and better trade management.

-

- Customer Support and Education

Clients need to feel supported, especially in a volatile environment like trading futures. The best futures brokers offer:- 24/7 customer service

- Personal account representatives

- Webinars, courses, and market reports

- Customer Support and Education

They understand that educated clients are more successful and more loyal.

Core Values of Unfavorable Futures Brokers

On the flip side, less trustworthy or outright unfavorable futures brokers exhibit warning signs that can jeopardize a trader’s capital and confidence.

- Lack of Transparency

Opaque pricing, hidden fees, and unclear margin requirements are common tactics used by shady brokers. Traders are left confused and misled about the true cost of trading futures.

-

- Poor Regulatory Standing

An unfavorable futures broker may not be properly registered or may have a history of regulatory violations. This includes:

-

-

- Operating without a license

- Failing to segregate client funds

- Receiving fines for misconduct

-

Such behavior is a red flag and often precedes more severe issues.

-

- High-Pressure Sales Tactics

Unscrupulous brokers often use aggressive marketing and push clients to take on excessive risk. These brokers may:

-

-

- Exaggerate potential profits

- Downplay risks

- Encourage over-leveraged trading

-

This goes against the fiduciary duty of putting client interests first.

- Poor Technology and Infrastructure

Subpar futures trading platforms can lead to missed opportunities, execution errors, or downtime during volatile periods. A broker’s tech stack is a strong indicator of their professionalism and investment in client success.

- Inadequate Customer Support

If a client can’t get help when needed, especially during high-stress trading scenarios, their confidence—and capital—can quickly erode. Unfavorable brokers often lack dedicated support teams or offer only generic help.

How Cannon Trading Embodies the Positive Core Values

Cannon Trading Company stands out in a crowded field of futures brokers, not merely by what it does but by how it does it. With over three decades of experience in the futures trading industry, the firm is deeply committed to client success and industry integrity.

- A Stellar Reputation with Regulators

Cannon Trading is registered with the Commodity Futures Trading Commission (CFTC) and is a long-standing member of the National Futures Association (NFA). This means: - Strict adherence to financial and ethical standards

- Secure handling of client funds

- Availability of fair dispute resolution mechanisms

Their clean record with regulatory agencies reinforces their trustworthiness and reliability.

- Decades of Industry Experience

Having been in the futures trading space since the late 1980s, Cannon Trading’s longevity is a testament to its resilience, adaptability, and commitment to serving traders. Their brokers bring institutional knowledge that helps both novice and seasoned traders navigate the complexities of trading futures.

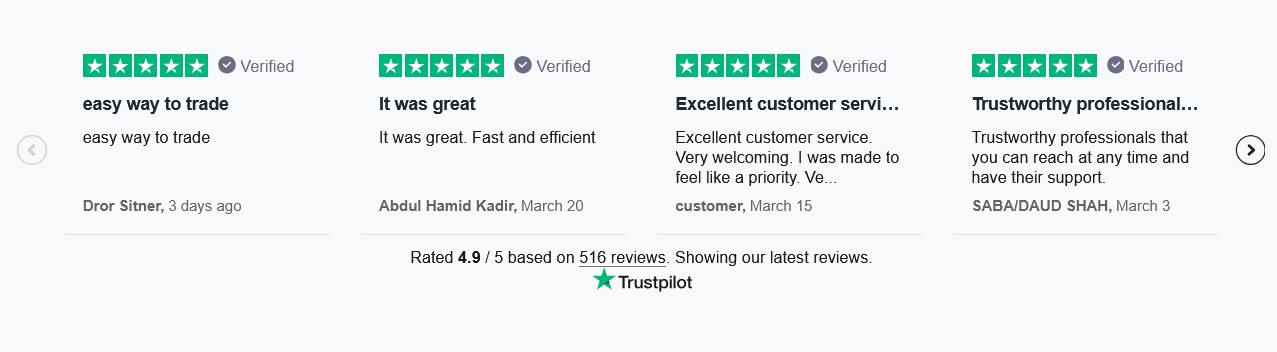

- Outstanding Client Reviews

With numerous 5 out of 5-star reviews on TrustPilot, Cannon Trading enjoys one of the best reputations among futures brokers. These reviews highlight: - Prompt and knowledgeable customer service

- Transparent and fair pricing

- Powerful platform options

- A hands-on approach to client success

The consistent praise from clients reflects the firm’s client-centric culture.

- Wide Selection of Trading Platforms

Cannon Trading offers an extensive suite of futures trading platforms to meet diverse client needs, including: - NinjaTrader

- CQG

- MetaTrader

- TradingView

- MultiCharts

By providing multiple platform options, the firm ensures that traders can operate in the environment that best suits their strategy and workflow.

- A Focus on Education and Empowerment

Cannon Trading provides free daily market commentaries, webinars, and one-on-one coaching sessions. Their educational resources are designed to: - Enhance market understanding

- Sharpen trading strategies

- Mitigate risk through informed decision-making

This strong emphasis on education sets them apart from other futures brokers who may prioritize transactions over transformation.

- Unwavering Ethical Standards

The team at Cannon Trading operates with a client-first mentality. Their brokers avoid high-pressure tactics and instead engage in honest, informative discussions. This ethical foundation is why so many clients stay with them for the long haul and why they are often referred to as the best futures broker by satisfied traders.

The Importance of Choosing the Right Futures Broker

Selecting a futures broker is not a decision to be made lightly. The broker’s values, technology, customer service, and regulatory adherence directly impact a trader’s ability to succeed. A good future broker becomes a partner in the trader’s journey, providing not just access to markets but also strategic insight and emotional support during market volatility.

Cannon Trading has demonstrated, time and again, that it is among the elite in the field. By consistently embodying the core values of reputable futures brokers, they offer a sanctuary of integrity in an industry often clouded by complexity.

The role of the futures broker is foundational to successful futures trading. From technological sophistication to regulatory compliance and customer service, the differences between reputable and unfavorable brokers are stark. Reputable futures brokers are transparent, ethical, regulated, and client-focused, while less favorable ones cut corners, obscure costs, and prioritize profits over people.

Cannon Trading shines as a model of excellence in this space. With decades of experience, an array of powerful futures trading platforms, high client satisfaction, and impeccable regulatory standing, it exemplifies the values every trader should look for in the best futures broker.

Whether you’re new to trading futures or an experienced investor seeking a reliable partner, Cannon Trading represents not just a service provider but a strategic ally in your trading journey.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading