Micro XRP Futures

The world of digital assets continues to evolve, and among the key innovations driving trader interest in 2025 is the emergence and growing popularity of micro XRP futures. As a smaller contract size of the more traditional XRP futures, micro XRP futures allow traders to access this fast-moving asset class with lower capital requirements, increased flexibility, and hedging precision. In the last two trimesters of 2025—covering the months of May through December—market watchers are keen to anticipate price trajectories, macroeconomic impacts, and the infrastructure supporting this segment.

In this in-depth article, we’ll explore what traders can expect from micro XRP futures in the remainder of 2025, delve into micro XRP futures price dynamics, and illustrate why Cannon Trading Company stands as one of the best futures brokers in the U.S. for those involved in trading futures—particularly digital asset derivatives.

Try a FREE Demo!

Understanding Micro XRP Futures: A Strategic Gateway to Digital Asset Derivatives

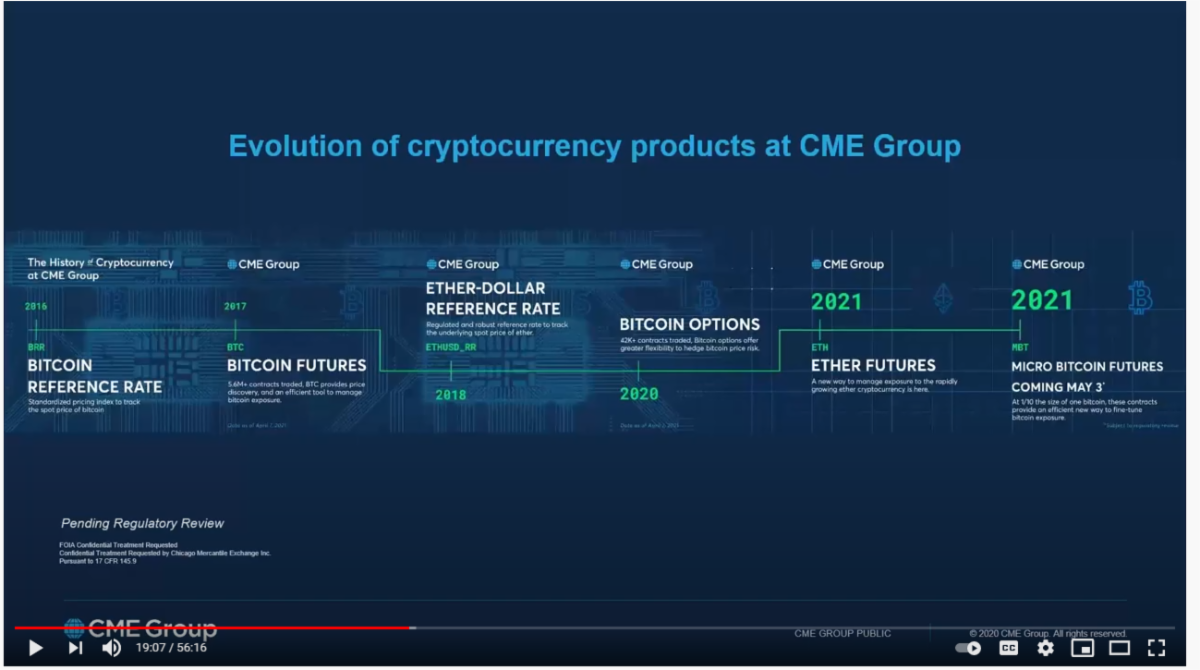

Before diving into forecast-based analysis, it’s essential to understand what micro XRP futures are and why they matter. Micro futures contracts are smaller versions of standard futures—often just 1/10th the size—which allow traders to manage exposure in a more controlled manner. In the case of micro XRP futures, these contracts allow speculators and hedgers to track XRP’s price movement without having to commit to the larger notional value of traditional XRP futures.

These contracts are particularly attractive for retail traders and institutions looking to fine-tune their strategies. With increased volatility in the digital asset space and growing adoption of XRP in international remittances and banking systems, micro XRP futures present an effective, capital-efficient trading tool.

The Second Two Trimesters of 2025: What Traders Can Expect

The remaining two trimesters of 2025—Q3 (July through September) and Q4 (October through December)—will be critical periods for XRP and by extension, micro XRP futures. Several macroeconomic, regulatory, and technical factors are likely to play significant roles.

- Ripple’s Expanding Use Case and Institutional Interest

Ripple Labs, the company behind XRP, continues to expand its partnerships with financial institutions across Europe, the Middle East, and Asia. By mid-2025, announcements regarding adoption of XRP for cross-border settlements and treasury management are expected to intensify. These developments will likely stimulate upward pressure on the micro XRP futures price, especially as institutional participation grows.

Institutional investors typically use futures contracts to hedge risk or gain leveraged exposure, and the availability of micro contracts allows even smaller institutions or sophisticated retail traders to follow suit. Expect volume in micro XRP futures to increase in parallel with the announcement of such partnerships.

- U.S. Regulatory Landscape and Clarity on XRP Classification

One of the main points of contention in the crypto space has been regulatory clarity. XRP has been at the center of legal and regulatory scrutiny for several years, particularly involving the U.S. Securities and Exchange Commission (SEC). However, as we move through 2025, there are expectations of finalized legislation around digital asset classification in the United States.

If XRP receives a formal designation as a commodity or a digital payment token, this could create positive momentum in the market. That kind of certainty would bolster trader confidence, increase institutional involvement, and potentially drive micro XRP futures prices higher in the last half of the year.

- Technical Analysis and XRP Price Trends

XRP entered 2025 with a moderate upward trend, building upon a strong Q4 in 2024. After a brief consolidation in Q2 2025, technical analysts expect a breakout pattern in Q3 based on symmetrical triangle formations and increasing trade volume.

As XRP’s spot price aims for the $1.50–$1.75 resistance zones by late Q3, micro XRP futures are likely to show significant price responsiveness. Traders involved in trading futures will need to watch closely for short-term volatility spikes, likely driven by speculative volume and news cycles. Precise entry and exit points will become crucial, and utilizing the flexibility of micro contracts will allow for tighter risk controls.

- Macro Influences: Fed Policy, Inflation, and Risk Appetite

The U.S. Federal Reserve’s interest rate policies and inflation data remain pivotal to all financial instruments, including crypto-based futures. If the Fed leans toward dovish policies in Q3 and Q4 2025, risk-on assets like XRP could experience tailwinds. That would reflect positively on micro XRP futures price movement as well.

Moreover, growing risk appetite due to a softer dollar and improving economic indicators may lead to broader participation in the futures trading space, including alternative digital assets like XRP. Micro contracts will serve as the gateway product for this fresh influx of interest.

Why Cannon Trading Company Is the Broker of Choice for Micro XRP Futures

Selecting a trustworthy, experienced futures broker is a critical decision when entering volatile, innovative markets like digital asset derivatives. In this respect, Cannon Trading Company stands out as a beacon of excellence.

- Decades of Experience in Futures Trading

Founded in 1988, Cannon Trading Company brings over three decades of experience to the table. Unlike newer entrants in the digital asset brokerage space, Cannon has weathered numerous market cycles and built its reputation on integrity, expertise, and client service.

Their long-standing presence gives them unique insight into the evolution of futures trading, including newer asset classes like crypto futures. Whether you’re trading commodities, interest rates, indices, or micro XRP futures, Cannon Trading Company ensures robust support, compliance, and execution quality.

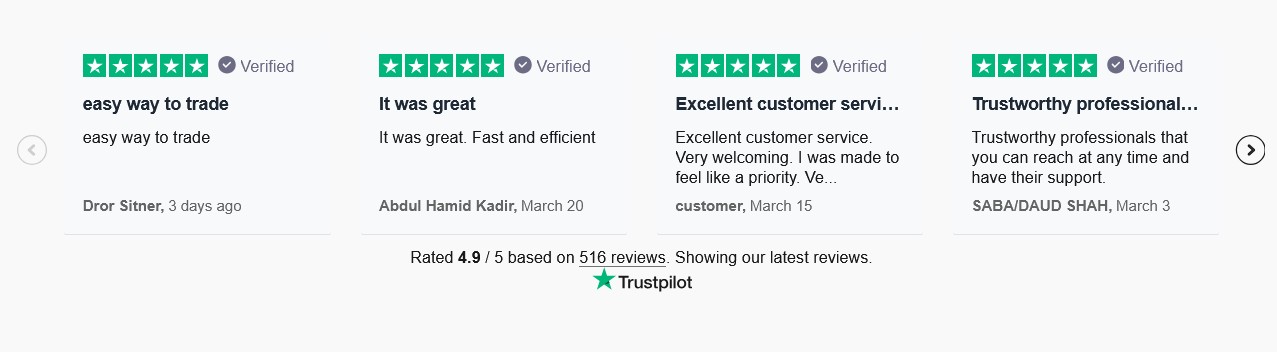

- Top Ratings on TrustPilot and Industry Reputation

With many 5 out of 5-star ratings on TrustPilot, Cannon Trading Company is repeatedly recognized by clients as one of the best futures brokers in the United States. These reviews frequently cite the firm’s customer service, fast response times, and educational resources—all of which are indispensable for those trading complex instruments like micro XRP futures.

Moreover, Cannon has earned an exemplary reputation with both federal regulators (such as the CFTC) and independent oversight bodies like the National Futures Association (NFA). This clean compliance record provides peace of mind for traders who prioritize transparency and security.

- Access to Industry-Leading Futures Trading Platforms

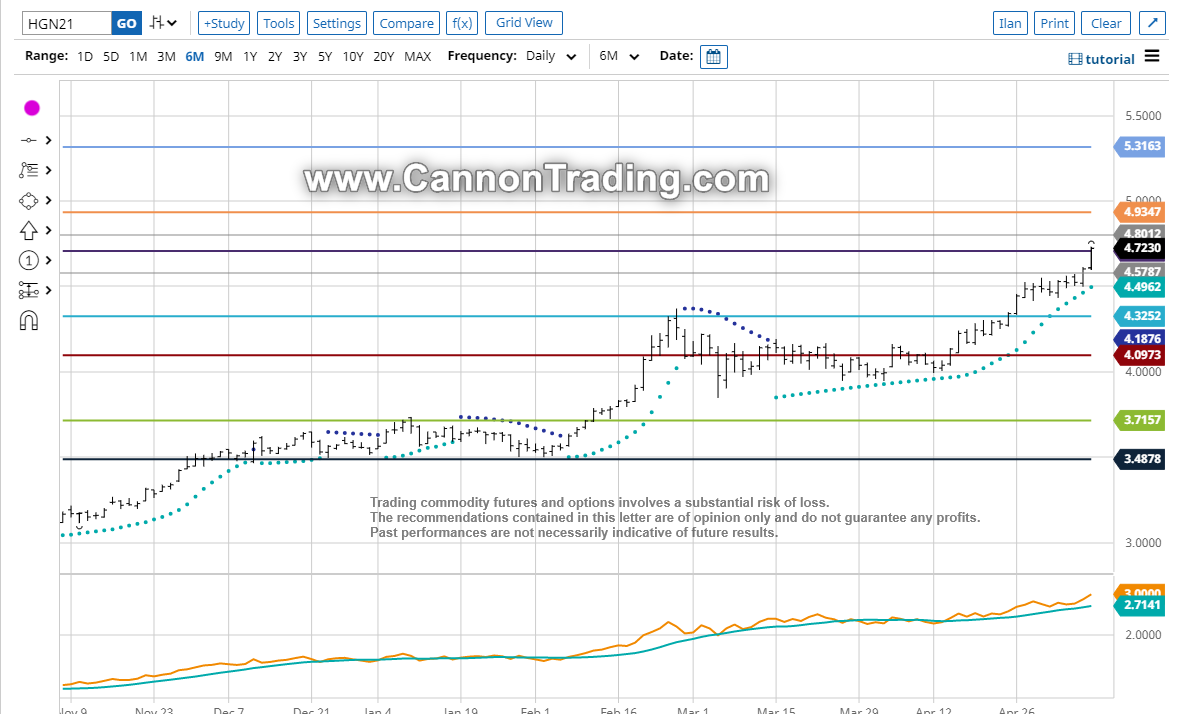

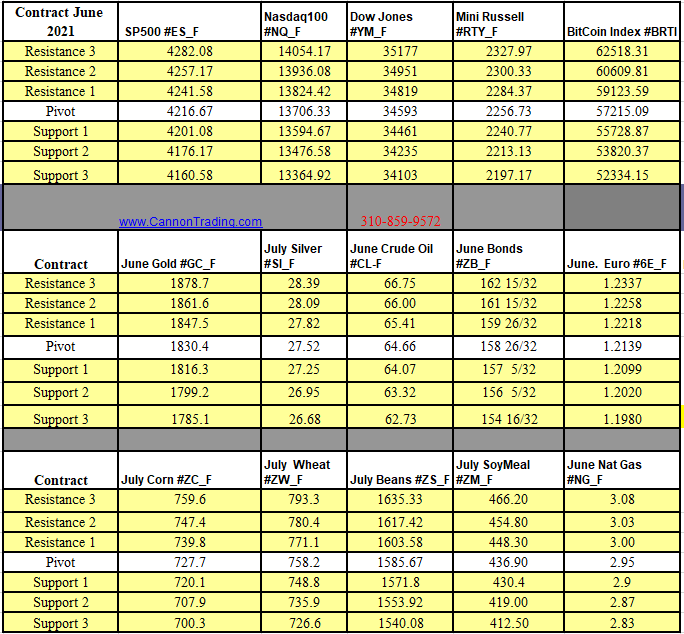

One of Cannon’s strongest assets is its diverse selection of top-performing futures trading platforms, all tailored to various trading styles and asset focuses. For digital assets and micro XRP futures, the firm offers access to the CannonX platform, which is CannonX powered by CQG—a sophisticated trading solution designed for speed, precision, and real-time analytics.

CannonX delivers professional-grade tools including advanced charting, automated trading, and powerful risk management—all of which are essential for navigating micro XRP futures prices. With CQG’s ultra-low latency routing and Cannon’s dedicated client support team, traders can execute with confidence.

Try a FREE Demo!

The Micro Advantage: How Futures Brokers USA Are Shaping the Market

Micro contracts are democratizing access to futures markets across the U.S., especially with digital assets like XRP. While traditional contracts were once the domain of institutional players, micro futures provide the necessary granularity and flexibility that today’s trader demands.

Cannon Trading Company Leads Among Futures Brokers USA

Among all the futures brokers USA has to offer, Cannon Trading Company is especially notable for its hybrid approach: high-tech trading environments paired with personalized, human-led service. Traders can call in, chat online, or work one-on-one with an advisor to discuss their strategies for trading futures, including those in the digital asset space.

As one of the best futures brokers operating in the U.S., Cannon’s ability to tailor solutions based on client needs stands as a unique advantage. They aren’t a one-size-fits-all brokerage; instead, they adapt to your trading objectives, platform preferences, and risk tolerances.

The Future of Micro XRP Futures: Speculation, Strategy, and Support

As we move through the rest of 2025, micro XRP futures will increasingly serve as a key instrument for crypto-savvy traders. Whether you’re looking to hedge spot XRP positions, engage in speculative plays, or simply dip your toes into digital asset derivatives, these contracts offer unmatched accessibility.

Key considerations for traders in Q3 and Q4 2025 include:

- Staying informed on regulatory outcomes, especially involving the SEC and Ripple Labs.

- Tracking spot XRP movement and aligning futures strategies accordingly.

- Leveraging volatility spikes for short-term trades using micro contracts.

- Utilizing platforms like CannonX powered by CQG for advanced execution and strategy testing.

- Working with reputable futures brokers who understand both legacy commodities and new digital frontiers.

Why Cannon Trading Company is a Great Choice For Your Go-To Future Broker

In a trading environment where speed, reliability, and deep product knowledge matter, Cannon Trading Company continues to shine. Their commitment to transparency, client education, and platform excellence has helped them maintain a top-tier status among futures brokers USA.

If you’re considering entering the micro XRP futures market, Cannon offers every tool you need—from access to CannonX, to regulatory peace of mind, to five-star-rated service. They’re not just a futures broker; they are a long-term trading partner.

Whether you’re an experienced trader scaling down to micro contracts or a newcomer seeking high-touch service and smart execution, Cannon is the logical choice. With their assistance, you’ll be well-equipped to navigate the opportunities and risks that the final two trimesters of 2025 will bring in the world of micro XRP futures.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

For More Information On Micro Bitcoin Futures, click here

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading