Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5. Economic Report for Monday April 16, 2012

Hello Traders

Watch a Seasoned Market Veteran TRADE LIVE Using Order Flow Analysis

Join us for a Webinar on April 17 8:15 AM central time

Space is limited.

Reserve your Webinar seat now at:

https://www2.gotomeeting.com/register/228463594

Cannon Trading is hosting Thomas DeLello, Founder and Head Trader at Order Flow Edge for a webinar – Order Flow Edge and understanding supply and demand

OrderFlowEdge is headed by 15 year veteran trader Thomas DeLello.

Thomas trades look for low risk profits as a function of trading what is real. By basing his market decisions on simple, objective ways in which to quantify Supply & Demand he effectively eliminates subjective emotions from his trading.

Thomas is very active in the ES S&P eminis and the Forex spot currency markets. He also trades currency futures, oil futures, and bond futures.

In this webinar you will learn:

* that Order-Flow is the driving force in the market. Change in order-flow precedes change in price.

* Understanding current supply and demand conditions in the market is the key

* How changes in order flow affect price

* Understanding current supply and demand conditions in the market.

* Identifying supply and demand imbalances in the market.

SEATS ARE LIMITED, SO DON’T MISS THIS SPECIAL FREE WEBINAR!

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Title: Watch a Seasoned Market Veteran TRADE LIVE Using Order Flow Analysis

Date: Tuesday, April 17, 2012

Time: 8:15 AM – 10:00 AM CDT

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

Macintosh®-based attendees

Required: Mac OS® X 10.5 or newer

Continue reading “Cannon Trading is hosting Thomas DeLello | Support and Resistance”

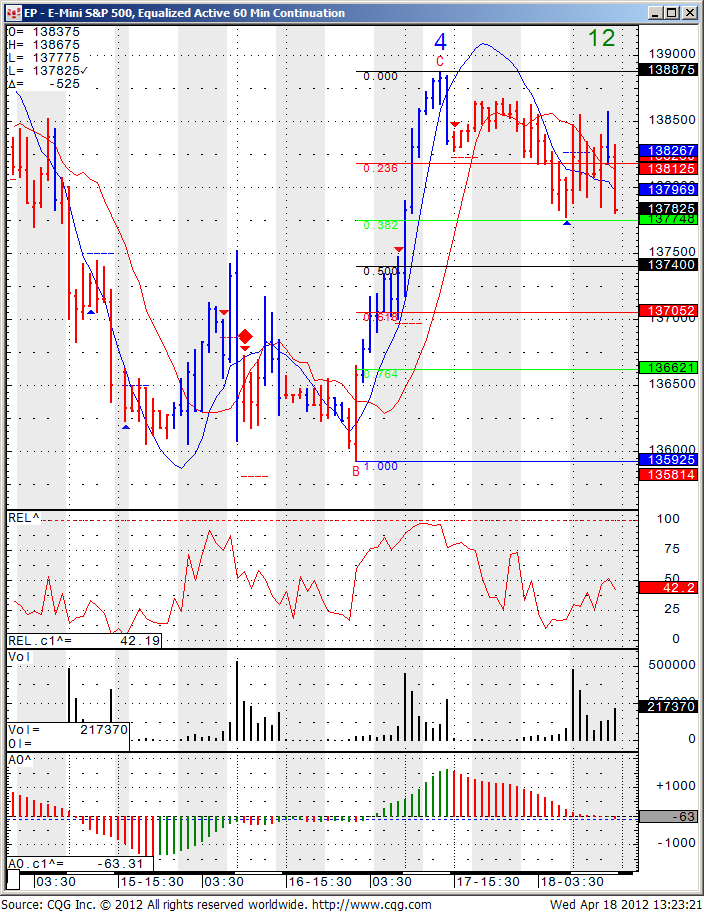

Continue reading “Hourly Mini SP 500 Chart | Support and Resistance Levels”

Continue reading “Hourly Mini SP 500 Chart | Support and Resistance Levels”