Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

1. Market Commentary

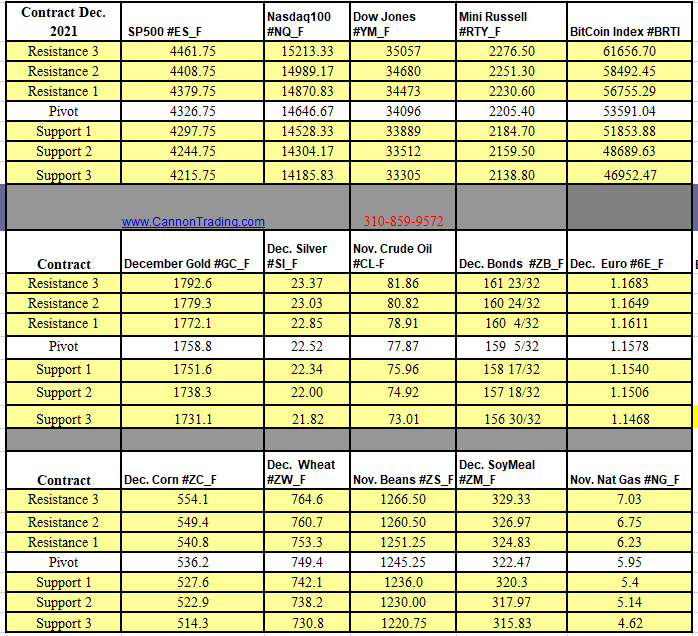

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday May 13, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

Top 50 Trading Rules:

Most Common Pitfalls To Avoid When Trading Futures-Commodity Futures

500 experienced futures brokers were asked what caused most futures traders to lose money when comes to trading futures.

Their answers reflected the trading experience of more than 10,000 futures traders. Download the PDF and find out what they said.

1.) Have a Plan

Many futures traders trade without a plan. They do not define specific risk and profit objectives before trading. Even if they establish a plan, they “second guess” it and don’t stick to it, particularly if the trade is a loss. Consequently, they overtrade and use their equity to the limit (are undercapitalized), which puts them in a squeeze and forces them to liquidate positions. Usually, they liquidate the good trades and keep the bad ones.

2.) News Factor

Many traders don’t realize the news they hear and read has, in many cases, already been discounted by the market.

3.) Trade Objectively

After several profitable trades, many speculators become wild and nonconservative. They base their trades on hunches and long shots, rather than sound fundamental and technical reasoning, or put their money into one deal that “can’t fail.”

4.) Know Your Size

Traders often try to carry too big a position with too little capital and trade too frequently for the size of the account.

Continue reading “Top 50 Futures Trading Rules 5.13.2015”