Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for March 7, 2012

Hello Traders,

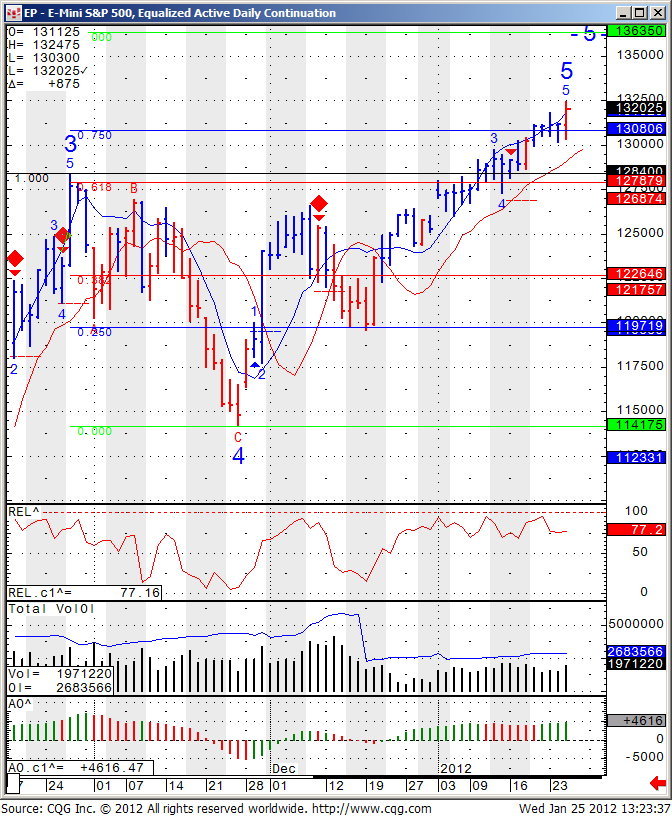

I mentioned last week I was looking for a confirmation to go short the mini SP500 on a swing trading basis. The confirmation came during last night session when the market broke below the red moving avg. ( my trigger) at 1363.

The hard question now is where does one place a stop, where does one look for profit target? etc.

The answer can vary quite a bit from trader to trader based on ones account size, time frame traded, market outlook and much more….

My initial target is still 1323 followed by 1289 but the hard part is where to place a stop now that the market has moved in my favor?

The proper stop is still around 1371, but like I said, you can attack this in many different ways and only the future will tell which route was the best to manage this trade…..

Continue reading “E-Mini SP 500 – Support and Resistance Levels”