____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

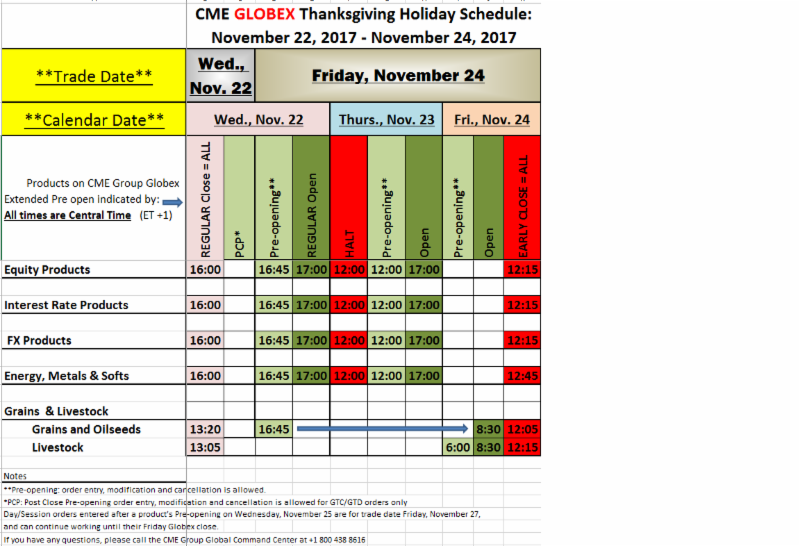

Happy Thanksgiving holiday to everyone, please make sure you are fully aware of the different trading hours, as the markets will be open “off and on” over Thursday and Friday. Wednesday is normal trading day across all markets. Call us at +1 310 859 9572 with any questions. All times below are central time.

Continue reading “Thanksgiving Holiday Schedule & Support & Resistance Levels 11.22.2017”