The Role of the Futures Broker

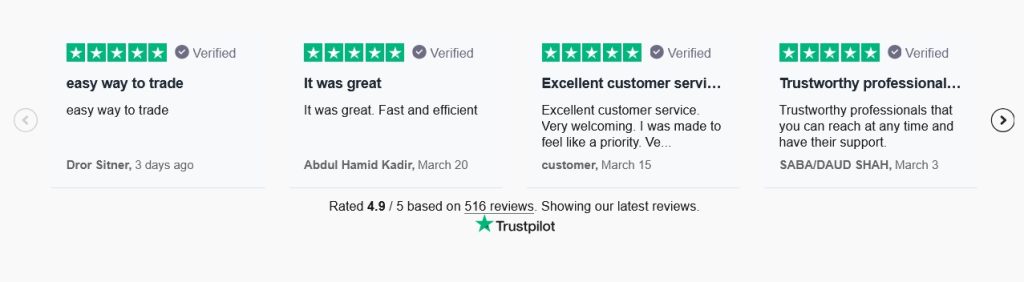

In the dynamic and fast-paced world of futures trading, the role of a futures broker has evolved from a traditional order-taker to a strategic partner, technology provider, and regulatory liaison. As we head into the second half of 2025, futures brokers are more vital than ever—offering clients unparalleled access to cutting-edge platforms, deep market insights, personalized trading support, and robust regulatory frameworks. Among the top-tier firms in the industry, Cannon Trading Company has distinguished itself as the best futures broker for both new and experienced traders, earning numerous 5 out of 5-star ratings on TrustPilot and maintaining an exemplary record with federal and industry regulators.

The Historical Evolution of the Futures Broker

The concept of the futures broker emerged in the 19th century, most prominently with the establishment of the Chicago Board of Trade (CBOT) in 1848. Initially, brokers served as intermediaries who matched buyers and sellers of grain contracts. Their role was transactional, with minimal strategic input. Traders would rely on handwritten order tickets, face-to-face open outcry systems, and brokers’ personal networks to execute trades.

As global markets developed and futures contracts expanded beyond agriculture to include commodities like crude oil, metals, interest rates, and eventually financial instruments such as indices and currencies, the futures broker evolved into a more sophisticated participant. During the 1970s and 1980s, the rise of electronic trading platforms started to reshape the industry, gradually phasing out the traditional open outcry method and introducing digital tools that allowed faster execution and greater transparency.

By the early 2000s, the modern futures trading ecosystem had become digitally native. Brokers transitioned into tech-savvy facilitators who not only processed orders but also provided clients with market data, charting software, back-testing tools, and compliance guidance. The COVID-19 pandemic in 2020 further accelerated this digital transformation, reinforcing the need for seamless, remote, and real-time access to futures contract trading.

How Futures Brokers Help Traders in 2025

As we enter the second half of 2025, the needs of traders have grown increasingly sophisticated. Today’s futures broker is no longer a passive executor but a comprehensive service provider. Here’s how top futures brokers empower clients to thrive in this environment:

- Access to Advanced Platforms

Brokers now offer access to a variety of cutting-edge platforms, and one of the most sought-after is the CQG platform. Known for its high-speed execution, reliable data feeds, and professional-grade charting tools, CQG has become a cornerstone of institutional and retail futures trading. Cannon Trading Company has elevated this experience through CannonX powered by CQG, an enhanced version of CQG tailored for traders who require the best performance with robust analytical capabilities and multi-asset compatibility.

- Personalized Support and Strategy Guidance

In 2025, algorithmic and AI-assisted trading are more prevalent, but human expertise remains indispensable—especially during market turbulence. The best futures brokers offer one-on-one consultations, trade desk support, and strategic insights that algorithms simply can’t match. Cannon Trading’s decades of experience are especially valuable here, as the firm’s veteran brokers provide customized solutions that align with each client’s risk tolerance and trading goals.

- Real-Time Risk Management

Volatility has become a constant feature of financial markets. Whether due to geopolitical tensions, central bank policy shifts, or macroeconomic data surprises, real-time risk management tools are vital. Brokers now offer dynamic margin tracking, price alerts, trailing stops, and portfolio analytics. The best futures broker ensures clients can act swiftly and decisively, using modern tools to manage their capital effectively.

- Regulatory Oversight and Compliance

As global regulations around derivatives grow more complex, traders benefit immensely from brokers with clean records and deep compliance knowledge. Cannon Trading Company, with its exemplary history of cooperation with federal and industry regulators, gives clients peace of mind. Their transparent policies and proactive compliance education ensure clients stay aligned with all relevant laws and guidelines.

When Are Futures Brokers Most Valuable?

Throughout history, certain market conditions have significantly elevated the value of experienced futures brokers. These periods include:

- High Volatility Periods

During geopolitical crises, global pandemics, or monetary policy shifts, market volatility surges. These environments offer opportunities but also elevate risks. Futures brokers are critical during these times for helping clients adjust margin levels, place protective stops, and interpret fast-changing data.

- Major Economic Announcements

Jobs reports, interest rate decisions, and GDP releases often move markets significantly. In such moments, the right futures broker provides pre-release insights and helps position trades to capture potential movements.

- Transition Periods Between Market Cycles

When markets transition from bull to bear or vice versa, traders can struggle to adjust strategies. Brokers with historical perspective and up-to-date technical tools are key to navigating these inflection points. Tools provided through platforms like CannonX powered by CQG become especially valuable during these times.

- Times of Regulatory Change

Changes to leverage rules, tax codes, or exchange policies can have massive implications. Brokers who stay ahead of these changes and communicate them effectively are indispensable for clients trying to maintain compliance and profitability.

Cannon Trading Company: A Trusted Futures Broker for 2025

Cannon Trading Company has emerged as a top best futures broker for a reason. Let’s explore what makes this firm the premier partner for traders as we move through the second half of 2025:

- Decades of Industry Experience

With a rich history dating back to the late 1980s, Cannon Trading’s longevity is a testament to its integrity, innovation, and adaptability. Few futures brokers can match their legacy, which spans across all major asset classes, market cycles, and technological revolutions. Their institutional memory and seasoned team give clients a distinct edge. - Exceptional TrustPilot Ratings

Reputation matters. With numerous “5 out of 5-star” reviews on TrustPilot, Cannon Trading has established itself as the best futures broker TrustPilot can recommend. These ratings speak to the company’s customer service, technical support, and overall reliability. Traders who partner with Cannon know they are in good hands.

Reputation matters. With numerous “5 out of 5-star” reviews on TrustPilot, Cannon Trading has established itself as the best futures broker TrustPilot can recommend. These ratings speak to the company’s customer service, technical support, and overall reliability. Traders who partner with Cannon know they are in good hands. - Technological Superiority

Cannon Trading provides access to the CQG platform, along with multiple other industry-leading platforms. Their unique offering, CannonX powered by CQG, combines the CQG infrastructure with proprietary enhancements such as smoother interfaces, advanced API integrations, and seamless mobile compatibility. This makes them an ideal broker for both discretionary and automated traders. - Regulatory Excellence

Cannon’s spotless record with federal and futures industry regulators is a mark of its professional standards. The firm’s adherence to regulatory protocols protects its clients and ensures that all futures contract trading is executed in accordance with best practices. - Wide Platform Selection

Different traders have different needs. Whether you’re a scalper, swing trader, or institutional manager, Cannon has a platform that suits your style. Their menu includes Rithmic-based systems, CQG, TradingView integrations, and proprietary dashboards. This range puts Cannon ahead of many futures brokers who offer only one or two platform choices.

The Strategic Advantage Going Forward

As we look toward Q3 and Q4 of 2025, economic uncertainty remains high. Central banks are debating rate cuts or pauses, inflation lingers in certain global regions, and geopolitical events continue to inject risk into the markets. Against this backdrop, working with a futures broker who offers stability, foresight, and advanced tools is critical.

Cannon Trading Company is uniquely positioned to provide that support. Through its CannonX powered by CQG suite, real-time guidance, and top-tier customer service, the firm ensures traders are not just reacting to the market—but anticipating it.

The need for a strong brokerage partner has never been clearer. Whether navigating futures contract trading in energy markets, metals, indices, or agricultural products, Cannon provides the support structure necessary to excel.

The business of futures brokers has transformed dramatically from its origins in physical trading pits to today’s sophisticated, digital-first landscape. In 2025, the best futures broker is not just a middleman but a strategic partner—providing tools, insights, education, and compliance assurance. This is where Cannon Trading Company excels.

With decades of experience, elite TrustPilot reviews, and standout tools like CannonX powered by CQG, Cannon is a logical choice for anyone serious about futures trading. As volatility persists and market opportunities evolve, Cannon remains a steadfast ally for those trading futures in pursuit of precision, performance, and profitability.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading