Interesting DATE tomorrow…1-11-11

Other than that I don’t have much to share, market is still waiting for either another leg up or correction to the downside.

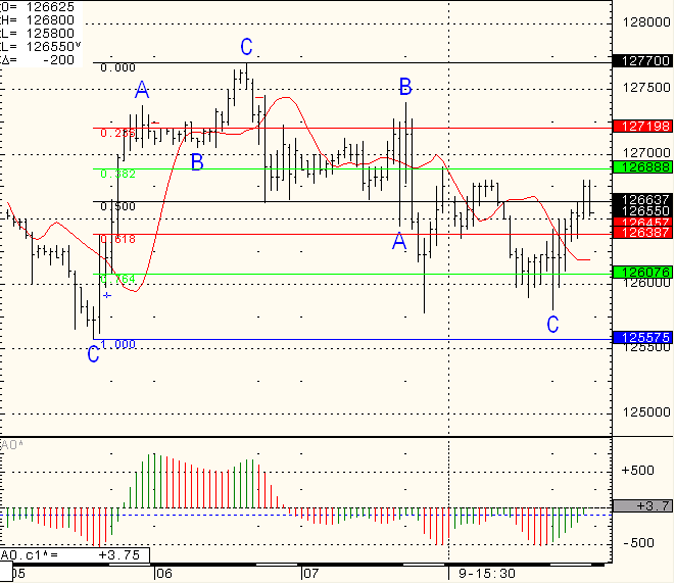

I am looking at 1255 to 1273 as the band and think that an hourly close above or below can trigger the next move.

Plan your trade, trade your plan!

Mini SP hourly chart for your review below:

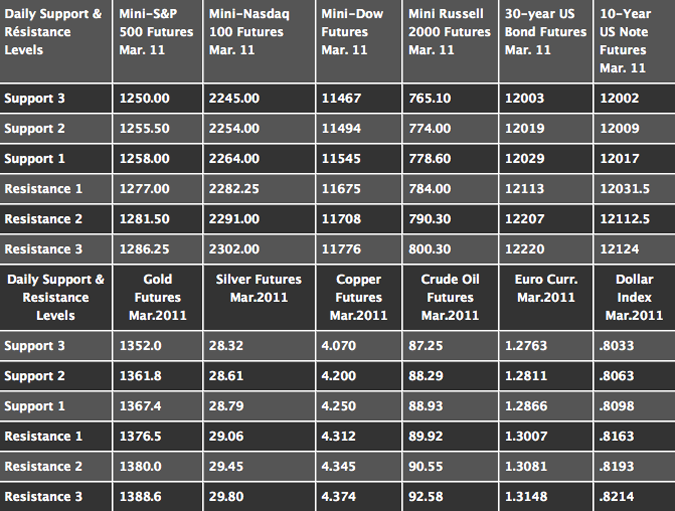

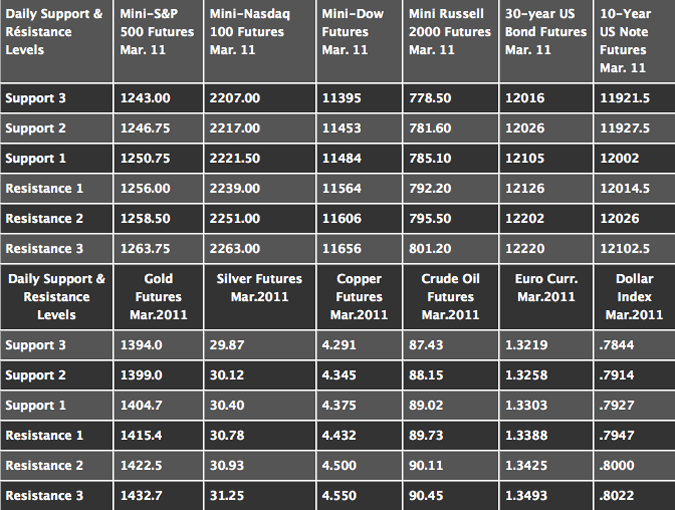

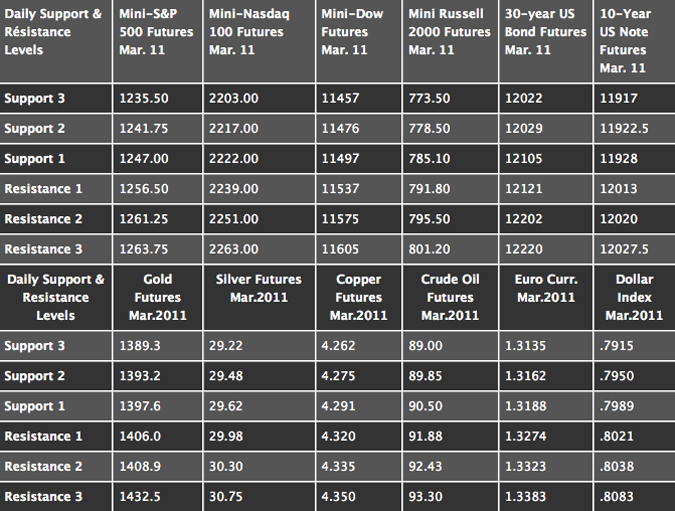

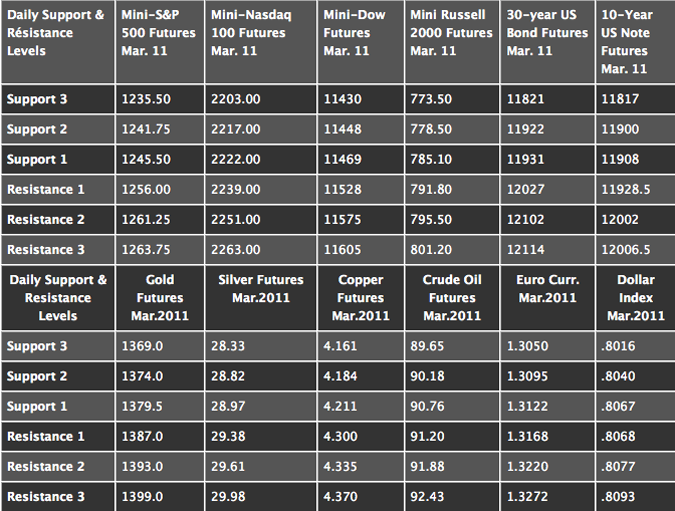

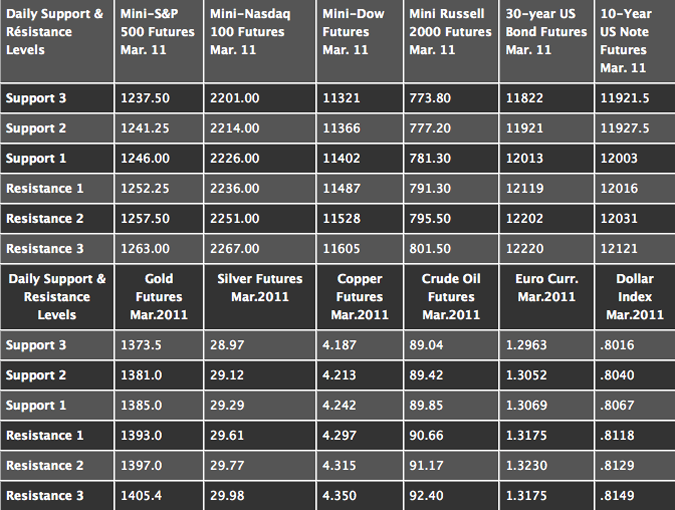

Continue reading “Futures Trading Levels and Economic Reports for January 11, 2010”